SAUDI ARAMCO WILL SELL MORE

REUTERS - JANUARY 28, 2021 - Saudi Arabia’s Crown Prince Mohammed bin Salman, the kingdom’s de facto ruler, on Thursday said that Saudi Aramco will sell more shares as part of plans to bolster the country’s main sovereign wealth fund.

Aramco, the world’s biggest oil company, completed the world’s largest initial public offering in late 2019, raising $25.6 billion and later selling more shares to raise the total to $29.4 billion.

The proceeds of that offer were transferred to the Public Investment Fund (PIF), Prince Mohammed’s vehicle of choice to transform the Saudi economy and diversify away from oil revenues.

“There will be Aramco share offerings coming in the coming years, and this cash will be transferred to the Public Investment Fund,” said Prince Mohammed, speaking at the kingdom’s Future Investment Initiative conference. He said the PIF would invest the proceeds locally and overseas.

The prince also said that apart from further Aramco share sales proceeds, mega projects PIF is backing in Saudi Arabia such as Red Sea tourism project and the $500 billion business zone NEOM are at zero book value on PIF’s books and will generate returns, boosting the fund’s asset size.

On Tuesday, the head of Saudi Arabia’s PIF said Aramco may consider selling more shares if market conditions were right.

Aramco’s shares were down 0.14% on Thursday at 34.75 riyals ($9.26), above its IPO price of 32 riyals. Thursday’s closing price valued the company at $1.86 trillion.

The Aramco initial public offering was seen as a pillar of economic diversification plans aimed at attracting foreign investment.

The $400 billion PIF plans to increase its assets to $1 trillion by 2025, a move that would make it one of the world’s biggest sovereign wealth funds.

The fund plans to invest 3 trillion riyals ($799.83 billion) in new sectors over the next 10 years and, under a five-year plan, it will create 1.8 million direct and indirect jobs by 2025, from 331,000 by the end of the third quarter of 2020.

Analysts and bankers have said that PIF’s investment and development plans will require huge amounts of external funding.

Saudi Arabia has attracted tens of billions of dollars in financing from international banks and debt investors over the past few years, but foreign direct investment has been lagging.

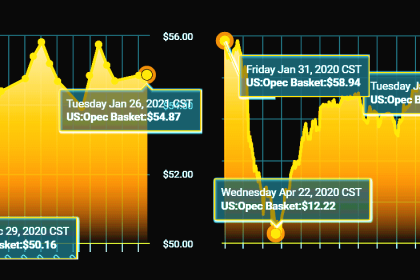

The kingdom’s economy suffered a sharp contraction last year due to the coronavirus crisis and lower oil prices, with oil exports still accounting for more than half the kingdom’s income.

($1 = 3.7508 riyals)

-----

Earlier: