GLOBAL ENERGY DEMAND WILL UP BY 28%

OPEC - 16 November 2021 - World Oil Outlook 2045

EXECUTIVE SUMMARY

The World Oil Outlook (WOO) presents OPEC’s medium- to long-term analysis and projections for the global economy, oil and energy demand, liquids supply and oil refining, as well as related policy and technology matters. This includes analysis of the energy industry’s various linkages and its shifting dynamics. The detailed review in this Outlook includes breakdowns by region, sector and timeframe. The forecast period in this 15th edition of the Outlook extends to 2045 and the shortterm outlook is consistent with the July 2021 edition of OPEC’s Monthly Oil Market Report (MOMR).

Signs of strong economic recovery are evident

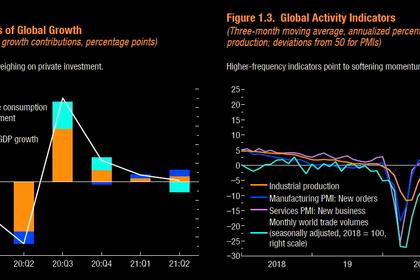

While the first signs of a strong economic recovery from the COVID-19-induced crisis are evident in quarterly growth rates, declining unemployment, business optimism and stock market valuations, there is also enormous potential for a huge rebound to follow as pent-up demand is satisfied, aided by the lasting effect of huge stimulus and infrastructure packages. On the other hand, worries persist about the pace and trajectory of this recovery, the spread of COVID-19 variants, rising inflation, and how to unwind the massive quantitative easing programmes launched by many central banks that have helped to underpin the rebound.

OPEC and countries participating in the Declaration of Cooperation (DoC) continue efforts to stabilize oil markets

OPEC, together with other countries participating in the DoC, having proved its value in helping stabilize the market in unprecedented circumstances during the pandemic and its fall-out, have extended the decision of the 10th OPEC and non-OPEC Ministerial Meeting (April 2020) until the end of 2022.

The COVID-19 pandemic has affected the global economy in multiple ways

The impact of the pandemic and the response mechanisms that have been developed, will have a considerable impact on medium-term economic growth. It is too early to judge the full consequences, but some trends and dynamics can already be discerned.

An important trend that began beforehand, but was accentuated during the pandemic is the move towards a more localized and less intertwined global economy. Another important consequence of the pandemic has been rapidly rising global debt levels. Fiscal and monetary stimulus including guarantees account for around $24 trillion. The challenges related to escalating debt levels have become an increasing concern, particularly given the active talk around inflation in 2021 and the potential for rising future interest rates and tax levels. Adding to this is the drop-off in travel and tourism and how long this continues, as well as the potential for improving productivity from the pandemic-induced drive towards digitalization and artificial intelligence (AI).

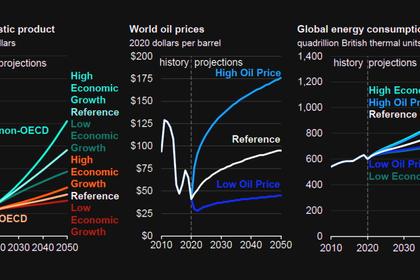

GDP growth is projected to average 3.1% p.a. over the forecast period (2020– 2045), slowing from 3.8% p.a. in the medium-term to 2.7% p.a. from 2035–2045

After the 2021 recovery, with gross domestic product (GDP) growth forecast at 5.5%, it is expected that growth will slow to around 4% in 2022 and then move back to levels slightly above 3%. It is then anticipated to move slightly higher to reach 3.2% at the end of the medium-term period in 2026. In OECD economies, growth is forecast to materialize more at the beginning of the medium-term period due to pent-up demand and the massive fiscal stimulus to counter the impacts of the pandemic. The medium-term growth outlook in developing countries is anticipated to be relatively diverse with the highest growth rates projected for India and China.

Global GDP growth between 2020 and 2045 is expected to increase at an average rate of 3.1% per annum (p.a.) Global growth through to 2045 will be largely driven by non-OECD countries. These are expected to expand by 3.9% p.a. on average, on the back of improving labour productivity and a growing working age population, even as the pace of GDP growth begins to slow in the long-term.

The global economy in 2045 will be more than double the size it was in 2020

Based on 2017 purchasing power parity (2017 PPP), global GDP is projected to rise from around $125 trillion in 2020 to almost $270 trillion in 2045. China and India combined are expected to account for 37% of global GDP in 2045. The Organisation for Economic Co-operation and Development (OECD) is set to account for slightly less, at 34%.

Significant demographic shifts will accompany future population growth

The global population is expected to reach 9.5 billion people by 2045. Future demographic trends are marked by an ageing population, a rising working-age population and increases in urbanization and migration rates. The global working-age population (15–64) is projected to rise by around 900 million throughout the projection period, driven by non-OECD countries. However, the relative share of the global working-age population to the world’s total population is anticipated to drop from 65% in 2019 to 63% in 2045. By 2045, approximately 66% of the world’s population is projected to be urbanized. The OECD is projected to experience a rise in its net migration rate of approximately 4.7% by 2045, whereas the developing world is projected to undergo an outflow of population.

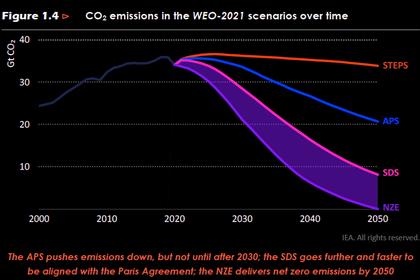

Recent changes in energy policies focus on accelerating energy transition

There is growing awareness among policymakers in many countries that there is a need to accelerate actions to address climate change, which have recently resulted in ambitious new policy intentions to achieve net-zero emissions by 2050. Several major countries and regions – including the European Union (EU), the United States (US), Japan, the United Kingdom (UK), Canada and Brazil – have proposed roadmaps to meet these goals, with China targeting carbon-neutral growth by 2060. At the same time, there is increased public acceptance of products and services with a lower environmental footprint, and a state of technology development that offers solutions – even if they come at a higher cost. These trends are being observed at a time when the post-COVID-19 recovery plans in some major economies provide significant sources of funding that could accelerate the energy transition.

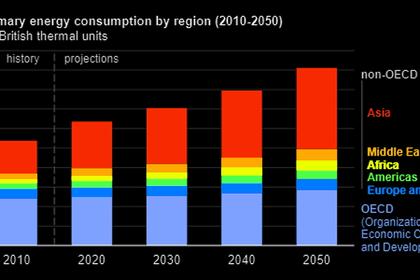

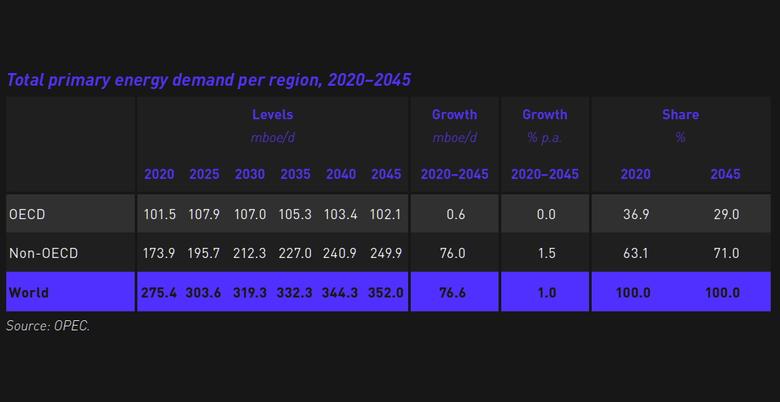

Global energy demand is set to increase from 275.4 mboe/d in 2020 to 352 mboe/d by 2045

Non-OECD primary energy demand is expected to constitute well over 70% of global primary energy demand in the long-term, growing from 174 million barrels of oil equivalent a day (mboe/d) in 2020 to 250 mboe/d in 2045. This growth is mainly attributable to increasing populations and growing economies in Asia, Africa and the Middle East.

For the OECD region, energy demand is set to flatten in the long-term. This underscores a further decoupling from economic growth due to structural changes and a policy push that continues to place increasing emphasis on energy efficiency and the deployment of low-carbon energy technologies. After a partial recovery from the impact of the COVID-19 pandemic, energy demand in the region is set to peak in the medium-term before declining to around 102 mboe/d by 2045, reaching a level similar to that seen in 2020.

Oil is forecast to remain the fuel with the largest share of the global energy mix until 2045

Primary oil demand is set to increase in the long-term from 82.5 mboe/d in 2020 to 99 mboe/d in 2045. Despite decelerating oil demand growth in the second part of the forecast period and strong growth in other energy sources, such as other renewables, gas and nuclear, oil is expected to retain the highest share in the global energy mix during the entire period. In 2020, oil accounted for 30% of global energy requirements. Alongside post-pandemic oil demand recovery, the share of oil is anticipated to gradually increase to a level of more than 31% by 2025, before it begins a decline and reach 28% by 2045.

‘Other renewables’ and natural gas are projected to contribute most to future incremental energy demand

Demand for other renewables is projected to expand from 6.8 mboe/d in 2020 to 36.6 mboe/d in 2045, representing the single-largest incremental contribution to the future energy mix. Moreover, it is also the fastest-growing energy source with its share in the global primary energy mix above 10% in 2045, up from just 2.5% in 2020. This is driven by falling costs and policies focused on reducing emissions.

Gas demand is expected to increase by 21.6 mboe/d between 2020 and 2045. This brings total gas demand to 85.7 mboe/d in 2045, thus becoming the second-largest fuel in the energy mix.

More stringent policies are set to reduce coal demand by almost 12 mboe/d during the forecast period

Medium- to long-term coal demand is forecast to drop meaningfully across all OECD regions. This is most dramatic in OECD Europe, where it falls by 5.5% p.a. over the forecast period. China’s coal demand is expected to slow to a plateau in the medium-term and then see a significant drop in the longer-term. At the global level, demand for coal is set to decline by almost 12 mboe/d, primarily due to measures targeting emissions reduction.

Oil demand is projected to reach a level of 104.4 mb/d by 2026

The global oil demand increase over the medium-term period (2020–2026) is estimated at 13.8 million barrels a day (mb/d). However, almost 80% of this incremental demand will materialize within the first three years (2021–2023), primarily as part of the recovery process from the COVID-19 crisis. OECD oil demand is expected to increase by almost 4 mb/d in the period to 2026. However, all of this increase will not be sufficient to return to pre-COVID-19 demand levels. Non-OECD demand is anticipated to increase by almost 10 mb/d over the medium-term, with around half of this increase needed to offset the demand decline in 2020.

Global oil demand is expected to increase by 17.6 mb/d between 2020 and 2045

Global oil demand is forecast to rise by 17.6 mb/d between 2020 and 2045, growing from 90.6 mb/d in 2020 to 108.2 mb/d in 2045. Long-term projections highlight a contrasting demand picture between continued growing demand in the non-OECD and declining demand in the OECD. This trend is set to start already in the medium-term, before intensifying over the long-term. OECD oil demand is projected to peak at levels around 46.6 mb/d in 2023, before it starts a longer-term decline towards a level of 34 mb/d by 2045.

In contrast, oil demand is set to continue to grow in the non-OECD region. Driven by an expanding middle class, high population growth rates and stronger economic growth potential, oil demand in this group of countries is expected to increase by 25.5 mb/d between 2020 and 2045, reaching a level of 74.1 mb/d in 2045.

Global oil demand set to plateau during the second half of the outlook period

Projections highlight the front-loaded pattern for future demand growth. Annual oil demand growth averages 2.6 mb/d during the first five years of the forecast period. Average annual growth is then expected to slow significantly during the second five-year period to 0.6 mb/d, and further to 0.3 mb/d during the period from 2030–2035. After that, projections indicate a plateauing of oil demand at the global level.

Significant demand increase projected to come from road transportation and aviation sectors

The transportation sector is forecast to be the major contributor to future incremental demand, adding 13 mb/d between 2020 and 2045. More than 90% of this increase is projected to come from the road transportation and aviation sectors, each contributing around 6 mb/d, though a large part of these increases is due to the sharp demand decline in these two sectors in 2020. However, adjusting long-term projections for the demand decline in 2020, the petrochemical sector remains the largest source of incremental demand to 2045, similar to last year’s Outlook.

Long-term oil demand growth will be limited by growing penetration of electric vehicles (EVs)

The total vehicle fleet is expected to reach 2.6 billion by 2045, increasing by around 1.1 billion from the 2020 level. EVs are set to approach 500 million by 2045, representing almost 20% of the global fleet. Some growth is also projected for natural gas vehicles (NGVs), with an expected increase of 80 million projected between 2020 and 2045. As a result, internal combustion engine (ICE) vehicles are set to maintain their leading role in the composition of the global fleet. The outlook sees ICEs constitute about 76% of the global vehicle population by 2045, largely sustained by the fleet size increase in developing regions. These developments are expected to keep road transportation oil demand in a narrow range of 46 mb/d to 46.5 mb/d after 2025.

Non-OPEC liquids to rebound in the medium-term

Non-OPEC liquids supply is set to continue its recovery and regain pre-pandemic levels in the course of 2022. As oil demand picks up again with the world economy expanding rapidly, in addition to the market stabilization efforts of OPEC and other participating countries in the DoC, fundamentals look set to remain stable and supportive, encouraging a return to upstream activity and investments. As such, non-OPEC total liquids supply is projected to rise from 62.9 mb/d in 2020 to 70.4 mb/d in 2026. The key contributors to growth are the US, Brazil, Russia, Guyana, Canada, Kazakhstan, Norway and Qatar.

US tight oil is a key driver of growth in the medium-term but peaks around 2030

Supportive market fundamentals should incentivize a return to growth for US tight oil production from 2022, which is expected to rise from 11.5 mb/d in 2020 to 14.8 mb/d in 2026. Tight oil output is expected to peak at 15.2 mb/d in the late 2020s, with US total liquids hitting a maximum of around 20.5 mb/d around the same time.

In the long-term, non-OPEC liquids supply declines, while OPEC sees an increase in its market share

In the long-term, after US liquids supply peaks, total non-OPEC liquids output is set to decline from a peak of 71 mb/d around 2030 to 65.5 mb/d in 2045, basically level with pre-pandemic 2019. As a result, OPEC liquids, which are expected to recover to pre-pandemic levels around the mid-2020s, rise further, increasing from 35.7 mb/d in 2030 to 42.7 mb/d in 2045. OPEC’s global market share rises from 33% in 2020, to 39% in 2045.

Oil-related investment requirements total $11.8 trillion, 80% of which is needed in the upstream

Cumulative investment requirements in the oil sector amount to $11.8 trillion in 2021–2045. Of this, 80% or $9.2 trillion, is directed towards the upstream, the bulk of which is in North America, as US tight oil, in particular, drives medium-term non-OPEC supply growth. Downstream and midstream investment needs, in order to expand and maintain the associated refinery, storage and pipeline systems required to bring oil to market, necessitate another $1.5 and $1.1 trillion, respectively.

The effect of strong distillation capacity additions is set to be offset by expected medium-term refinery closures of 4.5 mb/d

In the medium-term, 6.9 mb/d of new refining capacity is expected, in line with strong demand prospects in developing regions. Given global oil demand trends, this would lead to a distillation capacity overhang by 2026. However, during the ongoing rationalization wave, accelerated by the 2020 demand shock and the strategy shifts of some oil companies, around 4.5 mb/d of refining capacity could be shut in, mostly in developed regions. This should help balance out the downstream market in the medium-term.

Crude distillation capacity is expected to increase by 14 mb/d between 2021 and 2045, with a significant slowdown in the rate of required additions

Global refining distillation additions are projected at 14 mb/d between 2021 and 2045, of which 6.9 mb/d is in the medium-term (by 2026) and 7.1 mb/d beyond 2026. In line with oil demand patterns, almost 95% of the total additions is expected in developing regions, including the Asia-Pacific (6.4 mb/d), the Middle East (2.8 mb/d), Africa (3 mb/d) and Latin America (1 mb/d). However, the rate of distillation additions is expected to decelerate considerably throughout the outlook period with minor global additions beyond 2040.

Significant additions of secondary capacity will be driven by stricter product specifications and a shift to high quality products

At the global level, projections indicate the need to add some 7.1 mb/d of conversion units, 16.7 mb/d of desulphurization capacity and 4.7 mb/d of octane units in the period 2021–2045, to go with 14 mb/d of new distillation capacity. This is supported by stricter product specifications and a shift to higher-quality refined products.

Global crude and condensate trade set to recover from the 2020 shock with a gradual long-term increase and significant regional shifts

After the drop in 2020, global crude and condensate trade is projected to reach levels above 38 mb/d in 2025 and 2030 and 40 mb/d and above from 2035 onwards. This is supported by increased oil demand in the Asia-Pacific and rising crude and condensate supply in the Middle East. In the longer-term, Middle East crude and condensate exports are projected to increase to almost 23 mb/d in 2045, up from 18.5 mb/d in 2019, and in line with rising demand for OPEC liquids. Consequently, the share of the Middle East in the global crude and condensate trade increases to 57% in 2045, from 48% in 2019.

Asia-Pacific crude and condensate imports are projected to grow in the longterm with an increasing share of imports from the Middle East

Asia-Pacific will remain the most important region in terms of crude and condensate imports in the long-term. The overall import volumes are expected to increase from around 23.5 mb/d in 2019 (22 mb/d in 2020) to almost 30 mb/d by 2045. The Middle East remains the main supplier to the Asia-Pacific, with flows increasing to above 19.5 mb/d by 2045, which is around 4.8 mb/d higher relative to levels seen in 2019.

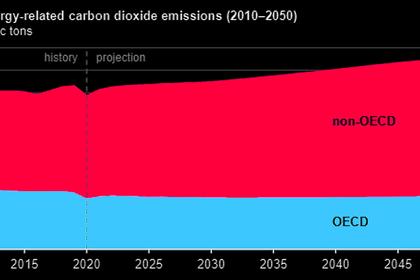

The pandemic has affected UN climate change and sustainable development processes, with implications for the implementation of the Paris Agreement and the 2030 Agenda

The year 2020 saw little progress in United Nations (UN) climate negotiations owing to COVID- 19. Climate diplomacy moved to informal discussions held in virtual mode, whereas COP26 and the sessions of the UN Framework Convention on Climate Change (UNFCCC) subsidiary bodies were postponed until 2021. A number of Parties announced their new targets and measures, yet the estimated emission reductions resulting from their implementation fall far short of what is required to achieve a target well below 2°C.

The fulfilment of developed countries’ commitments on critical issues such as climate finance would be required for all countries to be able to enhance their mitigation action and reduce vulnerability to the harmful effects of climate change. Intense negotiations are expected in Glasgow, Scotland, beginning on 31 October 2021, for Parties to resolve outstanding negotiation issues required for the full operationalization of the Paris Agreement.

With the pandemic having undermined years of development efforts, progress made on the implementation of a number Sustainable Development Goals (SDGs) has either stalled or reversed. The world is still short of achieving universal energy access. Eradication of energy poverty should, therefore, remain an overarching goal for resilient and sustainable development. International cooperation and solidarity are more important than ever. The central principle of the 2030 Agenda – to leave no one behind – must be kept at the heart of efforts toward achieving all SDGs.

Uncertainties on future economic development, energy policies and technology have widened the range of possible oil demand and supply trajectories

Developments during the past year have made it clear that there are a number of uncertainties related to the main factors affecting future oil demand. In respect to the global economy, the risk for oil demand over the medium-term is skewed to the downside and primarily related to a potentially extended pandemic situation. In the long-term, the risk is rather symmetric with each path deviating from the Reference Case by more than 6 mb/d at the end of the forecast period. The faster implementation of more stringent policies and penetration of energy efficient technologies could reduce future oil demand by more than 8 mb/d in 2045, compared to the Reference Case. Oil demand in the road transportation sector alone could be reduced by some 3 mb/d in 2045.

With regard to non-OPEC supply, different assumptions for investment, project timing, policies and technology are modelled in Lower and Higher Supply Cases, with risks heavily skewed to the downside. In the Lower Case, US tight oil declines gradually until a modest rebound is seen in the latter part of the 2020s, although it never again reaches pre-pandemic levels. This opens up a potential downside of nearly 4 mb/d at peak. In other non-OPEC countries, project cancellations, lower investment and to some extent policy measures curb as much as 3 mb/d in the long-term. The Higher Supply Case projects a US tight oil production upside of around 1 mb/d, while output in other non-OPEC countries adds 2.5 mb/d in the long-term.

-----

Earlier: