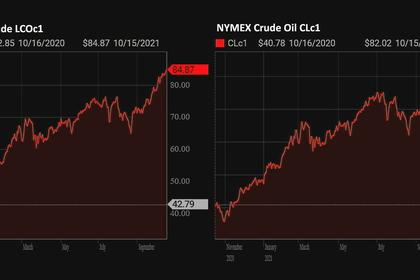

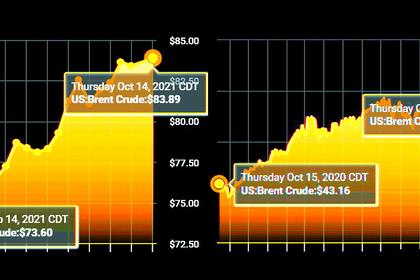

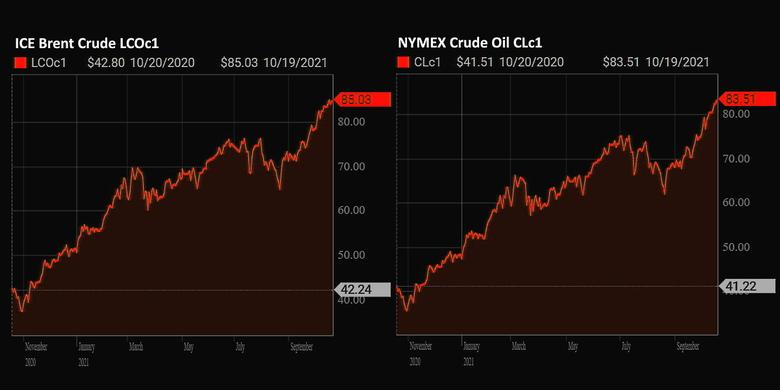

OIL PRICE: NEAR $85

REUTERS - Oct 19 - Oil prices rose on Tuesday as a supply crunch in natural gas, electricity and coal continued across the globe while falling temperatures in China revived concerns over whether the world's biggest energy consumer can meet domestic demand for heating.

The Brent crude benchmark rose 35 cents, or 0.4%, to $84.68 a barrel by 0827 GMT after falling 0.6% on Monday. The contract is still up nearly 7% this month.

U.S. West Texas Intermediate (WTI) futures gained 70 cents, or 0.9%, to $83.14, having risen 0.2% in the previous session and nearly 10% this month.

"In a bull market it is usually Brent that leads the way higher, but this time around (U.S.) domestic issues provide extra support for WTI," said Tamas Varga, oil analyst at London brokerage PVM Oil Associates.

"The recent hurricane season proved to be so disruptive that (U.S.) producers have not fully recovered from the damage caused by (Hurricane) Ida."

With temperatures falling as the northern hemisphere winter approaches and heating demand increasing, prices of oil, coal and natural gas are likely to remain elevated, traders and analysts said.

Colder weather has already started to grip China, with close to freezing temperatures forecast for northern areas, according to AccuWeather.com.

Coal futures in China rose as much as 7.8% on Tuesday, while riskier assets such as equities also gained. The rising coal and natural gas prices in Asia are expected to cause some end-users to switch to lower-cost oil as an alternative.

However, the power crunch that is sending prices higher is also hurting Chinese economic growth, which fell to its lowest in a year, official data showed on Monday.

China's daily crude oil processing rate also fell last month, dropping to the lowest level since May last year.

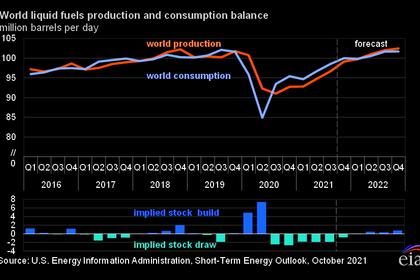

Helping to keep a lid on prices, U.S. oil output is set to rise. Production in the largest shale formation in the world's biggest oil producer is expected to gain further next month, the Energy Information Administration said.

-----

Earlier: