GLOBAL ECONOMY GROWTH 2021-22: 5.9% - 4.9%

IMF - OCTOBER 12, 2021 - WORLD ECONOMIC OUTLOOK

EXECUTIVE SUMMARY

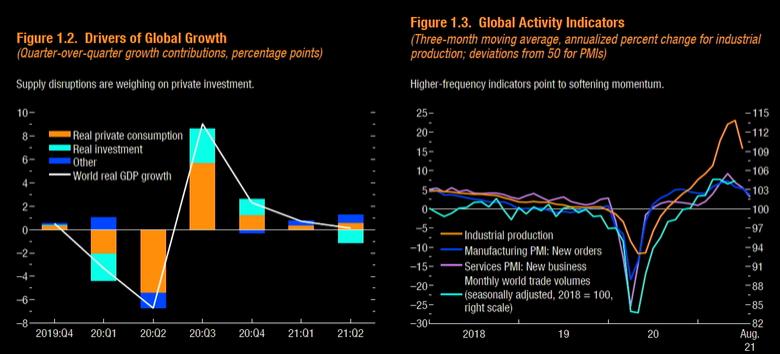

The global economic recovery is continuing, even as the pandemic resurges. The fault lines opened up by COVID-19 are looking more persistent—near-term divergences are expected to leave lasting imprints on medium-term performance. Vaccine access and early policy support are the principal drivers of the gaps.

Rapid spread of Delta and the threat of new variants have increased uncertainty about how quickly the pandemic can be overcome. Policy choices have become more difficult, confronting multidimensional challenges—subdued employment growth, rising inflation, food insecurity, the setback to human capital accumulation, and climate change—with limited room to maneuver.

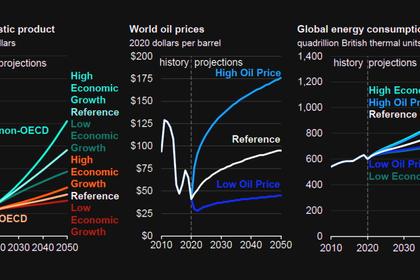

The forecast: The global economy is projected to grow 5.9 percent in 2021 and 4.9 percent in 2022 (0.1 percentage point lower for 2021 than in the July 2021 World Economic Outlook (WEO) Update). The downward revision for 2021 reflects a downgrade for advanced economies—in part due to supply disruptions—and for low-income developing countries, largely due to worsening pandemic dynamics. This is partially offset by stronger nearterm prospects among some commodity-exporting emerging market and developing economies.

Employment is generally expected to continue lagging the recovery in output.

Beyond 2022 global growth is projected to moderate to about 3.3 percent over the medium term. Advanced economy output is forecast to exceed pre-pandemic medium-term projections—largely reflecting sizable anticipated further policy support in the United States that includes measures to increase potential. By contrast, persistent output losses are anticipated for the emerging market and developing economy group due to slower vaccine rollouts and generally less policy support compared to advanced economies.

Headline inflation rates have increased rapidly in the United States and in some emerging market and developing economies. In most cases, rising inflation reflects pandemic-related supply-demand mismatches and higher commodity prices compared to their low base from a year ago. As discussed in Chapters 1 and 2, for the most part, price pressures are expected to subside in 2022. In some emerging market and developing economies, price pressures are expected to persist because of elevated food prices, lagged effects of higher oil prices, and exchange rate depreciation lifting the prices of imported goods. However, great uncertainty surrounds inflation prospects—primarily stemming from the path of the pandemic, the duration of supply disruptions, and how inflation expectations may evolve in this environment.

Overall, the balance of risks for growth is tilted to the downside. The major source of concern is that more aggressive SARS-CoV-2 variants could emerge before widespread vaccination is reached.

Inflation risks are skewed to the upside and could materialize if pandemic-induced supply-demand mismatches continue longer than expected (including if the damage to supply potential turns out worse than anticipated), leading to more sustained price pressures and rising inflation expectations that prompt a fasterthan- anticipated monetary normalization in advanced economies (see also the October 2021 Global Financial Stability Report).

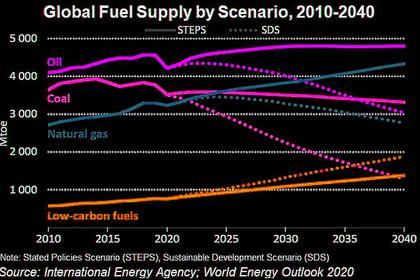

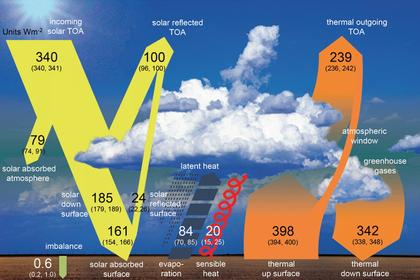

Multilateral efforts to speed up global vaccine access, provide liquidity and debt relief to constrained economies, and mitigate and adapt to climate change remain essential. Speeding up the vaccination of the world population remains the top policy priority, while continuing the push for widespread testing and investing in therapeutics. This would save millions of lives, help prevent the emergence of new variants, and hasten the global economic recovery. As discussed in Chapter 1, an IMF proposal lays out concrete, cost-effective steps to vaccinate at least 40 percent of the population in every country by the end of 2021 and 70 percent by mid-2022. It is also crucial to ensure that financially constrained countries can continue essential spending while meeting other obligations. The IMF’s recent General Allocation of Special Drawing Rights, equivalent to $650 billion, provided much-needed international liquidity. Moreover, doubling down efforts to curb greenhouse gas emissions is critical—current actions and pledges are not enough to prevent a dangerous overheating of the planet. The international community should also resolve trade tensions and reverse the trade restrictions implemented in 2018–19, strengthen the rules-based multilateral trading system, and complete an agreement on a global minimum for corporate taxes that halts a race to the bottom and helps bolster finances to fund critical public investments.

At the national level, the policy mix should continue to be tailored to local pandemic and economic conditions, aiming for maximum sustainable employment while protecting the credibility of policy frameworks.

- Fiscal policy: The imperatives will depend on the stage of the pandemic (also see the October 2021 Fiscal Monitor). Health care-related spending remains the priority. As the pandemic persists and fiscal space is limited in some countries, lifelines and transfers will need to become increasingly targeted to the worst affected and provide retraining and support for reallocation. Where health metrics permit, emphasis should shift toward measures to secure the recovery and invest in longer-term structural goals. Initiatives should be embedded in medium-term frameworks with credible revenue and expenditure measures ensuring debt sustainability.

- Monetary policy: Although central banks can generally look through transitory inflation pressures and avoid tightening until there is more clarity on underlying price dynamics, they should be prepared to act quickly if the recovery strengthens faster than expected or risks of rising inflation expectations become tangible. In settings where inflation is rising amid still-subdued employment rates and risks of expectations de-anchoring are becoming concrete, monetary policy may need to be tightened to get ahead of price pressures, even if that delays the employment recovery. The alternative of waiting for stronger employment outcomes runs the risk that inflation increases in a self-fulfilling way, undermining the credibility of the policy framework and creating more uncertainty. A spiral of doubt could hold back private investment and lead to precisely the slower employment recovery central banks seek to avoid when holding off on policy tightening. By contrast, monetary policy can remain accommodative where inflation pressures are contained, inflation expectations are still below the central bank target, and labor market slack remains. The unprecedented conjuncture makes transparent and clear communication about the outlook for monetary policy even more critical.

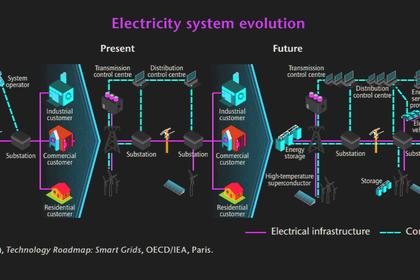

- Preparing for the post-pandemic economy: Finally, it is important to deal with the challenges of the postpandemic economy: reversing the pandemic-induced setback to human capital accumulation, facilitating new growth opportunities related to green technology and digitalization, reducing inequality, and ensuring sustainable public finances. Chapter 3 explores one dimension of this policy agenda—the importance of basic research investment for spurring productivity growth.

-----

Earlier: