LIMITED OIL GAS PRODUCTION

PLATTS - 11 Nov 2021 - Top energy majors have yet to see their oil and gas production recover from the impact of the COVID pandemic even as net-zero demands and a faster shift to renewables lay the ground for peak supplies from the sector in coming years.

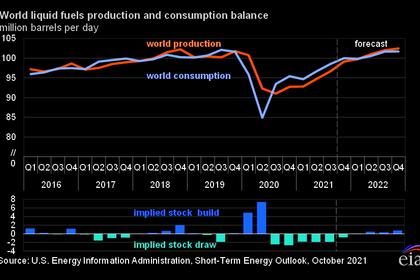

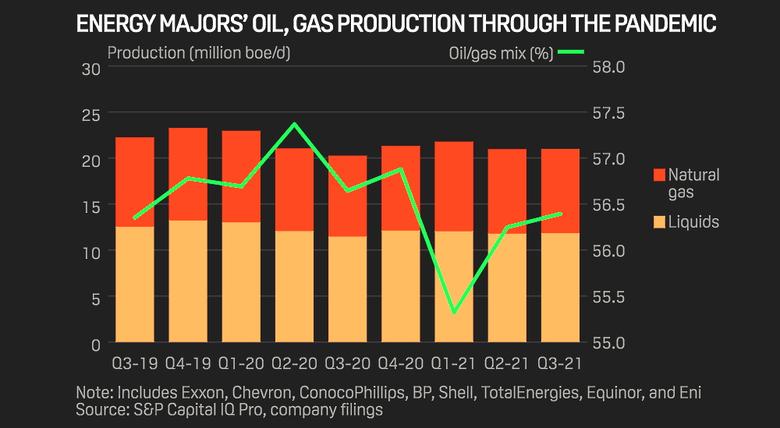

After global oil markets were rocked by the COVID-19 pandemic last year, combined oil and gas volumes from the eight biggest independent majors remained more than 2.2 million b/d of oil equivalent below pre-COVID levels, according to an analysis of the latest quarterly earnings reports.

At the end of 2019, combined oil output from ExxonMobil, BP, Shell, Chevron, TotalEnergues, Equinor, ConocoPhillips, and Eni stood at 13.3 million b/d, or about 13% of total global supplies, the figures show. By the third quarter of 2021, oil volumes from the group stood at 11.8 million b/d, or 11% below pre-COVID levels.

Oil and gas volumes in the sector have bounced from a low of 20.3 million boe/d in Q3 2020, but near-term volume growth in the sector is already facing headwinds from pledges by European majors to limit spending on upstream projects and curb exploration.

BP's promise to shrink its upstream output by 40% by 2030 stands out even if the target excludes its 20% stake in Russian oil giant Rosneft. Its rival Shell says its oil production has already peaked.

TotalEnergies -- which expects global oil demand to peak before 2030 -- expects gas-led projects to grow its upstream production to 3.3 million boe/d in 2025, up from 2.87 million boe/d last year, but not much higher than the 3 million boe/d in 2019.

Regional divide

The picture looks different in the US where ExxonMobil, Chevron, and ConocoPhillips have set less ambitious net-zero targets and more modest capex plans are allocated to clean energy projects. Exxon expects its production of fossil fuels to remain flat through 2025 at 3.7 million boe/d by leaning more on its US shale assets. Chevron is banking on growing its Permian production to 1 million boe/d by 2025, a move which will see its upstream volumes rise 15% to about 3.5 million beo/d.

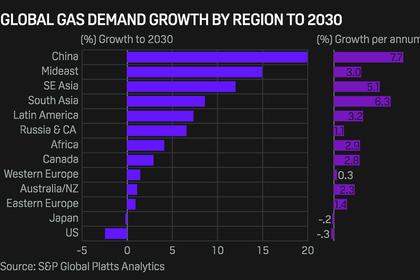

Another difference between regional players is the stronger focus on natural gas by European producers.

Both European and US majors have seen their upstream production mix remain steady over the course of the pandemic, the quarterly statements show. While many European-based producers are close to a 50-50 split between oil and gas production, their US rivals average 60% of liquids in their production mix, unchanged from pre-pandemic levels.

With US producers pledging to double down on developing their US shale, this divergence could grow further as European majors continue to target emission curbs helped by a shift towards lower-carbon natural gas.

TotalEnergies wants to evolve to 30% oil and 50% gas in its sales mix by 2030, with the remainder 20% from electricity, biomass and hydrogen.

Market share impact

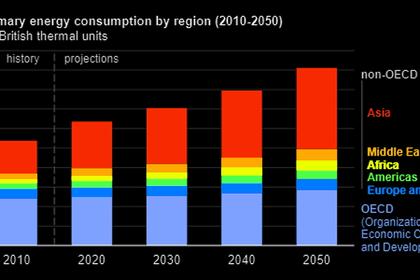

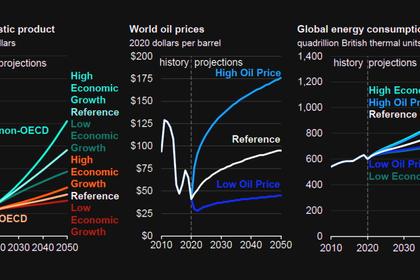

While a shrinking oil market under net-zero scenarios would change the supply landscape dramatically, it would not remove the need for continued investment in upstream projects.

If investment were to continue in currently producing fields but no new fields were developed, the average annual loss of oil supply would be around 4.5%, according to the International Energy Agency, a level that's consistent with its net-zero energy scenario to 2050.

One inevitable outcome of the pullback by Western majors from oil and gas is the loss of market share to national oil companies (NOCs), which account for well over half of global production and nearly two-thirds of remaining reserves. Middle Eastern NOCs often enjoy the lowest average development and production costs and many benefit from a lower-carbon intensity of their crudes, making them more resilient to future price volatility and demands for lower-carbon fossil footprints.

With global oil demand expected to peak by the late 2030s, according to S&P Global Platts Analytics' reference scenario, and increasing scrutiny on emissions from oil and gas, the prospect for a near-term production peak from transition-focused IOCs may well be a foregone conclusion.

-----

Earlier: