MICRO GRIDS FIND NICHES

By Fereidoon P. Sioshansi, Ph.D. PresidentMenlo Energy Economics

Forty or fifty years ago, the power sector around the world was dominated by a small number of very large, mostly but not always, vertically integrated monopoles providing an undifferentiated commodity – kWhs – at bundled regulated tariffs to all customers. These players, in many countries represented by a single state-owned monopoly, were generally run by engineers who were focused almost exclusively on the upstream of the customers’ meters, namely generation, transmission and distribution assets. Once the power was delivered to the meter, it was up to the customer to decide what to do with it, how much and when to use the kWhs, what types of appliances to buy and how often to use them.

While all of this is exciting, it is only the beginning of a proliferation of behind-the-meter (BTM) or what may more broadly be called non-conventional services. What is more unsettling for the incumbents, where they still exist, is that nearly all big players in the BTM and/or non-conventional service sector are newcomers and outsiders, not the traditional “utilities.” This is forcing the incumbents to form alliances with the new players to remain relevant – and viable.

kWhs, to store it for later use, and – enabled by aggregators and intermediaries – to engage in trading and sharing their surplus or deficit with their peers. As more wholesale and retail markets are “deregulated,” the bundled regulated tariff is being replaced by a myriad of other service options. They are, for example, retailers who offer free kWhs between 9 pm and 9 am or during the weekends so long as the customer agrees to a set price for the rest of the time or a minimum monthly bill. In the meantime, the standard commodity service has been replaced by premium kWhs, such as 100% renewable or 100% renewable from local wind or solar farms. Customers increasingly have the option to ask to be placed on variable pricing schemes such as time-of-use (TOU) pricing. In some cases, they are forced into such schemes, such as solar customers or those with electric vehicles in California.

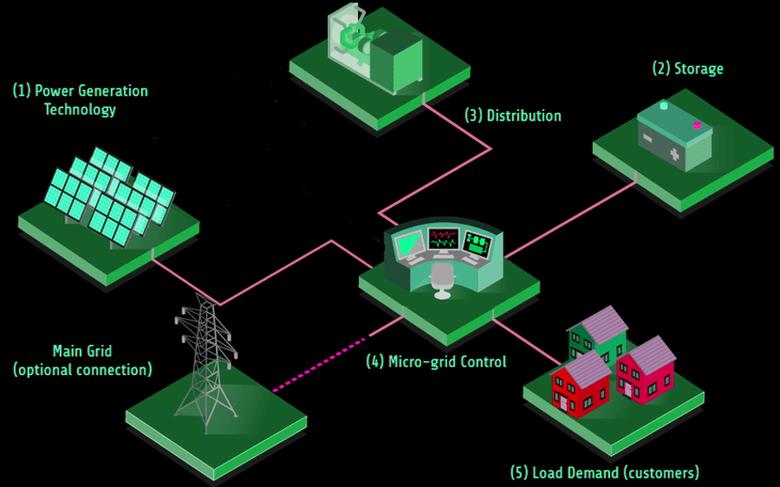

A case in point is the growing popularity of micro-grids, stand-alone power systems (SAPSs) or semi-independent energy communities (box) popping up nearly everywhere, especially in Europe.

Micro-grids find niches where existing service is poor, non-existent and/or expensive

While a single prosumager can only do so much, a collection of them can do far more, especially if aided by an aggregator or orchestrator who can remotely monitor and optimize the entire portfolio of loads, generation and storage. The larger the numbers that join such a scheme, the more can be done to minimize the costs, maximize the revenues or both. That, in a nutshell is the main attraction of forming micro-grids, energy communities or semi-independent eco-villages – they go by different names in different places.

Micro-grid projects, for example, are no longer experimental or considered as R&D especially in places where existing service quality and reliability is poor and/or prices are high, say in Puerto Rico – still suffering from devastating hurricanes in 2017 – or remote parts of Alaska or Canada’s Northern Territories where services are non-existent and notoriously expensive. The same applies to many remote parts of Asia, Africa or Australia and nearly any small island that is not connected to the mainland network.

Take a recent micro-grid project in Puerto Rico involving Enel X and Eaton where the former will build, own, and operate the system while the latter provides the balance of plant electrical distribution equipment. The micro-grid will enable the client, a manufacturing facility, to generate, store, and consume renewable energy while exporting any excess to the local grid while reducing stress on the fragile regional utility infrastructure.

The solar-plus-storage microgrid will combine 5 MW solar PVs with approximately 1.1 MW/2.2 MWh of battery storage fully integrated with the facility’s existing onsite power generation. Eaton’s microgrid control technology will balance where, when, and how electricity is consumed to ensure resiliency for the site, including during grid outages, which are frequent on the island.

Enel X has more than 6.3 GW of demand response (DR), 110 MW of installed storage capacity, manages more than 90,000 utility bills in 104 countries, and operates around 130,000 public and private EV charging stations around the world. In other words, it knows a thing or two about the power business and is part of Enel, one of the renewable supermajors highlighted in the article on page 3. Expanding is footprint in providing such services fits perfectly well with Enel’s future ambitions.

For its part, Eaton’s 92,000 employees in 175 countries, have expertise in power distribution, circuit protection, power quality, backup power, energy storage and automation. Like many other equipment suppliers, Eaton is trying to integrate software to make its hardware more productive and valuable.

Following the 2017 hurricanes, Puerto Rico’s Energy Bureau has set a target for 3,500 MW of solar and 1,500 MW of storage by 2025. The local utility, under-resourced and under-staffed, poorly managed and never particularly fit for the job or innovative, is more than happy to see others deliver where it could not.

The implications of these trends are not necessarily good for the remaining “utility” incumbents, whether they are generators, poles and wires companies or retailers. As some customers buy fewer kWhs from the network, the remaining customers have to pay even more for its upkeep and modernization, which tends to encourage more customer defection – the dreaded death spiral scenario.

Regulators, whose job is to keep bundled retail tariffs affordable for those who wish to remain on such service options, are struggling to come up with ways to minimize cost-shifting and free riding. With the rise of prosumers and prosumagers, clearly the traditional model when all customers bought all their kWhs from the same regulated vertically-integrated company is breaking down. Yet regulators cannot, and generally do not want to, stifle service or product innovation.

Another implication of these trends for regulators is to come up with new ways of charging for services now that customers are diverging into different categories with distinctly different service requirements. For example, a prosumager with a solar roof and storage whose electricity generation, consumption and storage is remotely monitored and optimized by a smart aggregator or is a member of an energy community or belongs to a semi-independent micro-grid has totally different service needs than the consumers who take traditional bundled service. Yet – with the exception of totally off-grid customers – the former is still connected to the same network and use it to sell their excess generation, buy any deficits during extended cloudy periods and enjoy the balancing and reliability services offered by the macro-grid. How much should these customers, or community of customers, pay for such services so as not to be a free-rider or subsidized by the others?

Since vertically-integrated utilities are broken up into competitive generators, poles and wires companies and competitive retailers in many parts of the world, the players are specializing into niches that best suits their capabilities and skills. As described in the article on page 3, some are resigned to focus on poles and wires while others like Italy’s Enel, Spain’s Iberdrola or American NextEra Energy maintain presence in different segments of the business.

All, however, realize that no matter what, most consumers, prosumers and even posumagers will remain connected and dependent on the network for certain critical services even if they no longer need many net kWhs.

-----

This thought leadership article was originally shared with Energy Central's Digital Utility Community Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Digital Utility Community today and learn from others who work in the industry.

-----

Earlier:

2020, November, 16, 12:15:00

SMART ELECTRIC GRID

The main question is how to design a better system of Generation, Transmission and Distribution of Electric Energy, with low carbon, without reducing the reliability and without imposing undue and unnecessary costs.

|

2020, November, 10, 11:00:00

CLEAN AND RELIABLE ENERGY

It’s possible that the coming transportation revolution will greatly reduce demand on the grid.

|

2020, November, 10, 10:55:00

NEW ENERGY TRANSMISSION TECHNOLOGIES

Utility-scale wireless transmission is another one that could change the way the grid operates.

|