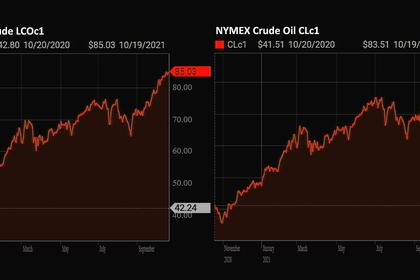

OIL PRICE: BELOW $85

REUTERS - Oct 20 - Oil prices fell on Wednesday after the Chinese government stepped up efforts to tame record high coal prices and ensure coal mines operate at full capacity as Beijing moved to ease a power shortage.

Prices for Chinese coal and other commodities slumped in early trade, which in turn pulled oil down from an uptick earlier in the day.

"With coal and gas prices easing and with the relative strength index (RSI) technical indicators still in overbought territory, the odds of a sharp, but material fall in oil prices are rising," said Jeffrey Halley, senior market analyst at OANDA.

China's National Development and Reform Commission said late on Tuesday that it would bring coal prices back to a reasonable range and crack down on any irregularities that disturb market order or malicious speculation on thermal coal futures.

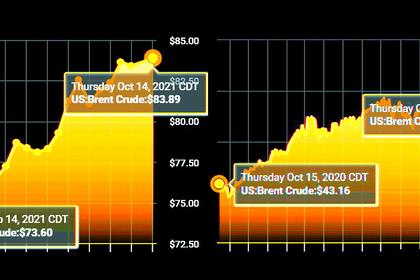

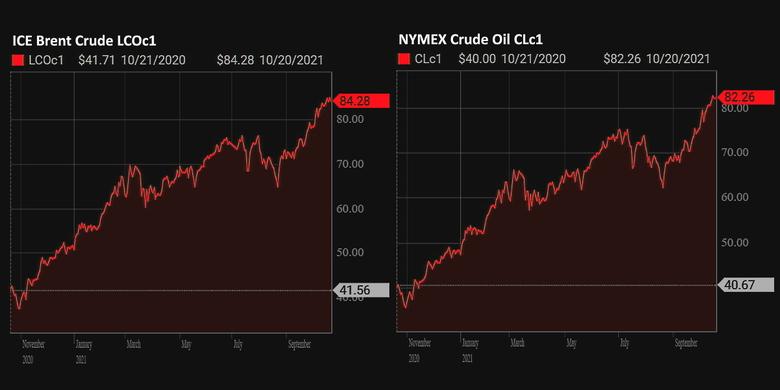

Brent crude futures dropped 64 cents, or 0.8%, to $84.44 a barrel at 0645 GMT, paring a 75-cent rise in the previous session, but still lingering close to multi-year highs.

U.S. West Texas Intermediate (WTI) crude futures for November, which expires on Wednesday, fell 56 cents to $82.40 a barrel. The more active WTI contract for December was down 59 cents, or 0.7%, to $81.85 a barrel.

"Brent crude could fall to $82 and WTI to $78.50 a barrel, and still comfortably remain in a strong bull market... Even if oil was to stage a $5 pullback, I continue to believe that it will be short in duration," analyst Halley said.

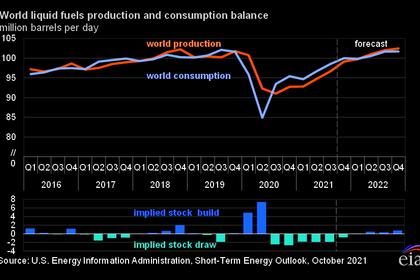

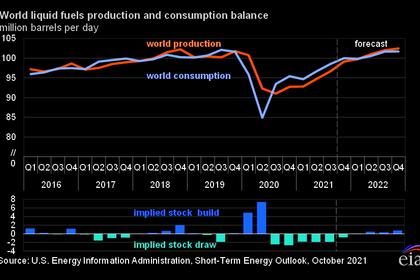

Oil markets in general remain supported on the back of a global coal and gas crunch, which has driven a switch to diesel and fuel oil for power generation.

But the market on Wednesday was also pressured by data from the American Petroleum Institute industry group which showed U.S. crude stocks rose by 3.3 million barrels for the week ended Oct. 15, according to market sources.

That was well above nine analysts' forecasts for a rise of 1.9 million barrels in crude stocks, in a Reuters poll.

However U.S. gasoline and distillate inventories, which include diesel, heating oil and jet fuel, fell much more than analysts had expected, pointing to strong demand.

Data from the U.S. Energy Information Administration is due later on Wednesday.

-----

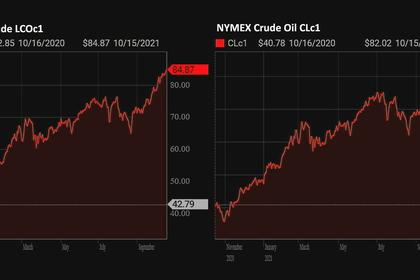

Earlier: