CHINA LNG PRICES UP

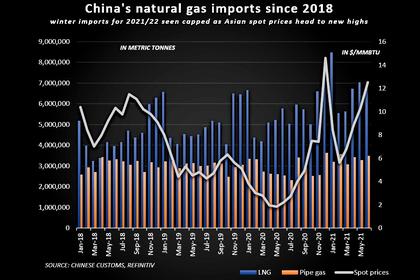

PLATTS - 03 Nov 2021 - China's trucked LNG prices have breached Yuan 8,000/mt ($1,252/mt), or the equivalent of $24/MMBtu, in several regions, an increase of 23% from a week earlier, driven by higher global LNG prices and several coastal terminals rationing supply and stockpiling reserves for peak winter demand.

Several domestic LNG terminals have been required to maintain an inventory level of above 75% at their LNG tanks to ensure stable supply for winter, resulting in tighter supply of domestic spot LNG and higher prices, sources said. In some regions, LNG has been diverted to boost pipeline supply to northern provinces where heating demand will be concentrated in coming months.

CNOOC Ningbo terminal has cut its trucked LNG sales volume to around 300 trucks/day from 400 trucks/day, ENN Zhoushan terminal to around 150-160 trucks/day from 230-240 trucks/day and Guanghui Qidong terminal to around 130 trucks/day from 160 trucks/day, while PetroChina Rudong terminal was selling only 25 trucks/day, according to sources in eastern China.

While trucked LNG prices offered by coastal LNG receiving terminals in east, south and north China typically see price fluctuations due to market sentiment, this year trucked LNG prices in landlocked provinces in the northwest have also surged to around Yuan 8,000/mt.

These landlocked plants convert pipeline gas to LNG for trucking due to network constraints, and the price hike in the northwest regions has added to bullish sentiment for trucked LNG prices in the rest of China that already face price pressure from seaborne LNG imports.

China's overall trucked LNG price averaged Yuan 7,813/mt across the entire country Nov. 1, up 14% from Oct. 25 and 32% higher than early October, data from Shanghai Petroleum and Gas Exchange showed.

Qidong LNG terminal in eastern Jiangsu province raised its offer for trucked LNG by Yuan 500/mt end October and by another Yuan 400/mt to Yuan 8,500/mt Nov. 1, a market source in east China said.

The Platts JKM price for spot LNG in Northeast Asia averaged $33.25/MMBtu over Sept. 16-Oct. 15 for November-delivery cargoes on a DES basis, up nearly 75% from a month earlier, and equating to almost Yuan 11,000/mt after adding taxes and fees.

ICE Brent crude price has risen 55.5% in the past three months and this was expected to reflected in the import cost of term LNG cargoes from November. Oil-linked LNG contracts are mainly pegged to the prior three-month crude prices.

Northwest price surge

China's LNG plants that process pipeline gas into LNG are mostly concentrated in the northwest where cheaper pipeline gas from domestic sources and imports from Russia and Central Asia are available. Trucked LNG volumes there are lower than at coastal terminals.

Trucked LNG prices in the northwest have seen the highest increase in the past week, mainly driven by higher cost feedstock pipeline gas, implying that supply of pipeline gas is tight.

Northwest China plants sold trucked LNG at Yuan 8,084/mt Nov. 1, up from Yuan 6,578/mt a week earlier, according to Chongqing Petroleum and Gas Exchange. Plants in the Sichuan-Chengdu region sold trucked LNG at Yuan 7,972/mt, up from Yuan 6,737/mt, and in the Beijing-Tianjin-Hebei region at Yuan 7,814/mt, up from Yuan 6,918/mt, exchange data showed.

Many cities in the northwest started centralized heating from mid-October, 10-15 days earlier than previous years due to an early cold snap, which is believed to have tightened gas supply.

A batch of 28 million cubic meters of feedstock pipeline gas offered by state-owned PetroChina's northwest branch to LNG plants on the Chongqing Petroleum and Gas Exchange was auctioned at around Yuan 5.43-5.46/cu m Oct. 29 for delivery over Nov. 1-7, market sources said.

Traders said this was a 40% increase from the last batch of pipeline gas auctioned on the exchange on Oct. 14 for the second half of October, and equates to around Yuan 8,450-8,500/mt after processing into LNG.

Higher feedstock gas prices have prompted many LNG plants in northwest China to raise their offers for ex-plant trucked LNG to around Yuan 8,500/mt at end October, but actual traded prices early this week eased, although they remained above Yuan 8,000/mt.

Prices retreated to around Yuan 7,500-7,600/mt in north China Nov. 2 due to weaker buying interest, a source in Beijing said, but noted that prices could pick up again with another cold snap forecast for later this week.

Tianjin started heating from Nov. 1, earlier than the normal start of centralized heating in north China from Nov. 15. The China Meteorological Administration warned of cold weather from Nov. 4, bringing blizzards and strong winds and 10-15 degree Celsius drop in temperatures in the northern region, according to a Nov 1 notice.

-----

Earlier: