U.S. LNG FOR ASIA UP

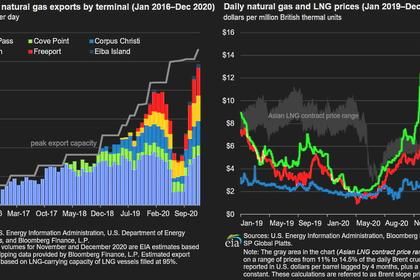

PLATTS - 11 Jan 2021 - US LNG export terminals were operating near capacity Jan. 11 as the spot price for deliveries to Northeast Asia approached a staggering $30/MMBtu amid ongoing supply constraints and strong winter demand.

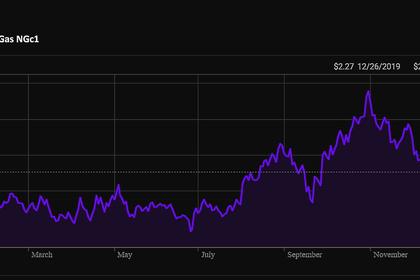

The benchmark S&P Global Platts JKM has soared to a record high from a record low in less than nine months.

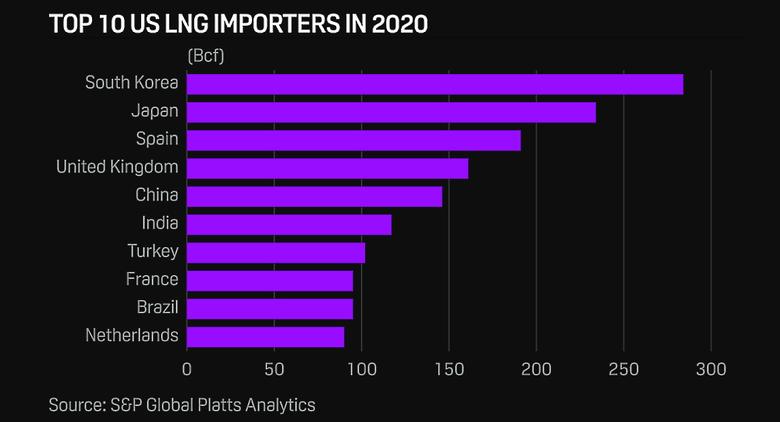

The current trend suggests that Asia will remain the top destination for US LNG for months to come, following robust deliveries to the continent in 2020. Three of the top five destinations last year for US LNG, including No. 1 South Korea, are in Asia, Platts Analytics data showed.

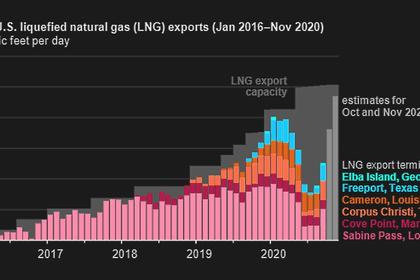

Despite the coronavirus pandemic's impact on demand last summer and widespread cancellations of US cargoes between April and November, total US LNG exports rose by 27% year over year in 2020, with 667 LNG cargoes delivered.

South Korea, the top buyer of US LNG last year, imported 86 US cargoes, a roughly 10% build over 2019, Platts Analytics data showed. Japan retained its position as the second-largest buyer of US LNG, taking 71 cargoes in 2020, a 31% build from 2019.

Spain was No. 3, followed by the UK at No. 4. China, at No. 5, imported 44 US LNG cargoes in 2020, a 10-fold increase over 2019. While tariffs were still in place, China granted waivers to importers, allowing US deliveries to resume in April 2020 following a 13-month pause.

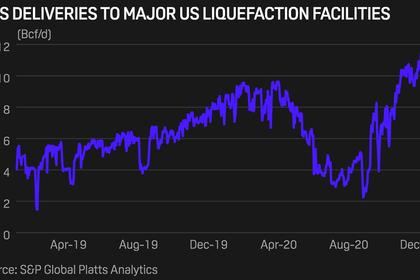

The six major US liquefaction terminals continue to keep utilization high amid the surge in prices for Asia-delivered cargoes.

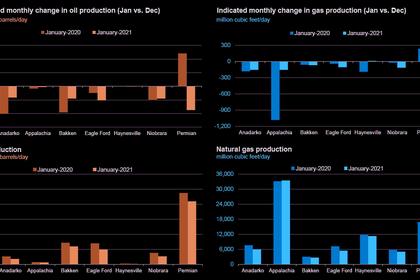

Feedgas deliveries totaled 10.92 Bcf/d on Jan. 11, about 600 MMcf/d below the record high of 11.56 Bcf/d set Dec. 13, Platts Analytics data showed.

The JKM for February was assessed $6.768/MMBtu higher from Jan. 8 at $28.221/MMBtu on Jan. 11. Beyond the general market trends affecting prices, some Japanese importers worry they may face an inventory shortage in January or February, should upstream supply issues or disruption in supply chains worsen.

Virtually all of the proposed second-wave North American liquefaction projects struggled in 2020 to secure sufficient long-term supply deals to make a final investment decision and advance to construction. Across the continent, Sempra Energy's Energia Costa Azul export project in Mexico was the only one to take FID during the year.

Commercial outlook

Developers have blamed travel restrictions amid the pandemic for making deals harder to reach, as well as volatile commodity prices for making buyers uncertain. They are hoping that if the run-up in the JKM is sustained, buyers will be encouraged to sign new deals to mitigate their cost risk.

"Certainly serves as a reminder of how tight the market can get, after being lulled into semi-permanent pessimism amid consecutive warm winters over capacity and the pandemic," said Michael Webber, managing partner of investment research firm Webber Research & Advisory. "Between this reminder, that global LNG markets were closer to balance than many assumed, and the immediate supply curve sliding back amid consistent project slippage around the world, the outlook for LNG certainly looks more constructive."

At the same time, buyers and investors will be smart and competitive about their options, Webber said.

"The days of a significant, blind bid into public greenfield companies are over, but the renewed attention could breathe new life into some of the better positioned projects," he said.

-----

Earlier: