OIL PRICES: $75 - $90

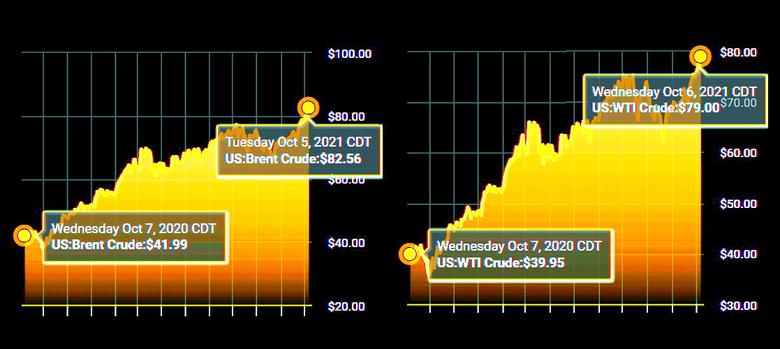

PLATTS - 05 Oct 2021 - Straining supply lines and under-investment in upstream will likely dog oil markets and support prices, with levels similar to current ones in a year's time, the CEOs of commodity traders Vitol, Gunvor Group and Trafigura said at an industry event Oct. 4.

Oil will likely be at $75/b, gas at the Dutch TTF hub, weather dependent, at $15/MMBtu ($66/MWh) and European carbon prices at $75/mt in October 2022, Vitol CEO Russell Hardy said at the Energy Intelligence Forum 2021.

Torbjorn Tornqvist, chief executive of Gunvor, forecast oil at $85/b, gas at the TTF at $60/MWh and carbon prices at $70/mt.

Trafigura CEO Jeremy Weir forecast oil at $90/b, gas at the TTF at $48/MWh and carbon at $60/mt.

S&P Global Platts assessed Dated Brent at $81.765/b, Dutch TTF day ahead prices at Eur89.4/MWh ($103.74/MWh) and and CORSIA-eligible carbon (CEC) offset credits at $7/mtCO2e at the close Oct. 4. Meanwhile, in the EU Emissions Trading System, EU Allowance futures contracts for December 2021 delivery on the ICE Endex exchange closed at Eur63.40/mt Oct. 4, down from an all-time high of Eur65.77/mt Sept. 28.

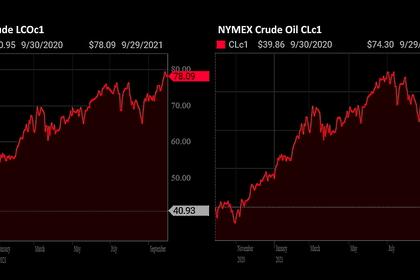

Commodity markets have seen turbulent times in recent months and years. Dated Brent has swung from $85.51/b in October 2018 to $13.24/b on April 2021; its lowest since March 18, 1999.

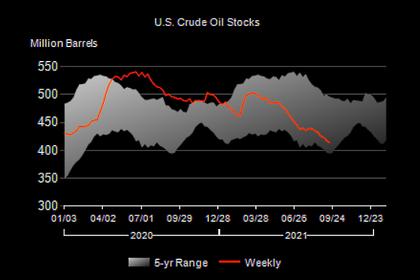

Commodities, including oil, have been supported off late by the bull run in gas markets, with stocks of the fuel low after last year's cold winter, low hydro, low wind and a booming industrial sector in many parts of the world.

The world is showing signs of emerging from the demand slump of the coronavirus pandemic but this has stretched supply lines, coal has become tight at short notice and energy is becoming unaffordable, both for domestic and industrial end-users while energy providers try to finance the energy transition, Hardy said.

While the extreme gas prices may not last, hydrocarbon markets are going to experience more volatility and will probably suffer underinvestment, he added.

Weir said the current energy crisis in Europe was "showing how important gas is in the energy transition."

Weir also called attention to constraints on supply, warning of "potentially big issues" in Europe and elsewhere. "On the demand side on industrial production we need to get these supply chains working properly so we can you feel like we have a have a smoother outlook. At the moment I'm pretty concerned about what we see," he said.

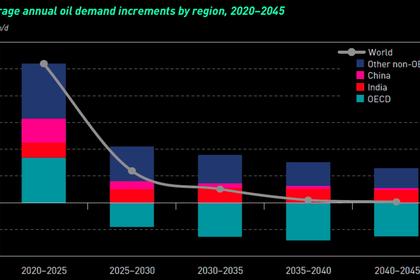

Hardy noted jet fuel demand was likely to rise into the 2030s and 2040s, as would petrochemical demand for oil, while gasoline and diesel demand could decline later this decade.

OPEC and its production allies have managed oil supply and oil prices well but the right ceiling for oil values has not yet been found, Hardy said.

The trading firm bosses said they would continue to invest in upstream hydrocarbon operations.

"We need oil," Tornqvist said, adding that exploration "isn't against the energy transition," and that managing emissions was a valid solution.

Vitol's Hardy said his company was investing a similar amount in upstream operations as in renewables.

S&P Global Platts Analytics expects prices to track lower in the months ahead. However, renewed tightening will occur in 2022, with prices at around $75/b in October 2022, Platts Analytics analysts said in their September World Oil Market Forecast.

Platts Analytics expects gas prices at the TTF to be around Eur80/MWh in December, and to decline to around between Eur30/MWh and Eur40/MWh in October 2022.

Hydrogen, carbon markets

The trading houses all saw opportunities in the carbon and hydrogen sectors.

"Carbon and hydrogen are both very attractive commodities," Weir said, noting that Trafigura was investing in both areas.

Hydrogen storage, distribution and production would be a "very exciting area" for Trafigura, Weir said.

However, for Gunvor's Tornqvist, the low-carbon hydrogen and ammonia markets were still some distance away from becoming a reality, and electrification of power and energy was the more pressing goal of the energy transition, he said.

-----

Earlier: