INDIA RENEWABLES NEED INVESTMENT

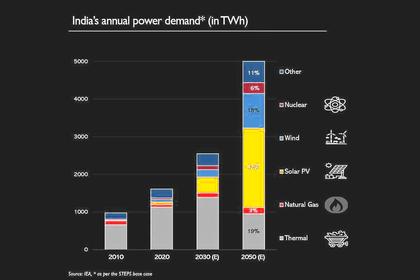

RW - India is the world’s fourth largest energy consumer and among the fastest growing large economies. With strong economic growth and electricity demand, the country will need additional sources of energy to fuel its economy, with the International Energy Agency (IEA) projecting that India’s energy demand will increase by 35% from 2019 to 2030.

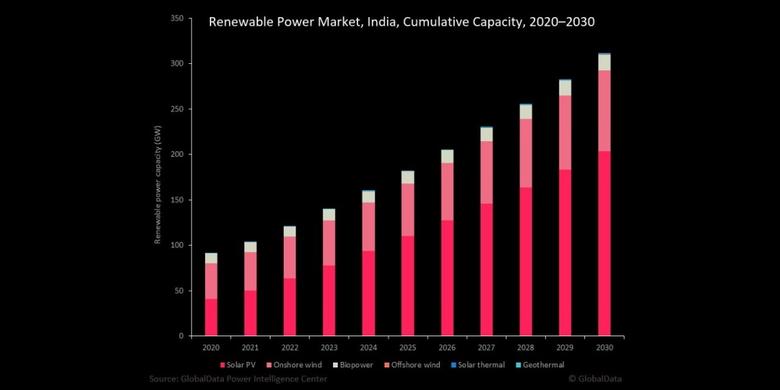

While the nation’s electricity needs have historically been met through thermal power – primarily state owned – the trend has changed. Over the past 15 years, private ownership of generation assets has increased consistently, with a rising share of non-hydro renewable energy (RE) sources. In India, the private sector both in generation as well as financing is playing a big role in RE deployment. Similar trends have been observed globally with renewable energy financing being led by private capital.

Over the last decade, the financing landscape in the RE sector has transformed as the sector went mainstream with a variety of financing avenues becoming available for incumbent players to tap into. This has been partly led by a global thrust towards sustainable finance and the rise of environmental social and governance (ESG) investing.

Sustainable finance bonds totalled US$552bn during the first half of 2021, an all-time first half record, while sustainable lending totalled US$321bn during the same period, more than tripling on a year-on-year basis, according to Refinitiv’s The Green Bond Guide. As per Bloomberg, ESG assets may hit US$53tn by 2025, a third of global assets under management (AUM).

That said, industry players will need to embark on a major financing drive for India to reach its renewable energy goals. Given that 70-80% of financing for renewables is done using debt, it is imperative to secure debt funding in a timely manner on favourable terms. Moreover, traditional financing structure and sources used to fund capacity expansion in the sector need to be augmented by other sources.

Domestic sources of lending remain limited for funding RE assets primarily due to a lack of non-bank debt sources, a shallow corporate bond market and a lack of domestic institutional financing. Offshore investments, debt and equity alike, can play an important role in helping Indian companies secure low-cost and tenured financing.

Funding Avenues for Renewable Energy Players

On the debt side, bond instruments are well suited to funding RE projects as they provide long-term capital at competitive rates, raised from a diverse set of investors. Further, with multi-decade low rates in the developed world and growing inclination towards ESG factors, global investor appetite for Indian RE assets is growing.

Green bonds are the most widely used bond instrument to fund RE assets, with global issuances of US$406bn in 2021 (till October). Another set of bond instruments, sustainability-linked bonds, have been used extensively by global utilities such as Enel and Total Energies to raise capital for their green energy initiatives. Sustainability-linked bonds have also started to make inroads into the Indian markets with Adani Electricity Mumbai recently raising US$300m in sustainability-linked bonds in July 2021.

While bonds may be more suited for RE projects, the majority of debt used during construction is raised through term loans from banks and financial institutions domestically, which is then refinanced either through another loan facility with more favourable terms or through bond issuances. These term loans are usually raised at higher rates, given the execution risk involved. A viable alternative to raising term loans domestically is to tap foreign lenders willing to take exposure to the renewable energy sector.

Bank of America (BoA), JBIC of Japan, HSBC, Barclays and Deutsche Bank are some examples of global financial institutions growing their sustainable books to achieve their net-zero pledges or being persuaded to lend to climate-aligned sectors by growing shareholder activism.

On the equity front, while an initial public offering (IPO) or private placement helps raise fresh capital and provides an exit for investors, asset level monetization, is imperative for RE companies to keep recycling capital from operational projects to under-construction projects.

Pooled investment vehicles such as infrastructure investment trusts (InvITs) allow companies to monetize operational cash generating assets by pooling multiple assets under a single entity.

Indigrid, sponsored by KKR, is India’s first power sector InvIT. It has recently acquired an operational solar asset while another KKR-sponsored company, Virescent, set up India’s first renewable-focused InvIT in September 2021.

Further strategic partnerships with oil & gas majors, like the one evidenced in Adani Green Energy’s deal with Total SE also helps recycle capital from operational projects. Global oil & gas companies such as Total, BP and Shell have made sizeable commitments towards green investments and can be potential partners for Indian RE developers.

Capital from Multilateral Development Banks (MDBs) is another source of both debt and equity which can be availed by Indian companies. MBDs differ from global and local commercial banks in that they do not seek to maximise investment returns, which allows them to invest in high-risk countries and sectors. They provided a total of US$66bn towards green funding in 2020. MDBs such as the World Bank, the International Finance Corporation (IFC), the Asian Development Bank (ADB), Germany’s KfW and Japan International Cooperation Agency (JICA) have committed capital to Indian renewable energy projects.

Globally a flood of capital is vying for opportunities to invest in zero-emissions renewable energy infrastructure assets, led by the advent of ESG investing. India presents attractive prospects for these investors to deploy capital and gain exposure to the country’s growing renewable energy sector while also helping developers to secure low-cost capital from optimum sources.

To leverage and attract this global capital, Indian companies have numerous financing avenues, ranging from green bonds and loans to InvITs. Into the future, the ability to secure this capital will be critical for these companies to reach their RE goals.

-----

Earlier: