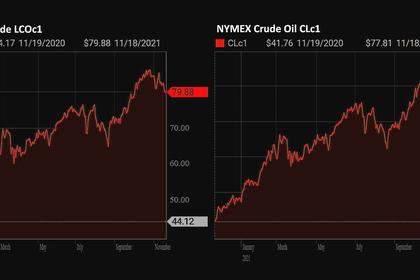

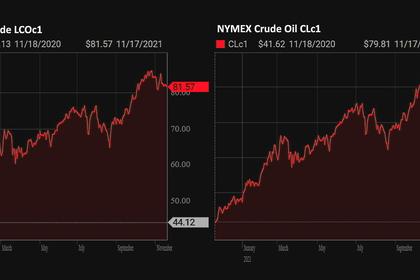

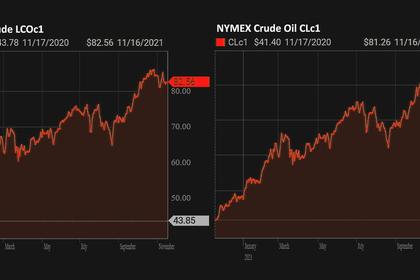

OIL PRICE: NEAR $82 AGAIN

REUTERS - Nov 19 - Oil prices rose on Friday, after wild swings the day before, as investor bet that potential coordinated releases by major economies of their official crude reserves may have less of an impact on markets than expected.

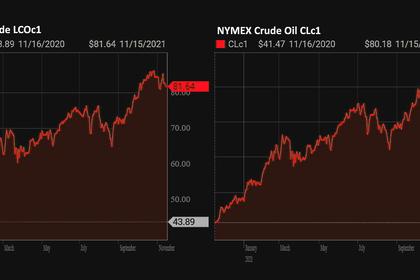

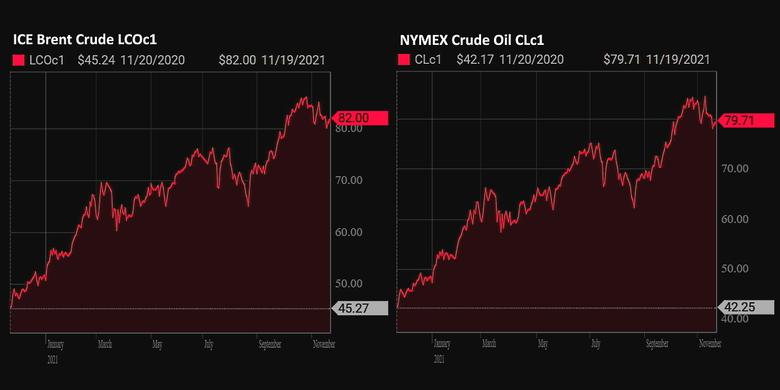

Brent crude was up 77 cents, or 0.9%, at $82.01 a barrel by 0733 GMT, after falling to a six-week low on Thursday before rebounding to close 1.2% higher.

U.S. West Texas Intermediate (WTI) crude for December delivery was up 79 cents, or 1%, at $79.80 a barrel, having swung through a more than $2 range the previous session before closing up.

The December contract expires on Friday and most trading activity has shifted to the January future, which was up 73 cents, or 0.9%, at $79.14 a barrel.

Both Brent and WTI are set for a fourth week of declines.

The market gyrations on Thursday followed a Reuters report that the United States had asked China, Japan and other big buyers to join a release of crude stocks from Strategic Petroleum Reserves (SPR).

Any release "would only provide a short-term fix to a structural deficit," Goldman Sachs oil analysts said in a note.

A move to supply oil to the market is now fully priced-in, at any rate, they said, adding a release "would not help the slow global supply response that only higher oil prices can overcome."

The Biden administration's push for a coordinated release of oil stockpiles has been seen as a signal to the OPEC+ production group that it should raise output to address concerns of high fuel prices in the world's biggest economies, starting with the United States, China and Japan.

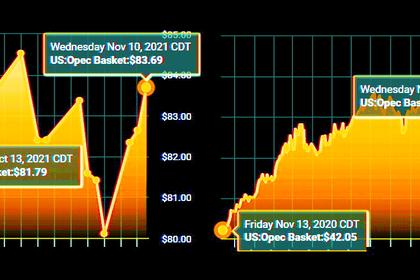

Brent has surged almost 60% this year, recently driven by a wider energy crunch as economies recover from the COVID-19 pandemic at the same time as the Organization of the Petroleum Exporting Countries (OPEC), and allies, known as OPEC+, has raised output only gradually.

The market structure for Brent remains backwardated, which is when prompt prices are higher than later-dated futures. That typically indicates that oil demand is higher than supply and is considered bullish for prices.

However, the backwardation has decreased amid the swings over the last two sessions, a sign the tightness in the market is easing.

The price difference between the front-month Brent crude contract and the one for six months later was $4.30 a barrel , down from a recent eight-year high of $6.30. Physical crude markets also showed some easing, traders said.

OPEC has maintained what analysts say is unprecedented restraint on production, even as prices have rebounded from the depths of the early stages of the coronavirus pandemic.

Data showing Saudi Arabia's oil exports hit an eight-month high in September, rising for a straight fifth month, also helped keep prices in check.

Still, "the market remains fundamentally tight and any volumes released are unlikely to substantially alter the global balance," Fitch Solutions commodities analysts said. "As such, we expect any downside to prices to be limited in both scale and duration."

-----

Earlier: