U.S. FOSSIL FUEL WILL UP

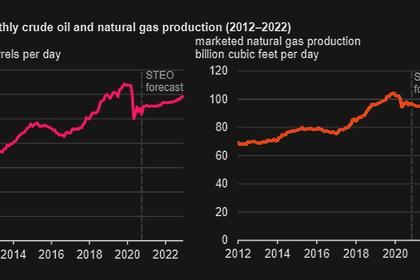

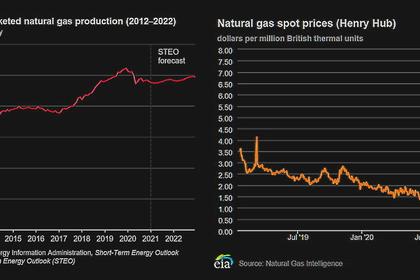

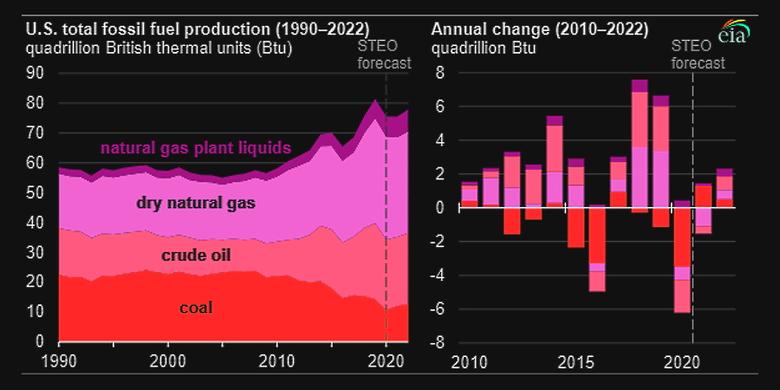

U.S. EIA - JANUARY 15, 2021 - In 2020, fossil fuel production in the United States declined by an estimated 6% from the 2019 record high of 81.3 quadrillion British thermal units (Btu). Based on forecasts in the U.S. Energy Information Administration’s (EIA) January 2021 Short-Term Energy Outlook (STEO), EIA expects total production of fossil fuels in the United States to remain flat in 2021 as increased coal production offsets declines in natural gas production. EIA expects production of all fossil fuels—crude oil, coal, dry natural gas, and natural gas plant liquids (NGPL)—to increase in 2022, but forecast fossil fuel production will remain lower than the 2019 peak.

EIA’s surveys measure fossil fuel production in physical units, such as cubic feet for natural gas, barrels for crude oil, and short tons for coal. In this article, energy production is expressed in heat content units to allow comparisons across fuel types. On a heat-content basis, dry natural gas accounted for the largest share of fossil fuel production in 2020, at 46%. Crude oil accounted for 31%, coal for 14%, and NGPLs for 9%.

From the mid-1980s through 2010, coal was the leading source of U.S. fossil fuel production, but coal production has since been surpassed by dry natural gas (in 2011) and by crude oil (in 2015). In 2020, the United States produced twice as much energy from crude oil (24 quadrillion Btu) than coal (11 quadrillion Btu) and three times as much energy from natural gas (35 quadrillion Btu).

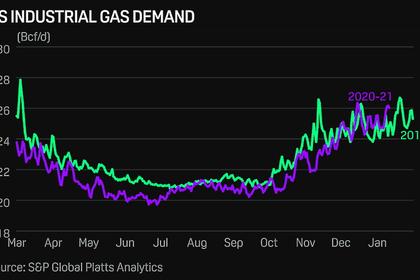

U.S. coal production fell by an estimated 24% in 2020, but according to EIA’s forecast, U.S. coal production will increase by 12% in 2021 and another 4% in 2022. In recent years, about 90% of U.S. coal has been consumed by the electric power sector. In EIA’s forecast, increases in natural gas prices are expected to reduce natural gas consumption for electricity generation, which will result in an increased share for coal—and to a lesser extent, an increased share for renewables such as wind and solar—in the electricity generation mix.

EIA estimates that U.S. NGPL production increased by 7% in 2020. Newly commissioned, more efficient natural gas processing plants supported growth in NGPL production even though natural gas production declined. EIA expects domestic NGPL production to increase by 2% in 2021 and by 7% in 2022 mostly because of ethane production growth.

-----

Earlier: