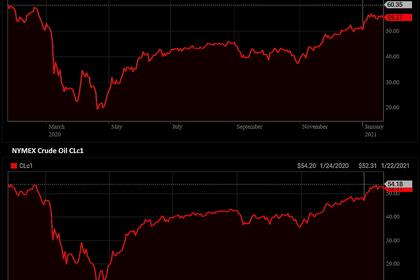

OIL PRICE: NOT ABOVE $56 AGAIN

REUTERS - JANUARY 26, 2021 - Oil prices dropped on Tuesday as the prospects for the rapid approval of new U.S. economic stimulus waned while increasing new coronavirus infections raised questions over the pace of any recovery in demand.

Brent crude was down 28 cents, or 0.5%, at $55.60 by 0747 GMT, while U.S. crude fell 26 cents, or 0.5%, to $52.51. Both rose nearly 1% on Monday.

Having recently hit 11-month highs, oil is caught between lingering doubts over any recovery in demand as the pandemic continues to rage, offset by optimism for more stimulus from the newly installed Biden administration in the United States to support economic growth as vaccines are rolled out.

But Biden administration officials are still trying to convince Republican lawmakers of the need for more stimulus, raising questions over when it will be approved.

“The negative sentiment sweeping Asia today, as the reality of U.S. stimulus politics dawns, has seen both contracts move lower,” said Jeffrey Halley, senior market analyst at OANDA.

Even as the pace of new infections falls in the United States, European nations have set tough restrictions to combat the spread of the virus, while China is reporting rising new COVID-19 cases, casting a pall over demand prospects in the world’s largest energy consumer.

Still, there are areas where demand for oil remains strong.

In India, crude oil imports in December rose to their highest in more than two years as the easing of coronavirus restrictions boosted economic activity.

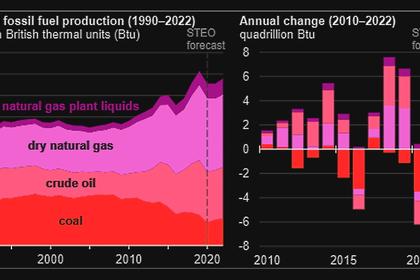

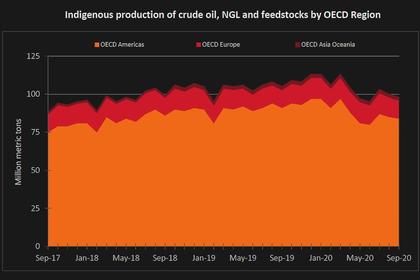

On the supply side, the Organization of the Petroleum Exporting Countries and its allies’ compliance with pledged oil output curbs is averaging 85% in January, tanker tracker Petro-Logistics said on Monday. The findings suggest the group has improved compliance supply curb commitments.

Also, output from the giant Tengiz field in Kazakhstan was disrupted by a power cut on Jan. 17.

“Through 2021, major supply and demand risks remain that threaten to jolt fundamentals into a much tighter or looser market,” Citigroup said in a note.

The bank cited the risk of higher supply if sanctions on Iranian crude are lifted, or U.S. drillers boost output from shale, against a bigger demand shock from the latest wave of lockdowns and restrictions.

-----

Earlier: