OPEC+ OIL DELIVERIES +400 TBD

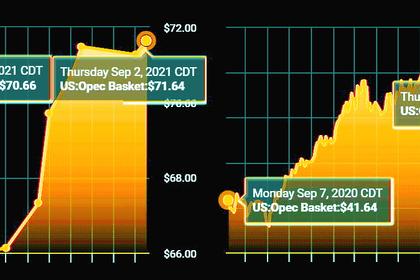

PLATTS - 27 Oct 2021 - OPEC's claim that there is no shortage in the physical oil market appears at odds with the upward trajectory of the futures market. Varying appetites for different quality and regional crudes is the missing link.

While the level of buying interest in Middle East barrels appears to better match OPEC's strategy to steadily bring crude back to the market, the bullish narrative that has pushed Brent above $85/b is led by appetite for sweeter grades, according to market participants and analysts.

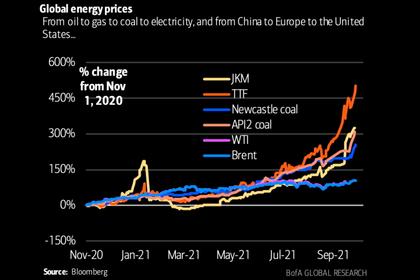

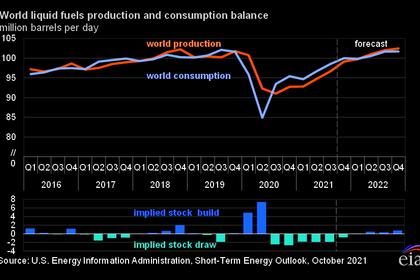

There is little doubt the market is well supported given strong signs crude demand is recovering, jitters over the amount of gas-to-oil switching as the energy crunch hits, and a sharp decline in oil inventories.

Much of the fervor surrounds light, sweet crudes and especially US grades, such as WTI Midland rich in distillates especially suited for substituting gas in Asia and Europe. The lighter, sweeter North Sea and Mediterranean grades have also proven popular.

How long this lasts is open to question given the higher prices. More than 1 million b/d of WTI Midland is expected to arrive into Europe through October and November, but sources have suggested a tepid start to December buying due to strong freight and tighter arbitrage economics.

"I cannot imagine there is much demand up there," one trader said, referring to the high offer levels for WTI Midland into Europe through December, adding also that "early January arrival [levels] will be much higher with the roll, so expect flows to diminish."

Refiners could revert to other light, sweet options as the spread between WTI and Dated Brent narrows, while Asia could pick up some of the slack, especially if China starts to snap up crudes again fearing winter shortages.

Meanwhile, for heavier, sourer crudes, often located in OPEC's Middle East heartland, the story is a little different. As refiners in Asia complete their purchases this month, there were still some unsold barrels of grades such as UAE's Upper Zakum available for loading in December.

Saudi Arabia along with some its Middle East OPEC allies, Iraq, Kuwait, lowered their official selling prices for their crude cargoes to Asia, Europe and US at the start of October, giving global refiners an incentive to increase liftings as OPEC+ raises output.

Buying interest in Forties, a North Sea grade but treated more as a sour crude in Europe, stands in stark contrast to its Brent benchmark peers, with long-haul demand struggling amid increasing freight rates and a wider Brent/Dubai spread.

Even West African grades, which compete with lighter sweet crudes, have found themselves down the pecking order due to higher freight costs and steep backwardation and the appetite for US and European barrels. However, Nigeria has raised its OSPs for most of its crude grades loading in November.

Angolan and Nigerian crude buying has been on a steady uptrend, especially from China, but sources suggest the market isn't tight, with refiners hardly scrambling to get suitable grades.

Chinese import quotas, a huge decider of demand for West African crude, were disappointing and present a grim outlook for Angolan crude according to a trader.

"Demand seems slow going in China despite all the shortages of coal, LNG, etc. which seems odd," the trader added.

Indian refiners are also leaning away from West African sweets due to the wide Brent/Dubai spread and favoring Middle East grades. Even though the average run rate of Indian refineries is around 90% so far in October, and imports are increasing according to tradeflow data from Kpler, Nigerian sweets are losing out.

Crude availability

Saudi Arabia's energy minister Prince Abdulaziz bin Salman recently stated he saw no evidence of a crude shortage despite fears of a new surge in prices in the coming months.

"The issue is not the lack of crude oil. Even if we supply it...where are the refineries that will convert it?" he said mid-October at the India Energy Forum by CERAWeek, rebutting claims from key producers such as India, the US and Japan that OPEC+ should do more to alleviate the spike in oil prices.

OPEC+ has been sticking to its script of bringing on 400,000 b/d of crude to the market each month, with the Saudi energy minister suggesting panic buying is causing much of the market tightness.

Independent oil consultant Anas Al-Hajji agrees.

"There were no refiners who needed oil and couldn't get it. Should the situation change in the winter, we may get a short squeeze until oil arrives from Saudi Arabia and its allies," he says.

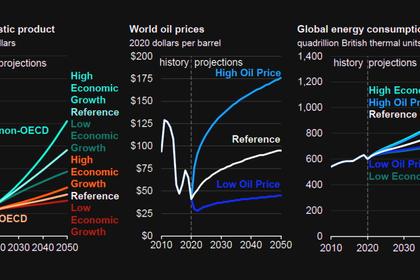

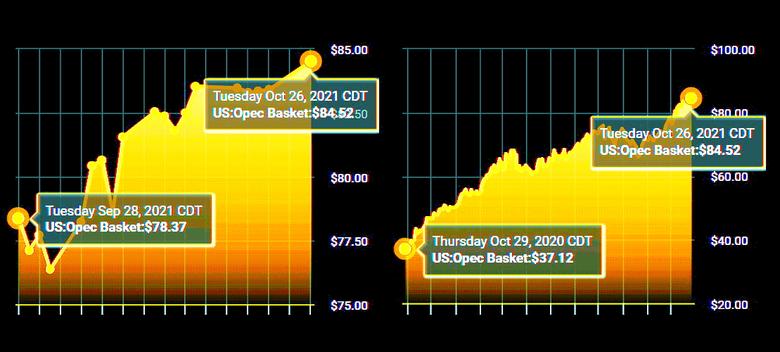

Oil prices have doubled since October 2020 and appear well supported above $80/b, with analysts pointing to the sharp decline in crude stocks this year which took OECD inventories to their lowest level since 2015.

However, with 2.8 billion barrels of crude in OECD commercial storage, according to Platts data, stocks remain adequate and even higher than at any other point since 2000. Added to that is a still-sizeable global spare capacity buffer of well over 3 million b/d according to Platts Analytics estimates, as well as larger Chinese oil stocks now than at that time.

Nevertheless, Goldman Sachs and UBS analysts continue to revise their oil forecasts higher and money managers have cut their short positions by more than 15% between Oct. 12-19, while reducing their longs by only 1%, according to Platts Analytics.

"The considerable reduction in short holdings, the largest since mid-June, indicates that hedge funds and asset managers are now more confident in the strength of the buying support and now cutting loose their downside protections," Platts Analytics said in a note.

It appears that for now the futures market has a momentum beyond the physical market. OPEC+ will have to consider that very dynamic when it meets again in early November but it seems the group is so far focused on fundamentals.

-----

Earlier: