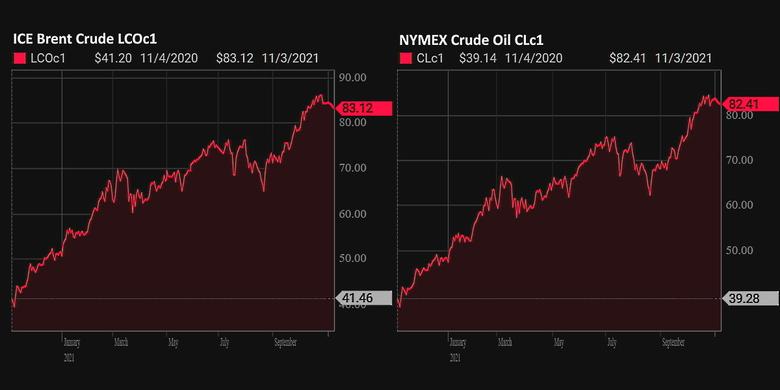

OIL PRICE: NEAR $83

REUTERS - Nov 3 - Oil prices fell on Wednesday as industry data pointed to a big build in crude oil and distillate stocks in the United States, the world's largest oil consumer, and as pressure mounted on OPEC to increase supply.

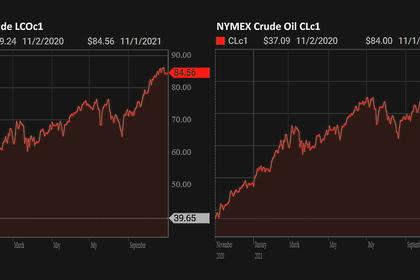

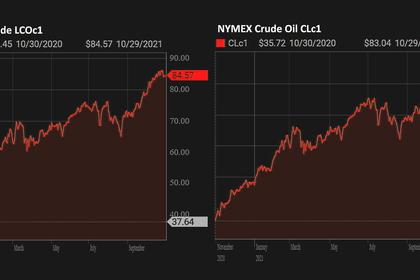

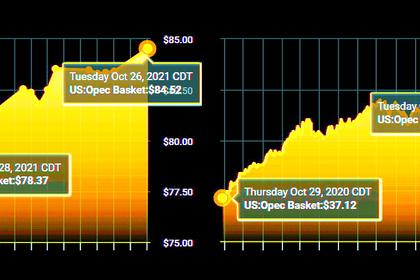

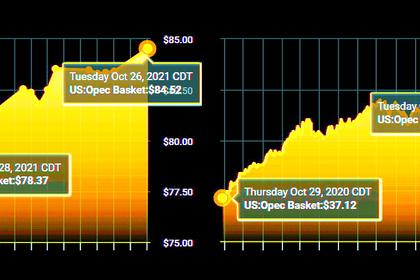

Brent crude futures fell $1.03, or 1.2%, to $83.69 a barrel by 0724 GMT, after dropping to a session-low of $83.27 earlier.

U.S. West Texas Intermediate (WTI) crude futures tumbled $1.30, or 1.6%, to $82.61 a barrel, after dropping to a low of $82.26 earlier.

"Crude prices are declining after the API reported the sixth straight week of crude oil inventory builds and as the Biden administration exhausts every possible plea to OPEC+ members before tapping their Strategic Petroleum Reserve," said Edward Moya, senior analyst at OANDA.

"World leaders are running out of cards to pressure OPEC+ and that should mean whatever dip that comes from tapping strategic reserves from China or the U.S. will likely be bought into."

President Joe Biden, speaking at a climate summit in Glasgow, blamed a surge in oil and gas prices on a refusal by OPEC nations to pump more crude.

The Organization of the Petroleum Exporting Countries and their allies, a group known as OPEC+, meets on Thursday to review its policy and is expected to reconfirm plans for monthly increases.

U.S. crude and distillate fuel stocks rose last week while gasoline declined, according to market sources citing American Petroleum Institute figures on Tuesday.

Crude stocks rose by 3.6 million barrels for the week ended Oct. 29. Gasoline inventories fell by 552,000 barrels and distillate stocks rose by 573,000 barrels, the data showed, according to the sources, who spoke on condition of anonymity.

Analysts polled by Reuters had expected crude oil inventories to have risen last week.

Data from the U.S. Energy Information Administration, the statistical arm of the U.S. Department of Energy, will be released later on Wednesday.

In a sign that high prices are encouraging more supply elsewhere, BP said on Tuesday it will ramp up investments in its onshore U.S. shale oil and gas business to $1.5 billion in 2022 from $1 billion this year.

-----

Earlier: