GLOBAL ECONOMY WILL UP 4%

THE WORLD BANK - Jan, 7, 2021 - Global Economic Prospects

Executive Summary

Although the global economy is emerging from the collapse triggered by the pandemic, the recovery is projected to be subdued. Global economic output is expected to expand 4 percent in 2021 but still remain more than 5 percent below its pre-pandemic trend. Moreover, there is a material risk that setbacks in containing the pandemic or other adverse events derail the recovery. Growth in emerging market and developing economies (EMDEs) is envisioned to firm to 5 percent in 2021, but EMDE output is also expected to remain well below its pre-pandemic projection. The pandemic has exacerbated the risks associated with a decade-long wave of global debt accumulation. Debt levels have reached historic highs, making the global economy particularly vulnerable to financial market stress. The pandemic is likely to steepen the long-expected slowdown in potential growth over the next decade, undermining prospects for poverty reduction. The heightened level of uncertainty around the global outlook highlights policy makers’ role in raising the likelihood of better growth outcomes while warding off worse ones. Limiting the spread of the virus, providing relief for vulnerable populations, and overcoming vaccine-related challenges are key immediate priorities. With weak fiscal positions severely constraining government support measures in many countries, an emphasis on ambitious reforms is needed to rekindle robust, sustainable and equitable growth. Global cooperation is critical in addressing many of these challenges. In particular, the global community needs to act rapidly and forcefully to make sure the ongoing debt wave does not end with a string of debt crises in EMDEs, as was the case with earlier waves of debt accumulation.

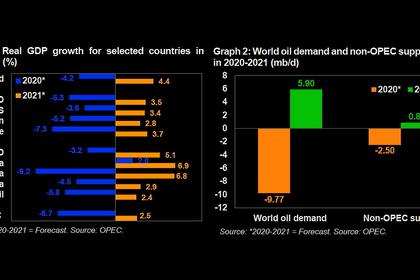

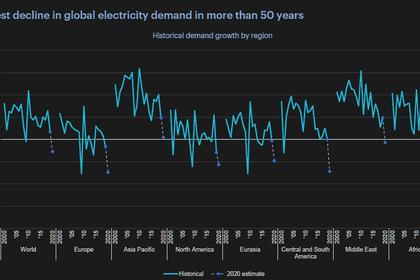

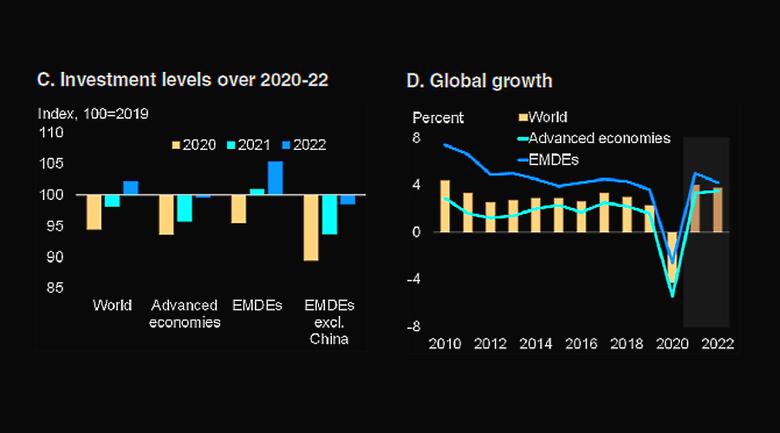

Global Outlook. Following a collapse last year caused by the COVID-19 pandemic, global economic output is expected to expand 4 percent in 2021 but still remain more than 5 percent below pre-pandemic projections. Global growth is projected to moderate to 3.8 percent in 2022, weighed down by the pandemic’s lasting damage to potential growth. In particular, the impact of the pandemic on investment and human capital is expected to erode growth prospects in emerging market and developing economies (EMDEs) and set back key development goals. The global

recovery, which has been dampened in the near term by a resurgence of COVID-19 cases, is expected to strengthen over the forecast horizon as confidence, consumption, and trade gradually improve, supported by ongoing vaccination.

Although aggregate EMDE growth is envisioned to firm to an average of 4.6 percent in 2021-22, the improvement largely reflects China’s expected rebound. Absent China, the recovery across EMDEs is anticipated to be more muted,

averaging 3.5 percent in 2021-22, as the pandemic’s lingering effects continue to weigh on consumption and investment. Despite the recovery, aggregate EMDE output in 2022 is expected to remain about 6 percent below its pre- pandemic projection.

Downside risks to this baseline predominate, including the possibility of a further increase in the spread of the virus, delays in vaccine procurement and distribution, more severe and longer-lasting effects on potential output from the pandemic, and financial stress triggered by high debt levels and weak growth.

Limiting the spread of the virus, providing relief for vulnerable populations, and overcoming vaccine-related challenges are key immediate policy priorities. As the crisis abates, policy makers need to balance the risks from large and growing debt loads with those from slowing the economy through premature fiscal tightening. To confront the adverse legacies of the pandemic, it will be critical to foster resilience by safeguarding health and education, prioritizing investments in digital technologies and green infrastructure, improving governance, and enhancing debt transparency. Global cooperation will be key in addressing many of these challenges.

Regional Prospects. The pandemic has exacted substantial costs on all EMDE regions. Although all regions are expected to grow this year, the pace of the recovery varies considerably, with greater weakness in countries that have larger outbreaks or greater exposure to global spillovers through tourism and industrial commodity exports. The East Asia and Pacific region is envisioned to show notable strength in 2021 due to a solid rebound in China, whereas activity is projected to be weakest in the Middle East and North Africa and Sub-Saharan Africa regions. Many countries are expected to lose a decade or more of per capita income gains. Risks to the outlook are tilted to the downside. In addition to region-specific risks, all regions are vulnerable to renewed outbreaks and logistical impediments to the distribution of effective vaccines, financial stress amid elevated debt levels, and the possibility that the impact of the pandemic on growth and incomes may be worse than expected over the longer term. In a downside scenario of a more severe and prolonged pandemic, growth would be lowest among the six EMDE regions in Latin America and the Caribbean, the Middle East and North Africa, and Sub-Saharan Africa, reflecting these regions’ reliance on exports of oil and industrial commodities, the prices of which would be reduced by weak global demand.

This edition of Global Economic Prospects also includes analytical chapters on the implications of the pandemic for long-term growth prospects, as well as on benefits and risks of recent unconventional monetary policy measures in EMDEs.

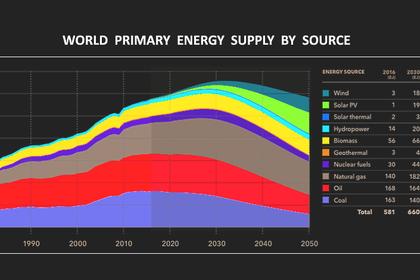

Global Economy: Heading into a Decade of Disappointments? The COVID-19 pandemic has caused major disruptions in the global economy. Economic activity has been hit by reduced personal interaction, owing both to official restrictions and private decisions; uncertainty about the post-pandemic economic landscape and policies has discouraged investment; disruptions to education have slowed human capital accumulation; and concerns about the viability of global value chains and the course of the pandemic have weighed on international trade and tourism. As with previous economic crises, the pandemic is expected to leave long-lasting adverse effects on global economic activity and per capita incomes. It is likely to steepen the slowdown in the growth of global potential output—the level of output the global economy can sustain at full employment and capacity utilization—that had earlier been projected for the decade just begun. If history is any guide, unless there are substantial and effective reforms, the global economy is heading for a decade of disappointing growth outcomes. Especially given weak fiscal positions and elevated debt, institutional reforms to spur growth are particularly important. A comprehensive policy effort is needed to rekindle robust, sustainable, and equitable growth. A package of reforms to increase investment in human and physical capital and raise female labor force participation could help avert the expected impact of the pandemic on potential growth in EMDEs over the next decade. In the past, the growth dividends from reform efforts were recognized and anticipated by investors in upgrades to their long-term growth expectations.

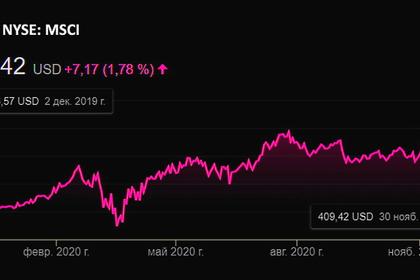

Asset Purchases in Emerging Markets: Unconventional Policies, Unconventional Times. Central banks in some EMDEs have employed asset purchase programs, in many cases for the first time, in response to pandemic-induced financial market pressures. These programs, along with spillovers from accommodative monetary policies in advanced economies, appear to have helped stabilize EMDE financial markets. However, the governing framework, scale, and duration of these programs have been less transparent than in advanced economies, and the effects on inflation and output in EMDEs remain uncertain. In EMDEs where asset purchases continue to expand and are perceived to finance unsustainable fiscal deficits, these programs risk eroding hard-won central bank operational independence and de-anchoring inflation expectations. Ensuring that asset purchase programs are conducted with credible commitments to central bank mandates and with transparency regarding their objectives and scale can support their effectiveness.

-----

Earlier: