CHINA LNG PRICES UP

PLATTS - 26 Oct 2021 - China's trucked LNG prices have surged to more than Yuan 7,000/mt ($1,093/mt) -- a record high in the non-heating season -- driven by expectations of a colder-than-usual winter, higher import costs, early onset of colder temperatures and a typhoon disruption in the south, according to trade sources.

"We saw significant demand growth from midstream and downstream buyers, mainly city gas distribution companies and some factories in the past few days," said a trader with a state-owned LNG supplier.

These buyers emerged to further replenish their inventory on fears that a cold winter would stimulate more gas demand, and supply might be tight with the start of large-scale centralized heating in the north next month, sources said.

The China Meteorological Administration has warned that the temperature is likely to be lower than normal in most central and eastern areas due to the La Nina event this winter, according to a notice posted on its official website Oct. 22.

Centralized heating in northern China normally lasts from Nov. 15 to March 15, with heating in some higher latitude areas starting even earlier and ending later. Local governments can also decide when heating services begin based on weather conditions.

"Domestic trucked LNG prices have recently surged to above Yuan 7,000/mt but the terminals continue to limit volumes sold downstream. I think these prices can continue to rise ... Yuan 8,000/mt sounds achievable now," a second China-based end-user said.

LNG plants raise prices

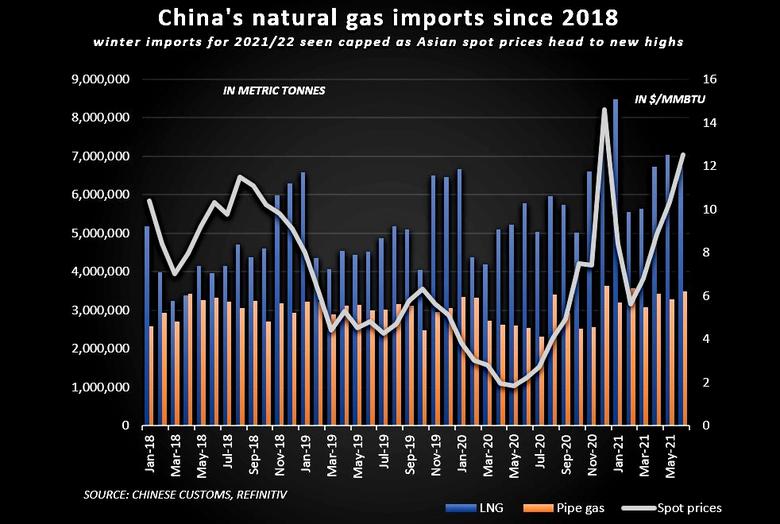

China's trucked LNG prices had risen to above Yuan 6,000/mt in August, then stayed around that level for nearly two months due to weak domestic demand despite a steady increase in Asian spot LNG prices, sources said.

Downstream markets gained momentum after LNG plants in the northwest regions took the lead in raising trucked LNG prices from mid-October due to higher costs of their feedstock pipeline gas as well as on improving demand, according to sources.

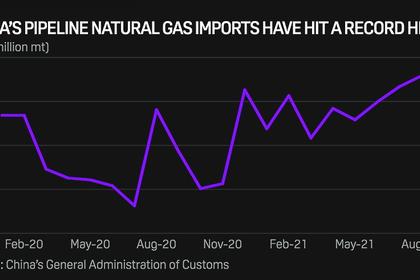

China's LNG plants, which process pipeline gas into LNG, are mostly concentrated in the country's northwest where it is easier to access cheaper pipeline gas resources, such as domestically produced natural gas and imported gas from Russia and Central Asia.

The auction price of pipeline gas on the Chongqing Petroleum and Gas Exchange settled at Yuan 3.90/cu m on Oct. 14 for Oct. 15-31 delivery, 35.4% higher than levels in early-October, data from domestic energy information provider Haoqi Net showed. The data also showed that trucked LNG prices in the northwest regions surged for nine consecutive days starting Oct. 11, with a total increase of Yuan 1,160/mt seen over the period.

Meanwhile, eight provinces and regions in northwest and northeast China have started centralized heating 10-15 days earlier than previous years due to an earlier-than-expected cold wave. Beijing temperatures fell below freezing point Oct. 17, the lowest level recorded for that time of the year since 1969, state-owned media Xinhua said.

Besides, demand from LNG-fueled heavy-duty trucks also increased due to growth in coal transportation, which helped push up prices.

Higher cost supports rise

The higher cost of imported LNG, as well as typhoon disruption in the south, have also encouraged terminals to raise trucked LNG prices in the past two weeks.

LNG terminals in the south increased their trucked price Oct. 13 as truck loading operations were interrupted by Typhoon Kompasu. This was followed by terminals in the north and east China amid higher Asian LNG spot prices, sources noted.

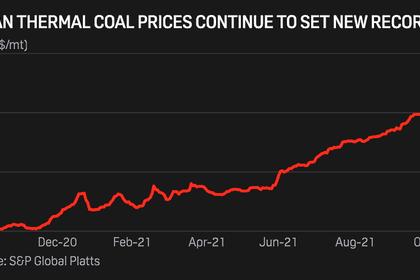

JKM, the benchmark price for spot LNG in northeast Asia, averaged $33.25/MMBtu Sept. 16-Oct. 15 for November-delivery cargoes on a DES basis, up nearly 75% from a month ago, S&P Global Platts data showed, equivalent to nearly Yuan 11,000/mt.

The ICE Brent crude price also surged 55.5% through Aug. 20-Oct. 20, and that is expected to be reflected in the import cost of term contract LNG cargoes starting November. Oil-linked contracts for LNG cargoes are mainly pegged to the prior three-month crude prices.

In addition, diversions of pipeline gas supplies to the north increased demand for trucked LNG in the south, supporting higher trucked LNG prices, market participants said.

Several domestic sources were of the view that the current price levels are not sustainable.

"I think given the current offer levels, downstream demand is really weak. It would depend on the weather now, but industrial users are really priced out," a third Beijing-based source said, adding that even without a cap on volumes sold, there was not an incentive for industrial users to procure additional LNG or natural gas for consumption due to negative production margins.

-----

Earlier: