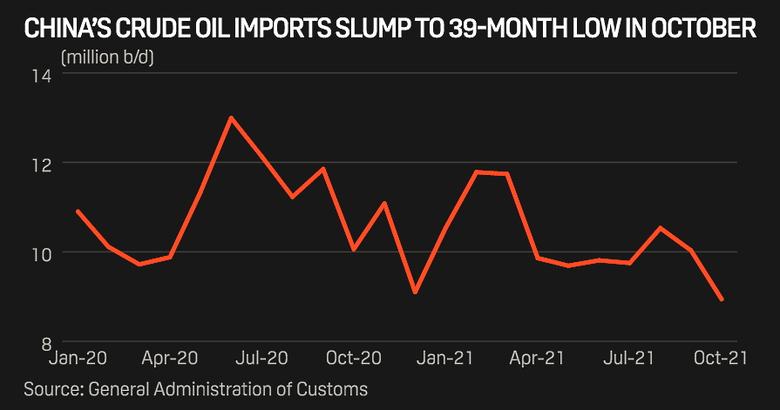

CHINA OIL IMPORTS DOWN

PLATTS - 08 Nov 2021 - China's crude oil imports slumped below the 9 million b/d mark to a 39-month low of 8.94 million b/d in October as both state-owned and private refiners slowed down buying, data from the General Administration of Customs showed Nov. 8.

The previous low was 8.52 million b/d in July 2018.

The October volume represented a 10.9% month-on-month drop on a b/d basis, and brought the first 10-month crude inflows to fall 6.9% at 10.25 million b/d from the same period in 2020, GAC data showed.

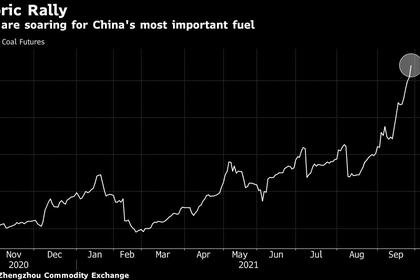

State-owned refiners were cautious in buying crude for October delivery due to high prices.

"Our crude stock was low but we dared not to buy more barrels for October as the crude price was too high," said a source with a central China-based Sinopec refinery.

ICE Brent averaged $83.71/b in October, rising 11.8% from $74.86/b in September, and hovering around $83/b as of Nov. 5.

As a result, refineries had to cut their utilization to a five-month-low of 81% in October despite strong domestic demand for gasoil, S&P Global Platts data showed.

"We can only lift gasoil production yield to meet demand instead of boosting crude runs due to tight feedstock," the Sinopec source said.

Meanwhile, independent refineries had to delay discharging crude arrivals as their crude import quota allocation was two weeks behind the expected end-September period.

Platts data showed that independent refineries imported 12.1 million mt crude oil in October. The volume fell 0.8% from September and dropped 24.1% year on year despite the greenfield 16 million mt/year Shenghong receiving its first two crude cargoes for startup.

The GAC releases data in metric tons that Platts converts to barrels using a 7.33 conversion factor.

On a metric tons basis, volume fell 7.9% on the month to 37.8 million mt in October.

Inventory hits 20-month low

To ensure domestic oil products supplies by preventing a significant drop in throughput, Chinese refineries had to draw crude inventory in October.

China's crude stock fell to a 20-month low of 825.76 million barrels last month, according to data intelligence company Kpler. The previous low was 808.44 million barrels in February 2020.

"With new crude import quotas for independent refineries, while state-owned giants promise to boost crude runs in November, China's crude imports set to have a strong rebound to above 10.3 million b/d this month," a Beijing-based analyst said.

Zhejiang Petroleum & Chemical is looked as the driver for boosting crude imports from the independent sector as it was just awarded an additional 12 million mt of quota late-October, which has to be consumed as much as possible by the end of 2021. Shenghong Petrochemical follows as a newcomer in the international crude market with a 2 million mt import quota for this year.

Meanwhile, both Sinopec and PetroChina, the top two refiners in China, said they would run at full capacity in November to increase gasoil supplies.

Products exports to fall

Meanwhile, oil products outflows in October fell 4.6% to 3.95 million mt from September, the data showed.

The volume is unlikely to increase in the rest of the year amid tight oil product export quotas and Beijing's call to ensure domestic oil products supplies.

Oil products export quotas are running out despite market sources saying that the government has issued 1 million mt of new fuel oil export quotas to Sinopec and PetroChina in the first week of November.

China issued 37 million mt of quotas for exporting gasoline, gasoil and jet fuel, and 11 million mt of fuel oil export quotas by end-October.

Over January-September, China's exports of gasoline, gasoil and jet fuel amounted to 33.7 million mt, according GAC data.

At the same time, China produced about 8.4 million mt of bunker fuel oil for exporting to the country's bonded ports for bunkering in January-September, according to local information provider Longzhong.

These showed that only about 7 million mt, or 2.3 million mt/month, of quotas are available for the fourth quarter, taking into account the 1 million mt of fuel oil quotas that may have been allocated in early-November.

Moreover, as the central government urged state-run companies to ensure domestic energy supplies amid rising commodity prices, both Sinopec and PetroChina have announced cuts in gasoil exports.

Oil products imports fell 2.8% at 2.16 million mt in October from a 14-month high of 2.93 million mt in August and 2.22 million mt in September, the GAC data showed.

This led to China's net oil products exports decreasing 6.6% on the month to 1.79 million mt in October.

-----

Earlier: