AUSTRALIA NEED HYDROGEN

PLATTS - 27 Oct 2021 - The price of renewable hydrogen will fall below that of conventional fossil fuel-based hydrogen production with carbon capture (blue hydrogen) by 2030 on the back of economies of scale and consumer choice, the Australian Clean Energy Finance Corporation's head of hydrogen investment Rupert Maloney said Oct. 26 during a panel discussion at the 7th Asia LNG & Hydrogen Gas Markets Conference.

Input energy costs in general were expected to fall on average in Australia, Maloney said, citing the government's target cost of A$15/MWh ($11.28/MWh) for solar power.

"The forecast we have is, within this decade, roundabout 2030, green hydrogen will be cheaper than blue hydrogen... quite quickly green will go lower than blue because of economies of scale," Maloney said.

Australian consumers would contribute to driving the cost reduction by opting for renewable fuels, inflating the value of Guarantees of Origin, he said.

The CEFC is a prominent government-owned green bank.

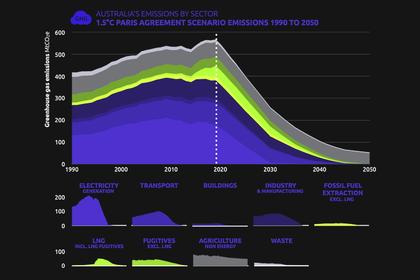

Australia is seeing a rapid rise in the addition of solar power and has over 80 hydrogen projects planned, with renewable energy-based schemes outnumbering blue hydrogen schemes.

The Clean Energy Australia Report 2021 by the Clean Energy Council showed more than 3 GW of new capacity was added in the small-scale solar segment in 2020, up from 2.2 GW the year before.

Australia's power generation totaled 227.34 GW in 2020, of which 62.92GW or 28% was renewable power, according to the report.

Others on the panel titled "Competing fuels or integral allies: Renewables, hydrogen, LNG" echoed Maloney's statement on consumer-driven change, but noted different rates of change in different geographies.

Sarah Bairstow, Chief Commercial Officer at LNG company Mexico Pacific Ltd. said Europe may have an appetite for carbon-neutral LNG but in Asia, a price-sensitive market, that appetite was less apparent. "Natural gas will be required in Asia for 30 years minimum," Bairstow said.

Kian Min Low, Chief Development Officer of JERA Asia, said energy demand in Asia would continue to see "phenomenal" growth, with governments seeking ways to lessen cost impacts via long term, fixed rate purchase contracts.

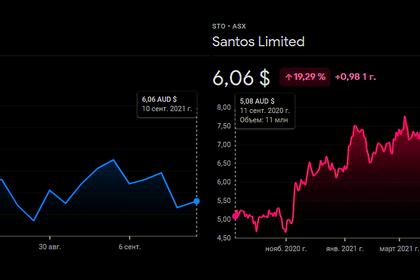

S&P Global Platts assessed Queensland hydrogen produced via alkaline electrolysis, including CAPEX, at A$6.06/kg Oct. 25, up 50.75% from A$4.02/kg on Aug. 13 when Platts launched assessments for Australia's hydrogen prices.

Western Australia hydrogen produced via steam methane reforming with CCS was assessed at A$6.68/kg Oct. 25, up 50.07% from A$4.28/kg assessed Aug. 13.

-----

Earlier: