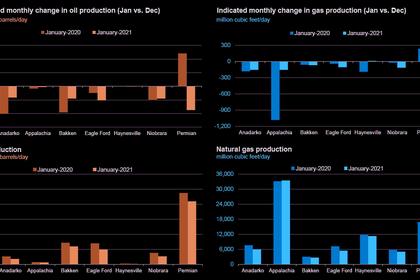

U.S. INDUSTRIAL GAS DEMAND UP

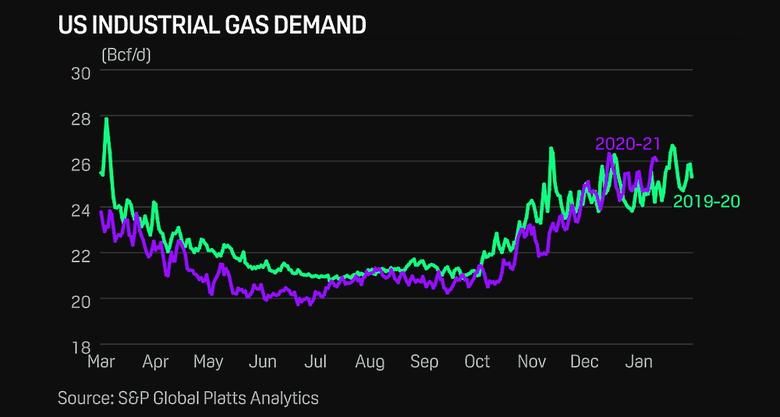

PLATTS - 11 Jan 2021 - Recent growth in industrial natural gas demand has continued into January, outperforming year-ago levels, despite recently expanded lockdowns related to the ongoing coronavirus pandemic.

Month to date, demand from industrial consumers has averaged over 25.3 Bcf/d, outpacing its January 2020 level by 700 MMcf/d, or about 2.8%, data compiled by S&P Global Platts Analytics shows.

As post-holiday-season coronavirus infections surge, states across the US have enacted more restrictions on activity, including lockdowns or curfews in California, Ohio and North Carolina. In additional states, including Washington, Oregon, New Mexico and Illinois, businesses are mostly closed, according to data compiled by The New York Times.

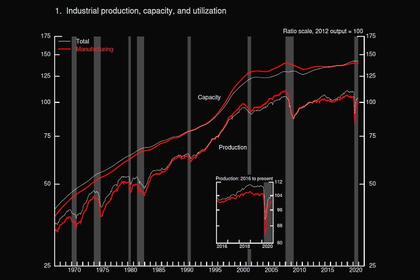

Current lockdowns, though, have failed to significantly slow industrial activity, which suffered a steep decline last March as measures taken in the US and globally cut demand for industrial end products. At the height of the 2020 decline, industrial demand fell nearly 1.4 Bcf/d, compared to its prior-year level.

Regional demand surges

Over the past six weeks, the growth in US industrial gas demand has been fueled in large part by industries in the Northeast, Texas and the Southeast, which together account for over 60% of US industrial gas consumption.

From Dec. 1 to date, industrial demand in the Northeast has grown nearly 330 MMcf/d compared with its year-ago level. In the Texas and the Southeast, demand from industrial end users is up about 160 MMcf/d and 155 MMcf/d, respectively, compared with last year, Platts Analytic data shows.

With the Gulf Coast region largely unaffected by recent state-level coronavirus shutdowns, it seems likely that annual gains in gas demand there will continue through the new year.

One potential risk for industrial gas demand in Gulf Coast Texas and the Southeast stems from continued volatility in the oil and gas industry – a major regional consumer. In January, capacity utilization at US refineries is estimated at just 80.7%, or about 12 percentage points below its year-ago level, data from the US Energy Information Administration shows.

In the chemicals sector, sample consumption data collected by Platts Analytics shows gas demand continuing to trail its year-ago level by about 2%. In addition to price volatility, the US oil, gas and chemicals industries faced extended operational disruptions last summer and autumn amid a historically active hurricane season.

Another potential risk for US industrial gas demand stems from weakness in the domestic and global economies. Historically, recessionary trends have weakened gas demand from the primary metals sector. Further potential economic disruptions caused by the pandemic or by slow vaccine distribution could reverse the primary metals sector's already sluggish recovery. January to date, gas demand from US metals manufacturers remains about 6% below its year-ago level, sample data from Platts Analytics shows.

-----

Earlier: