BRITAIN'S NUCLEAR FINANCE PLAN

N - 29 October 2021 - The UK on 26 October announced its Nuclear Energy (financing) Bill which proposes using the regulated-asset-based (RAB) model through which companies building new plants would be paid during the construction phase, cutting down their development risk and allowing them to secure cheaper financing for the projects.

Proponents say RAB has been used in the UK to finance monopoly infrastructure assets such as water, gas and electricity networks and would ultimately lower the cost of new projects for consumers. However, critics warn that it will leave taxpayers liable for any cost over-runs and delays during construction. The government said the scheme would likely add a few pounds to typical household bills during the early stages of construction and on average less than 1 pound a month during the full construction phase.

It also estimated that the model could save more than GBP30 billion ($41 billion) over the lifetime of a new nuclear project and attract funding from UK financial institutions. “The existing financing scheme led to too many overseas nuclear developers walking away… We urgently need a new approach to attract British funds and other private investors,” Business and Energy Secretary Kwasi Kwarteng said in a statement.

RAB has been used to finance previous infrastructure projects such as the Thames Tideway Tunnel and Heathrow Terminal 5. The decision will empower Kwarteng to exclude China’s state-owned China General Nuclear (CGN) from future energy schemes and could also allow him to remove the company from the proposed £20bn Sizewell C project in Suffolk, which is still subject to planning approval. CGN currently has a 20% stake in the project, with France’s EDF owning the remaining 80%.

Kwarteng said: “Our new model is a win-win for nuclear in our country. Not only will we be able to encourage a greater diversity of private investment, but this will ultimately lower the cost of financing new nuclear power and reduce the costs to consumers and businesses.”

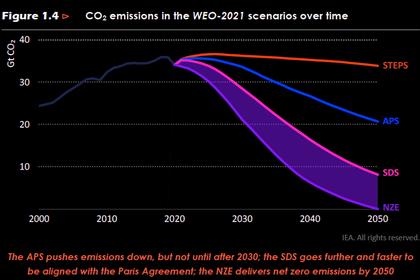

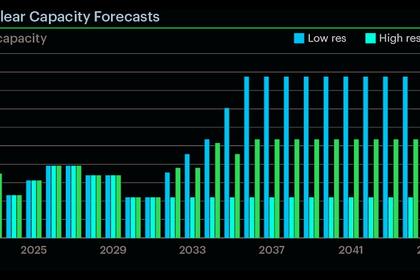

The announcement followed the unveiling of the government’s net zero strategy which set out £120 million towards nuclear projects through the Future Nuclear Enabling Fund. Currently, 17% of the UK’s electricity generation comes from seven nuclear power plants. However, this will fall by almost half by 2024, as many plants are due to shut between then and 2030.

Hinkley Point C in Somerset – another EDF project backed by CGN – which is identical in design to Sizewell C, is the only new plant under consturction. Together, Hinkley and Sizewell C are expected to produce 14% of the UK’s current electricity needs, but will not be operational until the late 2030s.

Announcing the new scheme, the UK Department for Business, Energy & Industrial Strategy (BEIS) said under the Contracts for Difference (CfD) scheme currently in use developers have to finance the construction of a nuclear project and only begin receiving revenue when the station starts generating electricity. This led to the cancellation of recent potential projects, such as Hitachi’s project at Wylfa Newydd in Wales and Toshiba’s at Moorside in Cumbria. Under the RAB model, consumers will contribute to the cost of new nuclear power projects during the construction phase.

“Initial contributions will give private investors greater certainty through a lower and more reliable rate of return in the early stages of a project, lowering the cost of financing it, and ultimately helping reduce consumer electricity bills,” BEIS noted. “Along with other government policies, including those set out in the Net Zero Strategy, such as on energy efficiency, average household energy bills in 2024 will still be lower than if no action was taken to reduce emissions.”

Kwarteng, said: “In light of rising global gas prices, we need to ensure Britain’s electricity grid of the future is bolstered by reliable and affordable nuclear power that’s generated in this country.

The existing financing scheme led to too many overseas nuclear developers walking away from projects, setting Britain back years. We urgently need a new approach to attract British funds and other private investors to back new large-scale nuclear power stations in the UK.” He added: “The RAB model will play an important role in attracting private investors to back new large-scale nuclear power stations, working alongside renewables on an increasingly low-carbon electricity grid. RAB could also be used on new nuclear technologies, including Small Modular Reactors designed and manufactured in the UK.”

Energy Minister Greg Hands said: “This legislation will help us build the new nuclear power stations we need to ensure a resilient, low-carbon electricity system for future generations. The only way to strengthen energy security is to generate clean power in this country, for this country. This finance model will also support the UK’s thriving civil nuclear industry, which currently employs 60,000 in high skilled jobs and help create thousands more as we level up opportunities across the whole country.”

-----

Earlier: