CHINA'S CARBON MANAGEMENT

PLATTS - 23 Nov 2021 - China's largest industrial groups, energy companies and financial institutions are rapidly building internal systems for the measurement and reporting of greenhouse gas emissions, and developing capabilities for trading carbon credits, Bo Bai, chairman of China-based private equity firm Asia Green Fund, and Singapore-based digital exchange Cyberdyne Tech Exchange, said in an interview.

"Many of these guys already have carbon asset management subsidiaries. You'll be surprised to know they are far more advanced in thinking about these matters, beyond the expectations of people outside China," Bai said.

Several of China's largest oil companies, manufacturing companies and power utilities had announced net zero plans ahead of Beijing's official announcement of carbon neutrality target by 2060. Before the launch of the national carbon market happened in 2021, Chinese exchanges were already running pilot programs to test carbon trading and familiarize companies with carbon measurement processes.

AGF has advised enterprises in China's most emission-intensive sectors, such as generation utility Huaneng, oil major China National Petroleum Corporation, or CNPC, and steel maker An Steel, on their climate and carbon strategies.

"For every investment that AGF made, we helped calculate the [customer's] carbon footprint," Bai said. Every Yuan 100 million (approx. $15.68 million) investment by AGF results in 172,732 mtCO2e of carbon emission reduction," according to AGF's 2020 carbon neutrality and green impact report.

Bai said when AGF began setting up carbon systems for its Chinese customers, it did so in "a painful way because the infrastructure was not in place yet." But the Chinese home market, particularly on the carbon aspect, has now grown to be huge, he said.

While the Asia Green Fund is focused on investments in the low-carbon space in China, it is also a key investor in CTX, an exchange licensed by the Singapore monetary authority to offer tokenized products backed by carbon credits, digital currencies and tangible assets such as solar and wind farms.

"The voluntary emission reduction market, in my view, is going to develop faster than the emission allowance market, which is driven by regulatory policies. The voluntary market is really driven by the general public. There is increasing consensus that people want to do something about it, while the governments have not got it ready," Bai said.

He also said that the registry for China's voluntary carbon market called Chinese Certified Emissions Reductions "will reopen soon", adding to the scope of the country's carbon ecosystem.

China's CCER project registrations were halted since 2017 to refine the policy framework, but market participants have been expecting Beijing to restart the domestic voluntary carbon market registry.

As of Sept. 30, China's total trading volume of greenhouse gas voluntary emissions reduction had exceeded 334 million mtCO2e, with turnover approaching Yuan 3 billion (approx. $469 million), official data showed.

Carbon credit tokens

"I think there's a strong synergy in terms of the know-how and the ecosystem, for us to be able to tap into the China side as a home market while utilizing Singapore's platform to open to global and international investors," Bai said, echoing strategies of financial exchanges that arbitrage between Chinese and overseas markets.

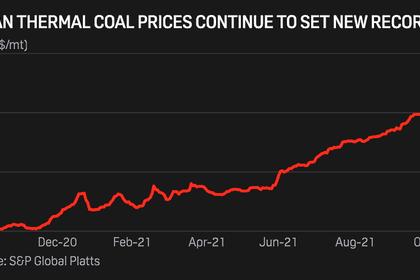

Bai said the first batch of carbon-neutrality tokens sold by CTX was bought by hedge funds who see an opportunity in China's carbon prices, which are low compared to Europe at less than $10 per mt, highlighting growing speculative interest in the carbon market.

He said investors have a pretty high certainty that prices in the Chinese carbon market could grow to several multiples of current levels which underpins the speculative activity in the market.

With carbon being commoditized and trading being increasingly digitized, transparent disclosures of carbon footprint by companies and standardization of trading "like West Texas Intermediate, or WTI, in the oil market" are important to sustain green investments and motivate carbon market growth, Bai said.

WTI is one of the main global oil benchmarks that simplify and standardize crude oil trades globally.

"Our aspiration is really for international issuers coming from China, and later from Malaysia, Indonesia, India. And hopefully we'll have investors and traders globally coming from Europe and the US," he said. "By doing this, we are using carbon to attract international capital into these developing countries and support the emission reduction projects," Bai added.

"What we're trying to do is create a new generation of benchmarking. This metaverse generation needs to have a digital carbon," he said.

-----

Earlier: