OPEC: DIALOGUE, COOPERATION, RESPECT

OPEC - 27 January 2021 - Special address by OPEC Secretary General

Delivered by HE Mohammad Sanusi Barkindo, OPEC Secretary General, at the S&P Global Platts Americas Petroleum and Energy Conference, 27 January 2021.

Ladies and gentlemen,

Good morning to our friends on the other side of the Atlantic, and good afternoon to everyone here in Europe.

It is a great pleasure to deliver this ‘Special Address’ at the S&P Global Platts Americas Petroleum and Energy Conference. I would like to thank the organizers for the invitation, and to all those who have taken time out from their busy schedules to listen in today.

I have been asked to speak about ‘the pursuit of global multilateralism to help drive the global energy transition’. It is a topic very close to my heart, and central to the Organization that I humbly lead as Secretary General.

Multilateralism has a long history, but it has perhaps never been more important to the world as we look build and shape today’s architectures for tomorrow. It will be vital for the energy transition, which is both a massive challenge and an enormous opportunity in the decades ahead.

To put it simply: we need to mould multilateralism and the energy transition into a form that delivers for each and every person on this planet.

For OPEC, what has been clear since it was founded back in Baghdad in September 1960 is the value placed on ever broadening dialogue and cooperation.

As an intergovernmental organization we have always been a proud member of the multilateral system. It is integral to our existence and central to our raison d'être.

The Founder Members acted in strict accordance with UN Principles and purposes in establishing OPEC and the very first resolution of the fledging Organization put dialogue front-and-centre.

Over the decades, this has expanded far and wide. Today, we have established productive dialogues with other international organizations such as the International Energy Agency, the International Energy Forum, the Gas Exporting Countries Forum, and cooperate and hold talks with the G20, the International Monetary Fund, the World Bank and various UN entities.

There are also a variety of constructive dialogues with major oil consumers and producers, such as the EU, India, China, the Russian Federation, as well as with a number of US energy industry stakeholders.

These relationships were particularly vital in 2020, in the face of the colossal impacts of the COVID-19 pandemic, something I will return to later.

It all underscores how OPEC is now an established part of the international energy community and the multilateral system.

In this regard, an outstanding example of the multilateral approach can be viewed through the prism of the Declaration of Cooperation (DoC), now in its fifth year, which has brought together 23 oil producing nations to help return balance to the market, and achieve a sustainable stability, in the interests of both producers and consumers.

It has helped the industry traverse two historic downturns. It has ushered in a new era in global energy cooperation.

Back at the start of 2017, the focus of the DoC was on returning balance and stability to the oil market in the aftermath of the devastating 2014-16 oil industry downturn.

The downturn had brought the industry to its knees. Nearly half a million people lost their jobs; an estimated one trillion dollars in investments were either frozen or deferred; a record number of companies filed for bankruptcy; and by July 2016 the OECD commercial stock overhang had soared to a record high of about 403 million barrels (mb) over the five-year industry average.

Over the subsequent three years, from 2017-2019, the diligent and coordinated response through voluntary production adjustment decisions taken by the DoC helped rebalance the market, restore stability and revive the industry.

When the year turned from 2019 to 2020, there was a great deal of optimism for the oil market in the coming 12 months. Not only for the oil market; the global economy too.

By March, however, the COVID-19 pandemic had pervaded almost every aspect of our daily lives, with widespread lockdowns, economies in major distress and many businesses shuttered in.

In terms of the oil and gas industry, every producer was impacted. No-one was immune.

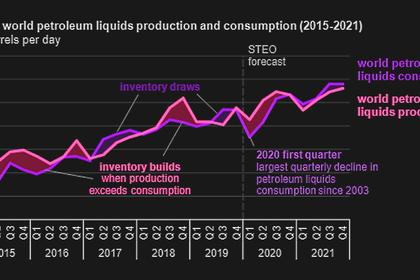

The DoC had to again stand up and be counted. Action was needed, and act we did with the largest and longest production adjustments in the history of the OPEC, the DoC and the oil industry agreed on 12 April 2020 to help counter the massive oil demand decline that at times was above 20 mb/d in April.

The phased reductions in the adjustment levels over a two-year period demonstrated the full commitment of all participants a common goal.

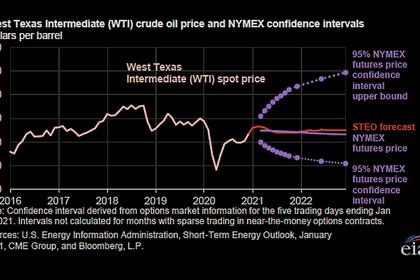

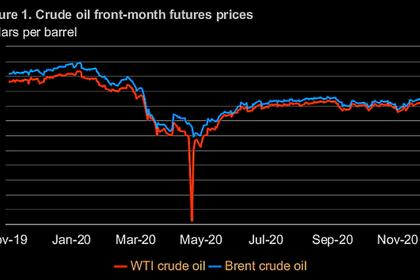

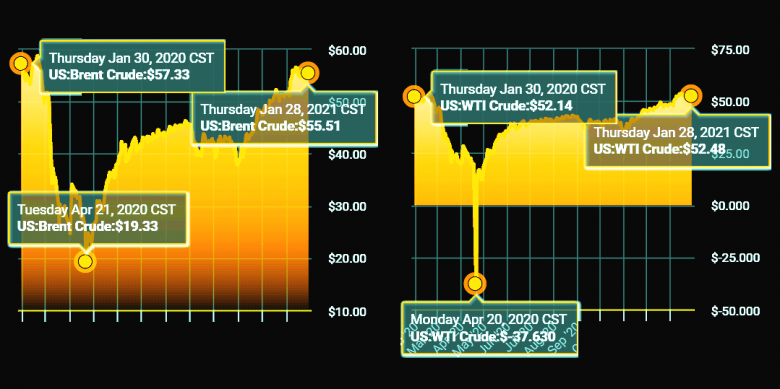

I am sure each and every one of us can recall the dire situation the industry was in, which was most dramatically illustrated on 20 April 2020 when the price of WTI went negative. It was a visceral day, and one often described as ‘Black Monday’.

It was a time when the industry faced a potential crude oversupply of nearly 1.3 billion barrels. There were even deep concerns that some storage hubs could actually reach tank tops.

Thankfully, this never came to pass, in part due to the decisive actions of the DoC. Since then the DoC has shown great courage and flexibility and has adapted as and when necessary to changing market dynamics, particularly with the post-summer advent of second and third waves of COVID-19.

We have never been complacent. It has been one step-at-a-time, guided by the data and analysis and robustly supported by the strong multilateral process we have in place.

Another pivotal outcome of the April 2020 meetings has been the broader encouragement and support that DoC participants have received. This came from the very highest levels of government, from the G20 and from the very largest global oil producers, including Norway, US and Canada, as well as consumers.

This was further built on with OPEC comparing notes with US independents, a relationship that has blossomed since we first met in Houston in 2017; other producing nations, such as Norway, Colombia and Brazil; major consumers, such as China, India and the EU; and select energy policymakers and experts from international institutions, consulting firms, the oil industry, the financial community and think tanks from around the world.

There was an acknowledgement of our mutual interdependence, and the benefits of working together to return confidence and stability to the global oil market.

The DoC was at times a polestar for the oil market during some of the dark days of 2020; a multilateral approach helping guide the industry through stormy waters.

We also realize our work is not done. We have our eyes firmly fixed on 2021. It is clear the recovery has been fragile and uncertainties remain, particularly in terms of the pandemic. Vaccines offer some much needed light at the end of the tunnel, but the ever increasing number of COVID-19 cases, and sadly human loss, as well as renewed lockdowns, are a harsh reminder of how delicate the situation remains.

Nonetheless, we are cautiously optimistic for the global economic rebound in 2021, and for significant oil demand growth. But we will continue to take a month-by-month approach to assessing market conditions, and stand ready to take any necessary actions through the DoC.

In looking further ahead, oil market stability, and more broadly, energy market stability, will be vital to the energy transition.

Stability begets stability, and this will be essential to helping bring on board the huge investments required in the years ahead. Our World Oil Outlook (WOO) 2020 shows that $12.6 trillion will be required between now and 2045 in the upstream, midstream and downstream oil sectors.

To place this in some further context, our current assessments show that upstream capital expenditure could have fallen by more than 30% in 2020, beyond the 23% losses experienced in both 2015 and 2016.

If this is not rectified it could leave long-term scars, not only for producers, but consumers too.

The return of investments is a core objective of the DoC. And, of course, huge investments will be required across all energies.

The multilateral approach of the DoC has shown just what can be achieved by working together, but as I think we can all appreciate, the future will need the coalescing of a broader coalition to tackle the energy challenges in the years ahead.

What is clear to all of us is that the world will continue to need more energy in the decades ahead.

In the near-term, as we recover from the COVID-19 pandemic, and looking longer term to 2045, as the global economy is expected to more than double in size, world population is projected to grow by over 1.7 billion people and given that we need to rid the world of the scourge of energy poverty, bringing light, heat, power, and low-emission fuels for cooking to billions that still go without.

There are obviously many facets to the future energy transition, but the basic challenge is simple: how can we ensure that there is enough energy supply to meet expected future demand growth, and how can this growth be achieved in a sustainable way, balancing the needs of people in relation to their social welfare, the economy, and the environment?

There are some who believe the oil and gas industries should not be part of the energy future, that they should be consigned to the past, and that the future is one that can be dominated by renewables and electric vehicles.

It is important to state clearly that the science does not tell us this, and the statistics related to the blight of energy poverty do not tell us this either.

We fully support the science. This is a given. We do not deny the existence of climate change. What the science and statistics tell us that we need to reduce emissions and use energy more efficiently.

Renewables are coming of age, with wind and solar expanding quickly, but – even by 2045 – in our WOO they are only estimated to make up just over 20% of the global energy mix. Oil and gas combined are forecast to still supply over 50% of the world’s energy needs by 2045, with oil at around 27% and gas at 25%.

We appreciate that some will view this as an OPEC forecast, dispute the numbers, and state that the Organization is against renewables.

In response, it is clear that many OPEC Member Countries have great solar and wind resources, and huge investments are being made in this field. OPEC welcomes the development of renewables. However, we do not see any reputable outlook projecting in their base cases that renewables will come anywhere close to overtaking oil and gas in the decades ahead.

In terms of electric vehicles, there is no doubt that they will continue to see expansion in the transportation sector. In our WOO, the share of electric vehicles in the total road transportation fleet is projected to expand to around 16% in 2045. We support their development in a sustainable manner.

However, for many of the world’s population, electric vehicles do not offer a viable alternative to the internal combustion engine, primarily due to cost. There is also debate about how environmentally friendly they are considering their build process, especially the required batteries, and the sourcing of the vehicles’ electricity.

Here, I think it is also relevant to highlight one key detail from our WOO. In the period to 2045, fuel efficiency improvements are expected to result in a far greater reduction in oil demand, than the increasing penetration of alternative fuel vehicles.

Looking at the scale of the challenge of the energy transition, we need to utilize all available energies, and it is crucial that we appreciate just what each energy source can provide in the decades ahead.

The challenge of tackling emissions has many paths and we need to explore them all. Complex problems require comprehensive solutions. The oil and gas industries are part of the solution; they possess critical resources and expertise that can help unlock our carbon-free future.

We need to look for cleaner and more efficient technological solutions everywhere, across all available energies. We will need a very broad portfolio of emission removal technologies to tackle climate change. We are believers that solutions can be found in technologies, such as carbon capture utilization and storage (CCUS) and others, as well in the promotion of the Circular Carbon Economy to improve overall environmental performance

It is vital that the required investments are made, in all energies, to ensure stable and continuous supplies, and to help reduce and, ultimately, eliminate emissions.

Without the necessary investments, there is the potential for further volatility and a future energy shortfall, which is not in the interests of either producers or consumers.

Moreover, if billions of people in the developing world suffering from a lack of energy access feel they are excluded from access to energies that have helped fuel the developed world, then this could sow further divisions and expand the divide between the haves and have nots, the global North and the South.

Let me be clear: nobody should be left behind in the energy transition. Sustainable Development Goal number seven of the UN ensures access to affordable, reliable, sustainable and modern energy for all people – not just for a select group.

OPEC and its Member Countries have been directly involved in the evolution of the UNFCCC, the Kyoto Protocol and the Paris Agreement and fully support the multilateral approach to addressing climate change and the energy transition. The core elements of the UNFCCC, particularly equity, historical responsibility and national circumstances must be considered at all junctures moving forward.

At OPEC, we welcome coordinated action and engagement with all stakeholders in the energy community. We also believe we have a perfect vehicle – the Charter of Cooperation (CoC). The CoC is open to all producers and offers a platform to address issues such as climate change, the energy transition and energy access in a coherent and inclusive way.

OPEC reaffirms its faith – time and time again – of the need for dialogue, cooperation, and respect.

We need to talk to each other and not at each other. We need to work with each other and not against each other.

This was perfectly illustrated by UN Secretary General, António Guterres, the world’s leading advocate for multilateral engagement. He said:

“I'm not a multilateralist against anybody. I'm a multilateralist because I believe in a multilateral order.”

Multilateralism is a means to discuss, reason and lay a path forward for us all. The challenges our planet faces require solutions from every corner of society – developed and developing nations. No-one can act alone.

That is not to say that multilateralism is easy. It is not. It is often complicated, but it is the only possible response. We need to keep on communicating and keep on partnering.

Looking across the Atlantic, we believe that we have established mutually beneficial and productive relationships with the oil industry in the US, as well as in Canada. We have much in common and we hope to further deepen these bonds in the years ahead.

The US is a vital cog in the global oil market, as both a major producer and consumer.

We also welcome the swift decision of the Biden administration to return to the Paris Agreement. The energy transition and the global conversation around it would be incomplete without the US at the head of the multilateral table.

Ladies and gentlemen,

We are all dedicated and passionate about evolving a sustainable energy future for all, and in this we need to leverage all available resources.

It is our deeply held conviction that dialogue and action on this matter should be inclusive and broad to try and evolve this energy transition in the least disruptive manner.

We need to think carefully about what an energy transition actually means; and we all need to follow the right paths.

Working together, through a multilateral approach, we can build a future worthy of future generations and one where no one is left behind.

Thank you.

-----

Earlier: