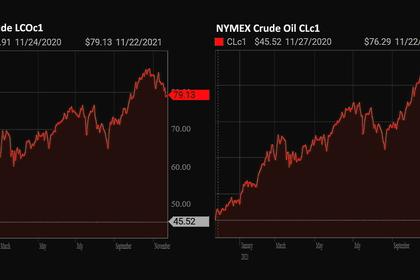

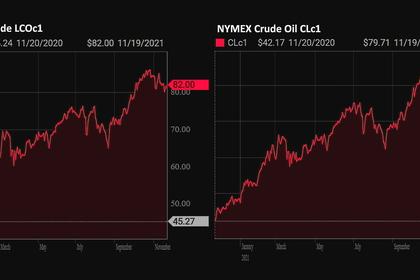

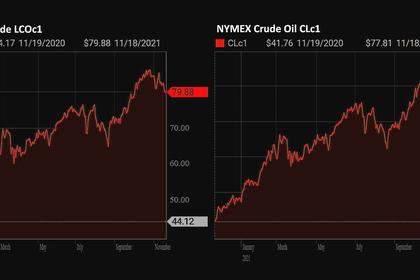

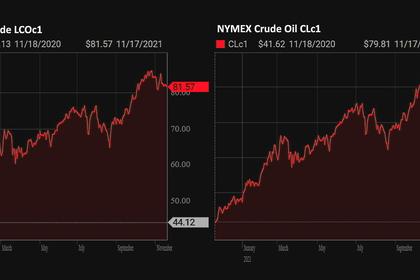

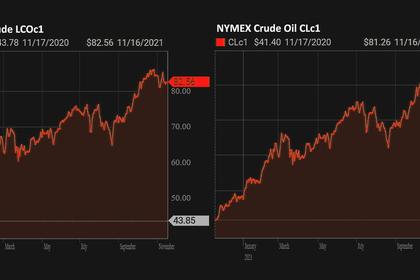

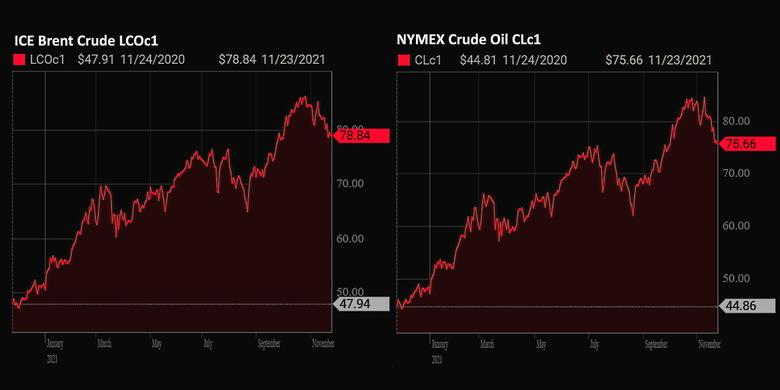

OIL PRICE: NEAR $79 ANEW

REUTERS - Nov 23 - Oil prices fell on Tuesday, reversing gains the previous session on talk the United States, Japan and India will release crude reserves to tame prices despite the threat of faltering demand as COVID-19 cases flare up in Europe.

The United States is expected to announce a loan of crude oil from its emergency stockpile on Tuesday as part of a plan it hashed out with major Asian energy consumers to lower energy prices, a Biden administration source familiar with the situation said.

Brent crude futures fell 67 cents, or 0.8%, to $79.03 a barrel at 0721 GMT, while U.S. West Texas Intermediate (WTI) crude futures fell 88 cents, or 1.2%, to $75.87 a barrel.

"U.S. President Biden is said to be preparing to announce a release of oil from its strategic petroleum reserve in concert with several other countries ...," ANZ said in a note.

Brent and WTI had both risen 1% on Monday on reports the Organization of the Petroleum Exporting Countries, Russia and their allies, an alliance known as OPEC+, could adjust their plan to raise oil output if large consuming countries release crude from their reserves or if the pandemic dampens demand.

With talk of a coordinated crude release having succeeded in driving prices back below $80 a barrel and an actual release only expected to have a temporary impact, analysts are turning their attention to the potential hit to demand from a fourth wave of COVID-19 cases in Europe.

"With speculative positioning somewhat more balanced, international travel reopening and lifting fuel demand, and with OPEC+ constraints in mind, any further sell-offs are likely to be short-term in nature and not sustained," said Jeffrey Halley, senior market analyst at OANDA.

He said only Europe could pressure prices and bearish bets should be off if the Northern Hemisphere experiences a cold winter.

"As Europe, and in particular Eastern Europe, struggles to halt the spread of COVID-19, the risk of lockdown-like measures looms large," said Rystad Energy analyst Louise Dickson.

She said demand in November for road and jet fuel in Europe was expected to fall to 7.8 million barrels per day (bpd) from 8.1 million bpd in October, although part of that is a normal decline for this time of year.

"If a new wave of lockdowns are enacted in Europe, oil prices will not be spared during the remainder of the flu season in the North Hemisphere," Dickson said in emailed comments.

-----

Earlier: