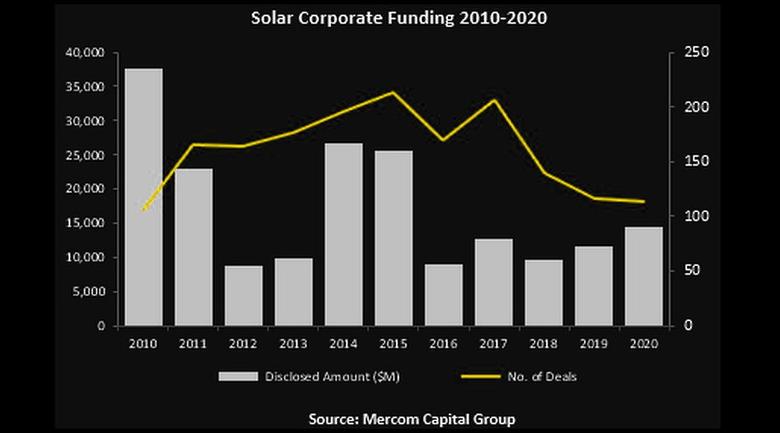

GLOBAL SOLAR FUNDING UP 24%

RENEWABLES NOW - January 12 - Corporate funding in the solar sector around the world rose by 24% year-on-year to USD 14.5 billion (EUR 11.9bn) in 2020, which proved to be "an unprecedented year” for publicly-traded solar firms according to the head of Mercom Capital Group.

“The solar ETF was up 225%, with 15 solar stocks up over 100% in 2020. Public market funding was also up with the help of several IPOs, and debt financing was up on the back of securitization deals,” CEO Raj Prabhu said, adding that solar asset purchases were at an all-time high.

Venture capital (VC) and private equity (PE) funding went down to USD 1.2 billion in 41 deals from USD 1.4 billion in 53 deals a year earlier. This includes USD 1.1 billion in funding to 27 solar downstream firms. Ayana Renewable Power took the largest individual share of the VC financing -- USD 390 million, followed by Silicon Ranch Corporation with USD 225 million raised.

At the same time, solar service providers secured USD 61 million, photovoltaic (PV) companies raised USD 17 million, Balance of System (BOS) firms got USD 15 million, thin-film technology developers bagged USD 15 million and concentrator photovoltaics (CPV) manufacturers raised USD 5.5 million.

Public market financing doubled to USD 5.1 billion, with Array Technologies implementing a USD-1.2-billion initial public offering (IPO) in the final quarter of the year.

Debt financing increased by 6.4% to USD 8.3 billion, including eight securitisation deals for a record total of USD 2.2 billion.

Societe Generale was the top large-scale solar investor in October-December 2020, having backed five projects, while Sumitomo Mitsui Banking Corporation invested in four.

Last year, there were 62 merger and acquisition (M&A) deals compared to 65 in 2019 and most concerned the downstream segment. The most notable such deal was Sunrun’s USD-3.2-billion all-stock acquisition of Vivint Solar.

In total, 39.5 GW of large-scale solar projects got new owners last year compared to 26.1 GW in 2019, marking a record year in this regard.

(USD 1.0 = EUR 0.822)

-----

Earlier: