LIBYA'S OIL DIFFICULTIES

PLATTS - 24 Jan 2021 - Libya's resurgent crude exports could face a massive blow, as a militia controlling three key eastern terminals is threatening to shut down shipments in a long-festering salary dispute.

The Petroleum Facilities Guard militia group has begun a strike at the Ras Lanuf, Marsa el-Hariga and Es Sider terminals, demanding the immediate "disbursement of all salaries, health insurance payments, and other oilfield-related payments," it said in a Jan. 24 statement.

The eastern PFG is loyal to the self-styled Libyan National Army and its leader, Khalifa Haftar, in opposition to the UN-backed Government of National Accord. The PFG has been complaining of a delay in salary payments for several months.

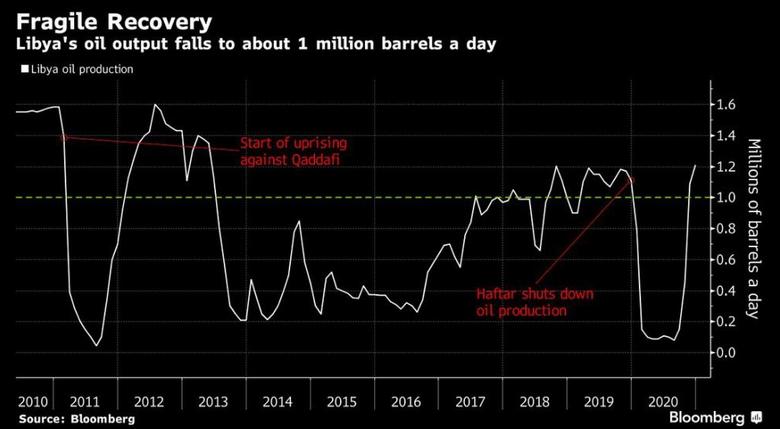

The dispute comes as Libyan crude and condensate output surged to around 1.25 million b/d earlier this month, its highest level in more than six years, after the GNA and LNA agreed a permanent UN-mediated ceasefire in late October.

The revival of Libya's critical oil sector has already taken a recent blow with several buyers canceling purchases of Amna, Abu Attifel and Zueitina grades after high mercury levels were detected in the cargoes, Platts reported on Jan. 21. High levels of mercury can be very toxic, posing concerns for refiners due to potential damage to refining units.

The port closures, however, would be catastrophic for Libya and are symptomatic of the challenges the country faces in uniting its various tribes and factions to rebuild the country after years of civil war.

Revenue dispute

Sources told S&P Global Platts the PFG is currently in talks with the Libyan Ministry of Finance to resolve the dispute, and the UN is also expected to get involved.

The feud between the state-owned National Oil Corporation and the Central Bank of Libya on the distribution of oil revenues has resulted in a delay of oil payments.

NOC has refused to release its oil revenues to the Central Bank, which are currently deposited with a foreign bank, until a unity government is formed.

In a recent research note, Platts Analytics said Libya will remain the largest near-term political risk to oil supply due to recent events.

"Despite positive steps toward the formation of a unity government this week, revenue feuds with the central bank and NOC appear to be escalating," it said in a recent research note. "With the UN-backed Tripoli government in disarray, risk of disruptions will persist."

Under the recently agreed ceasefire, the GNA and the LNA have committed to establish a unity government and hold elections within 18 months.

The LNA continues to control the bulk of Libya's oil infrastructure and talks between the two factions in the past few months have failed to deliver a breakthrough on some of the key issues.

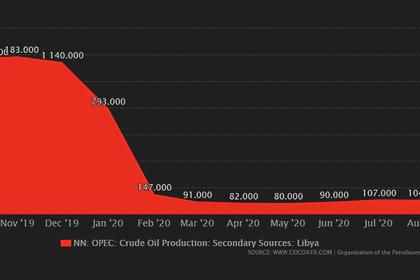

Conflict between the GNA and LNA almost completely halted its oil output for most of last year.

Libya holds Africa's largest proven reserves of oil, and its main light sweet Es Sider and Sharara export crudes yield a large proportion of gasoline and middle distillates, making them popular with refineries in Europe and China.

-----

Earlier: