GLOBAL OIL DEMAND WILL UP

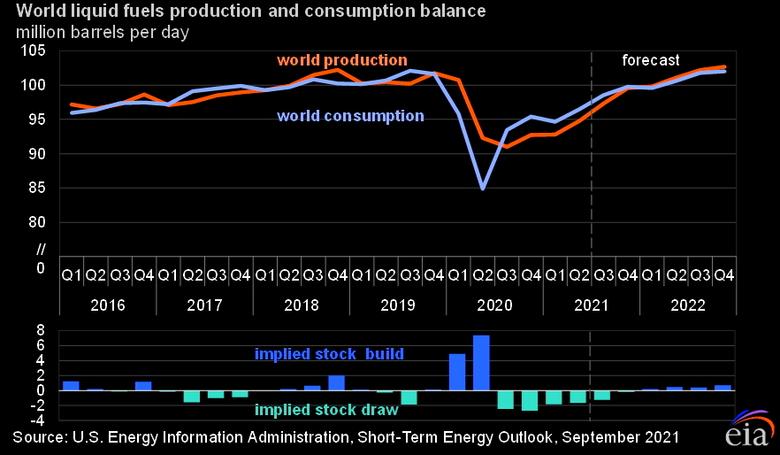

PLATTS - 06 Oct 2021 - Global oil demand is set to recover to its pre-pandemic level toward the end of 2022, supported by demand growth in Asia, and increase for "several more years to come" without additional major government policy changes, the head of the International Energy Agency told S&P Global Platts.

"Global oil demand is expected to return to pre-COVID levels towards the tail end of 2022, but the recovery will be uneven. Asia is clearly the driver of growth," IEA Executive Director Fatih Birol said in a written interview with Platts during the Tokyo "Beyond Zero" Week hosted by Japan.

"By the end of 2022, it is expected to be 1.5 million b/d higher than at the end of 2019, offsetting declines in Europe, North America and elsewhere," Birol said.

The coronavirus pandemic-led crisis has been a catalyst in many ways for the energy transition, with many countries and energy companies committing to more ambitious climate goals, including mid-century targets for net zero emissions, Birol said.

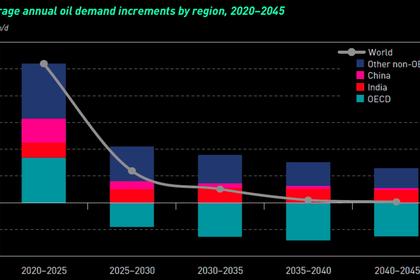

"However, our analysis shows that although the COVID-19 crisis caused a historic decline in global oil demand, it's not necessarily a lasting one," Birol said. "If we don't see additional major policy changes from governments and more rapid changes in behavior, then global oil demand is set to increase for several more years to come."

Amid intensifying global moves away from fossil fuels to clean energy sources, "oil and gas markets may experience heightened market volatility and concentration," he said. "This can happen if reductions in oil and gas demand are outpaced by decreases in supply due to lack of investment in existing fields, or if available supply is concentrated in fewer countries."

In any scenario, "an orderly transition requires investment to sustain supplies at the appropriate level," he said.

Monitoring gas

The IEA is currently closely monitoring global gas and LNG markets as it sees the current high prices are due in part to extreme weather, unplanned outages and demand recovery from the pandemic.

"Security of energy supply is one of the IEA's core missions, and we are closely monitoring the situation on global gas and LNG markets and current high prices, which hit all-time highs in both Europe and Asia," Birol said.

Gas prices globally have hit record highs in recent weeks, with the Platts JKM spot Asian LNG price reaching $39.671/MMBtu for November and the TTF month-ahead price hitting $39.914/MMBtu Oct. 5.

Unlike its mandate for its member countries to have emergency oil stocks equivalent to a minimum 90 days of net oil imports for a possible coordinated release in event of a severe supply disruption, the IEA currently does not have any mandate for emergency gas reserves.

Asked about the role of LNG for decarbonization in Asia, Birol said: "Natural gas occupies a difficult space in energy transitions. Its role varies by timeframe, geography and sector. However, in the immediate future, switching to natural gas can make sense for some countries in Asia that are highly dependent on coal or that use oil in industry: it can avoid emissions while helping to improve air quality," he said.

Several Southeast Asian countries such as Thailand, the Philippines and Vietnam are already taking measures to reduce the role of coal in their energy mix to the benefit of LNG and renewables, Birol said.

"But LNG alone cannot be a sustainable option to net zero emissions. It has to be associated with clean energy production from renewables and take into account its own transition to low-carbon gas supply," he added.

Hydrogen supply

There are more than 60 hydrogen and hydrogen-based fuels projects announced, with 20 already under development, Birol noted. Hydrogen projects could lead to a few million mt a year of supply by 2030, he added.

To facilitate these hydrogen supply chains, Birol said that a continued decrease in the cost of low-carbon hydrogen and derived fuels is needed.

In addition, the development of a set of internationally agreed standards, including methodology to calculate the carbon footprint of hydrogen production and the implementation of certification programs that can provide importers certainty on the product they are buying, is required, he said.

"Demand creation is a key lever to unlock hydrogen potential as a clean fuel. However, it is lagging behind what is needed to put the world on track to reach net zero emissions," Birol said. "To date, however, the use of low-carbon hydrogen is more costly than its fossil competitors."

Carbon pricing, which is already in place in some countries, is helping to close this cost gap, he said.

"A wider adoption of carbon prices combined with other policy instruments like auctions, mandates, quotas and hydrogen-specific requirements in public procurement can help industry de-risk investments and improve the economic feasibility of low-carbon hydrogen." Birol said. "This will ultimately unlock investments also in the development of low-carbon hydrogen production capacities."

-----

Earlier: