QATAR LNG EXPANSION

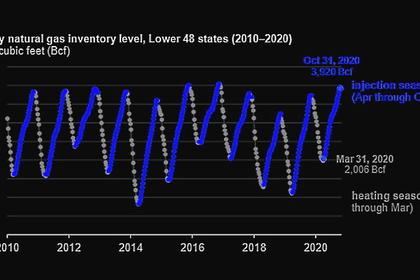

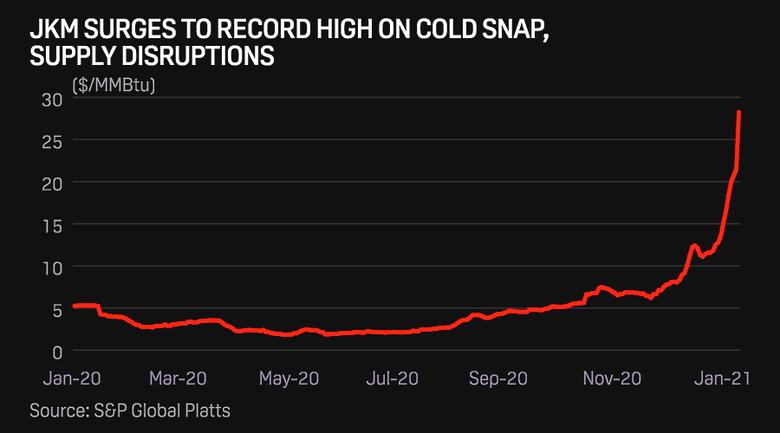

PLATTS - 12 Jan 2021 - Surging LNG prices are giving Qatar an incentive to quickly move forward in 2021 with the expansion of its export capacity and further develop its new gas trading venture.

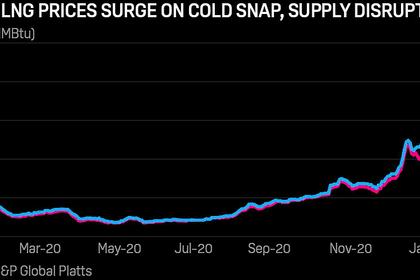

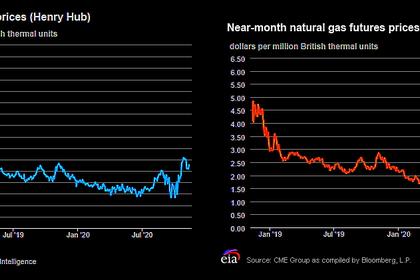

Since May, when the S&P Global Platts JKM spot price bottomed out below $2/MMBtu due to oversupply, the market has enjoyed a sustained rally. The benchmark was assessed at an all-time high of $28.22/MMBtu on Jan. 11 as extreme cold took hold in northeast Asia, boosting demand for spot cargoes amid a period of tightness in the LNG shipping market.

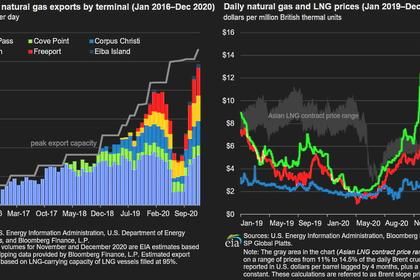

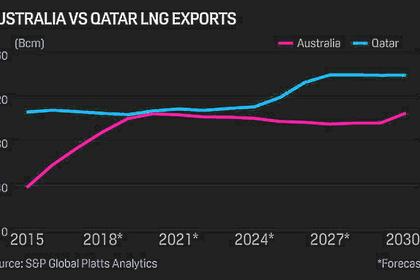

State-owned Qatar Petroleum is planning a to increase LNG production by 43% to 110 million mt/year by 2025, up from 77 million mt/year currently.

A second phase of its project to expand the North Field -- the world's largest offshore gas field -- will increase capacity by an additional 16 million mt/year to 126 million mt/year by the end of 2027.

Since the North Field expansion was first announced in 2017 major international LNG players have been aggressively vying for stakes in the $20 billion project. They include Qatar's existing LNG partners Total, Exxon Mobil, Royal Dutch Shell and ConocoPhillips, as well as Eni, Chevron, Equinor, and several Asian players. So far, none have been offered contracts.

"The IOCs have got to invest in something. It's probably looking like not a bad time to get back into LNG," said Jim Krane, a fellow at Rice University's Baker Institute for Public Policy. "LNG exports, especially with long term contracts, are a pretty stable source of income. They're not as prone to volatility as oil, and gas synergizes well with renewables."

New export markets

QP is expected to finally announce the winning companies towards mid-2021. Despite international oil companies cancelling projects and slashing budgets amid the unprecedented economic shocks of 2020, the North Field expansion project is still an attractive prospect, industry officials have told Platts.

"There's an element of project management and international best practices," said Robin Mills, CEO of Qamar Energy, a Dubai-based consultancy. "QP has not done an LNG project on their own before and this is a big one, with unique features like carbon capture and storage. They would benefit from expertise from IOCs [and] also, on the marketing side, portfolio offtake by the portfolio players, particularly Shell and Total."

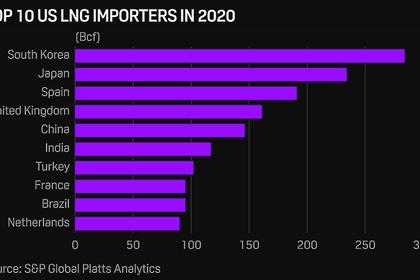

Asian players could gain small stakes in the project, which would serve to secure offtake agreements in high growth markets, such as India and China.

"The idea is to deter other entrants and push them out; to make it harder for Mozambique and other countries," said Mills. "Europe is a big and liquid market, so they don't need firm offtake commitments. It's just a question of how much gas Qatar can put into Europe without overwhelming the benchmark."

Other export markets could be realized closer to Qatar.

Saudi Arabia and the UAE have in recent weeks reopened their borders to Qatar, ending their three-year blockade over a diplomatic dispute. Trade links may soon follow.

"In the long term, it would be a bonus for the Qataris. There is a huge gas export market possibly next door, if they can get their houses in order," said an industry source, who asked not to be named due to the sensitivity of their position. "The Saudis are desperate for gas. If there is a real reconciliation, Qatar's massive amounts of local gas, which they can tap. That's where the real negotiations will be in the future."

-----

Earlier: