GLOBAL INDEXES UP ANEW

REUTERS - JANUARY 19, 2021 - Global shares climbed and the dollar eased on Tuesday ahead of Janet Yellen’s Treasury Secretary confirmation speech, in which she is expected to bolster the case for heavy fiscal stimulus in the world’s largest economy.

Concerns that pandemic lockdowns could slow the road to economic recovery faded into the background as markets prepared for possible positive surprises from the earnings season.

Asian shares posted strong gains and in Europe upbeat earnings reports from miner Rio Tinto and computer peripherals maker Logitech helped the STOXX 600 benchmark index edge up by 0.1% in morning trade.

Wall Street looked set for a strong start, with S&P 500 futures rising 0.6% and Nasdaq futures up 0.9% after the long holiday weekend.

The MSCI world equity index, which tracks shares in 49 countries, was up 0.3% by 0907 GMT.

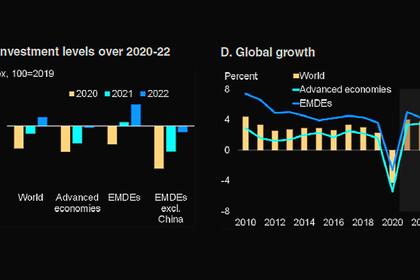

“Yellen ... will attempt to sell U.S. President-elect Biden’s $1.9 trillion fiscal stimulus plan (arguing that low interest rates allow a big fiscal stimulus),” Paul Donovan, Chief Economist of UBS Global Wealth Management, said in a note.

“If the growth rate generated by government investment in infrastructure or people exceeds the cost of borrowing, it is a worthwhile exercise.”

Yellen will tell the Senate Finance Committee that the government must “act big” with its next coronavirus relief package, according to her prepared statement seen by Reuters.

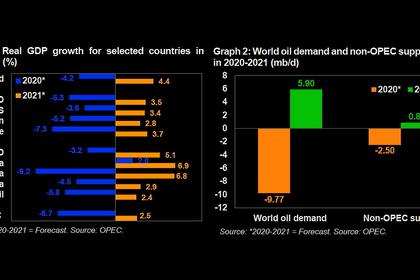

Asian shares had climbed on investor expectation that China’s economic strength would help TO underpin growth in the region. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 1.5% to a record high.

Data on Monday confirmed that the world’s second-largest economy was one of the few to grow over 2020 and actually gathered pace as the year drew to a close.

Analysts at JPMorgan felt the coming earnings season could brighten the mood, given the consensus in Europe was for a 25% fall year on year, setting a very low bar.

“The projected EPS (earnings per share) growth in Europe now stands at the lows of the crisis, which seems too conservative and could likely lead to positive surprises over the reporting season,” they wrote.

The same could be true for the United States, where results from BofA, Morgan Stanley, Goldman Sachs and Netflix are due this week.

Despite the risk-on mood on Tuesday, dealers were wary ahead of U.S. President-elect Joe Biden’s inauguration on Wednesday, given the risk of more mob violence.

Wall Street is also bracing for tougher regulations now that the Democrats control the Senate, with Biden set to nominate two consumer champions to top financial agencies.

In foreign exchange markets, the U.S. dollar slipped from close to its highest in nearly a month as caution set in before Yellen’s speech.

The dollar index was last at 90.63, down 0.15% on the day but comfortably above its recent trough of 89.206.

The euro rose 0.2% to $1.2106 after touching a six-week low of $1.2052 overnight, while the dollar weakened by 0.3% against the safe-haven yen at 104.04.

In fixed income markets, Italian 10-year bond yields fell slightly to 0.592% ahead of a confidence vote in the Senate that could force Prime minister Giuseppe Conte to resign.

But expectations that snap elections are unlikely, coupled with ECB stimulus to fight the adverse impact of the coronavirus crisis, limited any sell-off.

Gold rose 0.3% to $1,843 an ounce after briefly reaching a six-week low of $1,809.90 overnight.

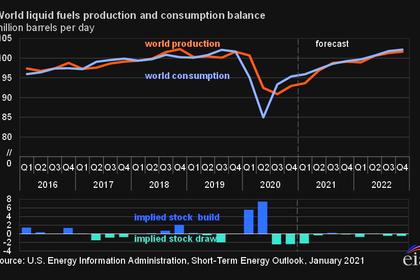

Crude oil prices firmed on optimism that government stimulus will buoy global economic growth and oil demand. Brent crude futures rose 0.7% to $55.40 a barrel and U.S. crude was up 0.5% at $52.60.

-----

Earlier: