CHINA NEED COAL, GAS

PLATTS - 19 Oct 2021 - Northern China is seeing an early start to the winter heating season due to falling temperatures, which will boost demand for coal, natural gas and electricity sooner-than-expected and is bullish for fuel prices at a time when global supply remains tight, according to market participants and traders.

Eight provinces and regions in northwest and northeast China, comprising Inner Mongolia, Heilongjiang, Xinjiang, Gansu, Qinghai, Jilin, Shaanxi and Shanxi, have started centralized heating earlier than previous years due to a cold wave, with some cities providing heating 10-15 days earlier than scheduled, according to reports by state-owned media CCTV through the week ended Oct. 17.

The heating season in China normally lasts from Nov. 15 to March 15 in the north, where cold weather is most extreme, but local governments can decide when heating services begin based on local weather conditions.

Temperatures have dropped sharply in many parts of northeast and northwest China, state media said. In Heilongjiang, all heating systems have been opened, and heating companies in Harbin city began supplying heat 4 days earlier than normal, Yulin in Shaanxi province is 10 days ahead of schedule, and Datong in Shanxi province started 13 days earlier than previous years.

China's Central Meteorological Observatory issued a cold wave "blue" warning at 10 am local time on Oct. 15, followed by the China Meteorological Administration initiating a "level four" emergency response, the lowest on a scale of 1 to 4, to the cold wave at 11 am on the same day, according to notices.

According to CMO's forecast, the temperatures in some northern, northeast and eastern regions were expected to drop by 12-14 degrees Celsius from Oct. 15-18 onwards, and temperatures in the northwest started dropping even earlier. Beijing city also experienced a cold wave over the weekend.

According to Beijing's heating regulations, if the temperature is lower than 5 degrees Celsius for 5 consecutive days, heating can be started in advance, CCTV's report said Oct. 14. Hulunbuir city in Inner Mongolia, one of the country's coldest regions, saw heavy snowfall over the weekend, with temperatures plummeting to minus 15 degrees Celsius, CCTV said Oct. 17.

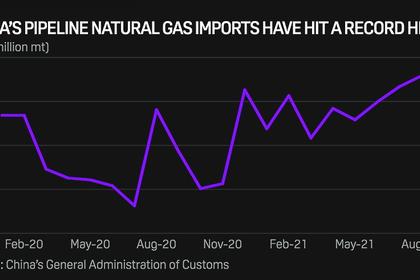

Centralized heating mainly comprises the use of fossil fuels to heat homes through a network of insulated pipelines that transport steam. Authorities have been preparing winter fuel stockpiles through supply and demand measures for months, and most recently pipeline gas was being diverted to the northern regions, market sources said.

Supply of pipeline gas in southern China was reduced by around 10% recently, including gas via arterial gas pipelines --- the China-Central Asia, West-East and Sichuan-East pipelines -- to boost supplies to the north, a few local gas distributors said over the Oct. 16-17 weekend.

"The cut in pipeline gas delivery volume is mainly within the tolerance level of 10% built into the contract," a source in Shenzhen said.

SHORING UP WINTER SUPPLY

At a news conference on Oct. 13, Chinese government officials outlined the State Council's measures to boost energy stocks for winter, and steps to manage the ongoing energy crisis.

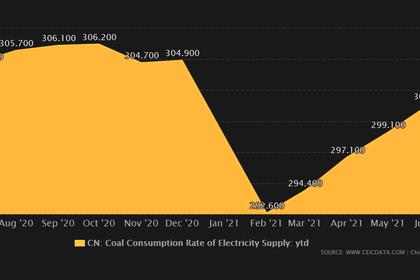

The National Development and Reform Commission has been coordinating with grid and generation utilities to guarantee sufficient coal supplies for power generation, and up till Oct. 9, 13.47 GW and 12.20 GW of coal-fired power units in northeast and east China respectively -- which were paused temporarily during August-September -- have resumed operations, NDRC Secretary General Zhao Chenxin said.

"We have estimated that China's gas storage has reached 27 billion cu m, combining domestic production, pipeline and LNG import, which should be sufficient to meet the peak gas demand," he said.

Zhao said authorities would guarantee sufficient energy supply to the residential sector, which occupies 15% of China's power demand and less than 50% of gas demand, and added that the coal mining provinces of Shanxi, Shaanxi and Inner Mongolia were boosting coal production to full capacity.

"It is not a challenging task to fully guarantee residential energy supplies. NDRC will guide the provincial governments to prioritize residential energy needs, and cut commercial energy use to guarantee residential supply if necessary," he said, noting that the "complicated situation" was linked to the global surge in energy prices.

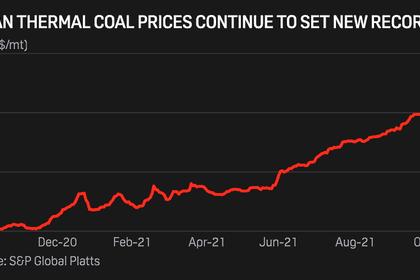

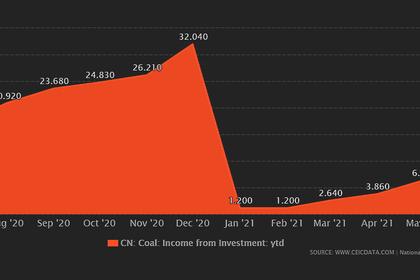

US coal demand increased by nearly 30% year on year, UK's electricity price doubled and natural gas price increased by 2.5 times compared with last year, the LNG price in Northeast Asia increased by 5.4 times and the Australia Newcastle coal price increased by 3.2 times, Zhao said.

"For the fourth quarter, China's coal production is estimated to increase by 55 million mt, which can help to relieve the supply shortage and curb the price surge," Sun Qingguo, department head of the National Mine Safety Administration, said. He noted that around 976 coal mines had been reviewed, out of which 153 coal mines qualified for production expansions, driving production growth of 220 million mt/year.

Yu Bing, deputy director of the National Energy Administration, said at the Oct. 13 conference that China's power shortage has been alleviated through October, with month-to-date power generation rising 10.8% year on year and utilities sitting on coal stocks of 81.99 million mt, equivalent to 15 days of coal supplies.

For the upcoming winter, demand for power and heating will reach its peak, while hydro power supply will reduce due to limited precipitation, Li Ming, deputy chief engineer with the State Grid Corporation of China, said. "We estimated the power grid load will hit a record high at 1 billion kW," he said, adding that the power grid may face significant challenges to provide sufficient power supply.

-----

Earlier: