CHINA'S POWER CRISIS

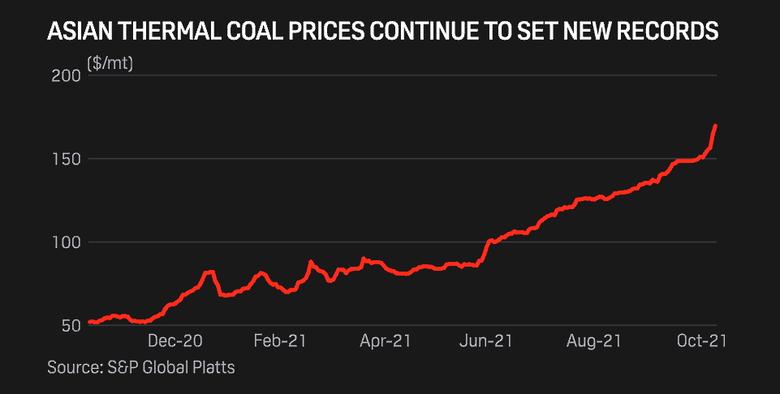

PLATTS - 12 Oct 2021 - A substantial retreat in global coal and gas prices will be necessary to take the heat off and alleviate China's power crisis, although domestic measures will provide some near-term respite, analysts and market participants said.

Coal and gas traders as well as market participants in the supply chain are not very optimistic that generation fuel prices will slump anytime soon given the acceleration in Asia's energy demand, uncertainty around peak winter weather and the global surge in energy prices -- from oil to coal.

"If the winter is a tough one, then [export] prices may remain bullish even till April," an Indonesian coal trader said.

The S&P Global Platts Northeast Asia Thermal Coal price hit a record high $174.32/mt Oct. 11, its value doubling in a span of less than five months, while Platts JKM for November was assessed at $35.210/MMBtu Oct. 11, having eased from an all-time high of $56.326/MMBtu last week.

Recently, the coal supply shortage has spread to key markets like India, where stockpiles at power plants have been dwindling for months and fell to 7.175 million mt Oct. 4, from 37.557 million mt Dec. 31, 2020. Importers have refrained from purchasing at prevailing high prices, leading to a scramble for coal and causing power outages at some states.

Market participants said that while Chinese demand is lifting coal prices, the downside risk is limited given suppressed demand from India -- the world's third-largest coal consumer.

In China, the central government is intensifying contingency measures, including the potential easing of restrictions on Australian coal stuck in Chinese port warehouses.

Since 2020, China had imposed an unofficial ban on Australian coal -- leading to cargoes of high-ash coal languishing for years at Chinese ports -- which had reportedly been sold to India earlier this year at around $96-$100/mt FOB, market sources said. This is in line with reports of higher coal exports from China during this period.

However, market sources said some of these offers had been rescinded in anticipation of easing restrictions, although no official announcement has been made so far.

"My colleague in China, who has old Australian cargoes, is still not able to sell them," an Indonesian trader said Oct. 6.

Prompt Chinese domestic coal prices scaled new peaks this week with offers for Qinhuangdao 5,500 kcal/kg NAR coal heard around, or above Yuan 2,000/mt FOB [$310.66/mt], while offers for 5,000 kcal/kg NAR were heard at around Yuan 1,700-1,800/mt [$264.06-$279.63/mt], sources said Oct.11.

Structural coal shortages

The tight supply for coal did not happen overnight and has been building for months as more importers signed fewer long-term contracts with Indonesian and Australian coal producers from as early as 2020, pushing producers to cut back production in response.

In the first quarter of this year, Indonesian thermal coal supply was hit by adverse weather conditions and COVID-19 infections, followed by heavy rains and flooded mines in Kalimantan in September, along with ongoing issues of labor shortages and lack of mining equipment.

Indonesian miners struggled to clear delivery backlogs under their domestic market obligations or, DMO. State-run electricity company Perusahaan Listrik Negara has requested for an additional 18 million mt of coal for the remainder of 2021, market sources said.

In addition, Indonesia's Ministry of Energy and Mineral Resources imposed an export ban on 34 companies which failed to fulfill their DMO between Jan. 1 and July 31, according to a notice dated Aug. 7.

A senior executive at Adaro, Hendri Tan said in September at the Coaltrans Asia conference that Indonesia is likely to meet around 570 million-580 million mt of its 650 million mt production target this year.

"Coal producers have been matching output to longer-term contractual volumes, rather than supplying into the spot market," Matthew Boyle, head of Coal and Asia Power Analytics at S&P Global Platts said, adding that China's stronger than expected power demand in H1 resulted in higher-than-anticipated coal usage and pre-winter restocking.

"While the restocking period is seasonal, lower-than-anticipated utility coal stocks meant utilities required more coal to meet their restocking requirements. This, Platts believes, is the crux of the reported domestic coal supply crisis in China," Boyle said.

Since China's domestic coal prices are likely more expensive than seaborne coal imports, Boyle said: "We have serious doubts that seaborne coal imports would be able to meet this apparent demand surge."

"We also believe current coastal power utility coal stockpiles are around the 12-day level, higher than the reported eight-day level mid-September, but still below levels to ensure generation continuity," he added.

Shipping constraints have been adding up.

At the start of October, Platts Analytics estimated the vessel queue at Qinhuangdao port consisted of more than 73 vessels, 25 more than a month ago and adding 3-4 weeks to unloading schedules.

"If a coastal utility was indeed short for coal, the seaborne market would not be a viable option to source spot coal," Boyle said.

"Platts Analytics also believes this is a short-term squeeze on domestic coal supply," he said, adding that the coal supply crisis should ease considerably by end-October followed by easing power cuts.

-----

Earlier: