OIL PRICE: NEAR $85 ANEW

REUTERS - Nov 10 - Oil prices rose on Wednesday, extending strong gains in the previous session, after industry data showed U.S. crude stocks unexpectedly fell last week just as near-term travel demand picked up with COVID-19 pandemic curbs easing.

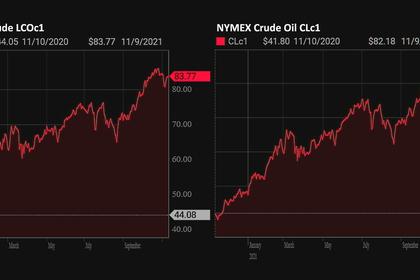

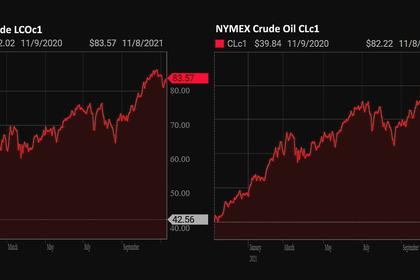

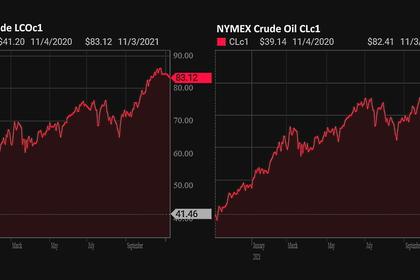

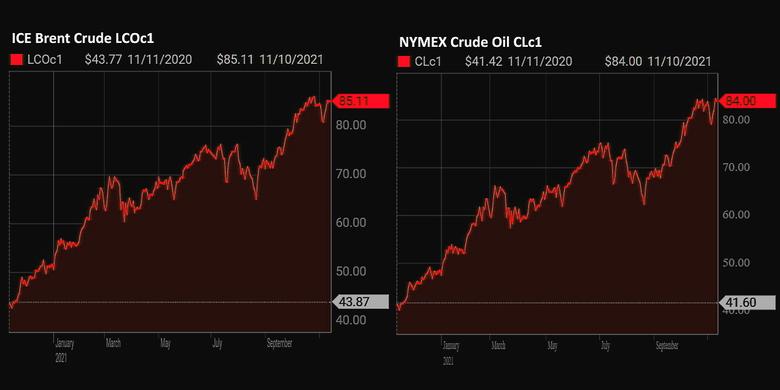

Brent crude futures were at $85.22 a barrel by 0732 GMT, up 44 cents, or 0.5%, to after rising 1.6% on Tuesday.

U.S. West Texas Intermediate (WTI) crude futures rose 16 cents, or 0.2%, to $84.31 a barrel, adding to Tuesday's 2.7% gain.

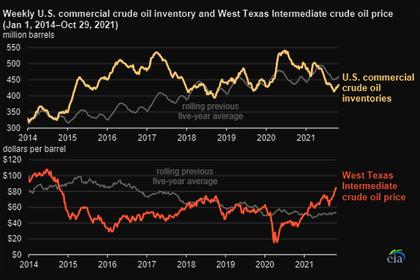

Both benchmarks touched their highest in two weeks earlier on Wednesday, supported by tightening global oil inventories during the past several months, and the latest data from the American Petroleum Institute reinforcing the view that supply remains constrained.

According to market sources, API data showed U.S. crude stocks declined by 2.5 million barrels for the week to Nov. 5, defying analysts' estimates for a 2.1 million build in crude stocks in a Reuters poll.

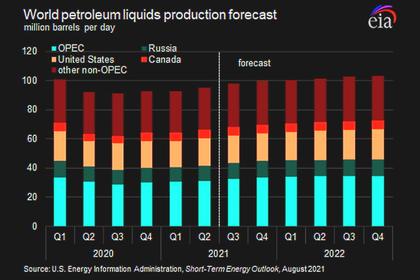

"Supplies are tight with OPEC sticking to its guns," Avtar Sandu, senior commodities manager at Phillip Futures in Singapore said, referring to the recent agreement between the Organization of Petroleum Exporting Countries and their allies to maintain an output growth of 400,000 barrels per day in December.

Growing air travel is also supporting oil demand, he said.

"I still see a bull charging on; it might be taking a break now, but (if there's) any small spark, it might just continue its march," Sandu said.

The market will be awaiting weekly inventory data from the U.S. Energy Information Administration (EIA) on Wednesday to see whether it confirms the drawdown in crude stocks.

Further underpinning the view the market remains tight, trading giant Vitol Group's CEO Russell Hardy said on Tuesday that oil demand had returned to pre-pandemic levels and that the first quarter of 2022 could see demand exceed 2019 levels.

"The possibility of a spike to $100 per barrel is clearly there," Hardy told the Reuters Commodities Summit.

Market gains on Tuesday were mainly driven by a short-term outlook from the EIA, which projected gasoline prices would fall over the next few months.

That was a key factor U.S. President Joe Biden had been watching to determine whether to release oil from the Strategic Petroleum Reserve amid concern over recent soaring gasoline prices.

"The EIA report ... does curb concerns that the U.S. will release oil from its Strategic Petroleum Reserve (SPR)," Commonwealth Bank analyst Vivek Dhar said in a note.

However, Singapore OCBC bank economist Howie Lee said: "I would be surprised if they don't release it."

"Inflation is turning out hotter than they expected and I don't think they want oil prices to continue compounding that price pressure."

-----

Earlier: