ПРИБЫЛЬ ГАЗПРОМА 1,6 ТРЛН. РУБ.

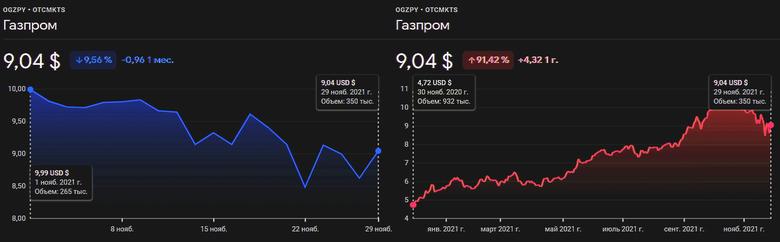

ГАЗПРОМ - 29 ноября 2021 - Сегодня ПАО «Газпром» представило не прошедшую аудит консолидированную промежуточную сокращенную финансовую отчетность за девять месяцев, закончившихся 30 сентября 2021 года, подготовленную в соответствии с Международным стандартом финансовой отчетности (IAS) 34 «Промежуточная финансовая отчетность» (МСФО (IAS) 34).

В таблице ниже представлены не прошедшие аудит данные консолидированного промежуточного сокращенного отчета о совокупном доходе за девять месяцев, закончившихся 30 сентября 2021 года, и за девять месяцев, закончившихся 30 сентября 2020 года. Все суммы в таблице представлены в миллионах российских рублей.

|

|

За девять месяцев,

закончившихся 30 сентября

|

| |

2021 года

|

2020 года

|

|

Выручка от продаж

|

6 725 132

|

4 301 218

|

|

Чистый доход по торговым операциям с сырьевыми товарами на ликвидных торговых площадках Европы

|

130 491

|

11 911

|

|

Операционные расходы

|

(5 202 452)

|

(3 944 332)

|

|

Убыток от обесценения финансовых активов

|

(63 954)

|

(43 645)

|

|

Прибыль от продаж

|

1 589 217

|

325 152

|

|

|

|

|

|

Финансовые доходы

|

421 457

|

527 050

|

|

Финансовые расходы

|

(289 834)

|

(1 277 952)

|

|

Доля в прибыли ассоциированных организаций и совместных предприятий

|

225 640

|

98 727

|

|

Прибыль (убыток) до налогообложения

|

1 946 480

|

(327 023)

|

|

|

|

|

|

Расходы по текущему налогу на прибыль

|

(245 891)

|

(57 376)

|

|

(Расходы) доходы по отложенному налогу на прибыль

|

(120 651)

|

182 192

|

|

Налог на прибыль

|

(366 542)

|

124 816

|

|

|

|

|

|

Прибыль (убыток) за период

|

1 579 938

|

(202 207)

|

|

|

|

|

|

Прибыль (убыток) за период, относящаяся к:

|

|

|

|

Акционерам ПАО «Газпром»

|

1 550 299

|

(218 378)

|

|

Неконтролирующей доле участия

|

29 639

|

16 171

|

|

|

1 579 938

|

(202 207)

|

Ниже приведена более подробная информация в отношении основных показателей, характеризующих структуру выручки от продаж.

|

в млн руб. (если не указано иное)

|

За девять месяцев,

закончившихся 30 сентября

|

|

|

2021 года

|

2020 года

|

|

Выручка от продажи газа

|

|

|

|

Европа и другие страны

|

|

|

|

Чистая выручка от продаж (за вычетом акциза и таможенных пошлин)

|

2 460 824

|

1 135 130

|

|

Объемы в млрд куб. м

|

175,7

|

154,4

|

|

Средняя цена, руб. / тыс. куб. м (включая акциз и таможенные пошлины)

|

17 838,9

|

9 165,0

|

|

Страны бывшего Советского Союза

|

|

|

|

Чистая выручка от продаж (за вычетом таможенных пошлин)

|

267 303

|

199 546

|

|

Объемы в млрд куб. м

|

24,1

|

21,3

|

|

Средняя цена, руб. / тыс. куб. м (включая таможенные пошлины)

|

12 248,4

|

9 829,0

|

|

Российская Федерация

|

|

|

|

Чистая выручка от продаж (за вычетом НДС)

|

732 584

|

622 882

|

|

Объемы в млрд куб. м

|

170,0

|

151,1

|

|

Средняя цена, руб. / тыс. куб. м (за вычетом НДС)

|

4 308,4

|

4 122,9

|

|

Общая выручка от продажи газа

|

|

|

|

Ретроактивные корректировки цены на газ

|

5

|

2 324

|

|

Чистая выручка от продаж (за вычетом акциза, НДС и таможенных пошлин)

|

3 460 716

|

1 959 882

|

|

Объемы в млрд куб. м

|

369,8

|

326,8

|

|

|

|

|

|

Чистая выручка от продажи продуктов нефтегазопереработки (за вычетом акциза, НДС и таможенных пошлин)

|

1 858 231

|

1 301 542

|

|

Чистая выручка от продажи сырой нефти и газового конденсата (за вычетом НДС и таможенных пошлин)

|

622 682

|

343 161

|

|

Чистая выручка от продажи электрической и тепловой энергии (за вычетом НДС)

|

415 744

|

348 467

|

|

Чистая выручка от продажи услуг по транспортировке газа (за вычетом НДС)

|

166 737

|

163 838

|

|

Прочая выручка (за вычетом НДС)

|

201 022

|

184 328

|

|

Итого выручка от продаж (за вычетом акциза, НДС и таможенных пошлин)

|

6 725 132

|

4 301 218

|

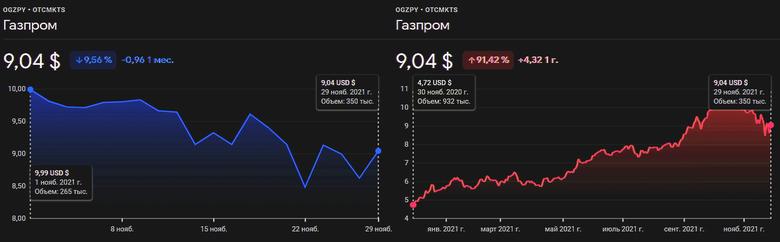

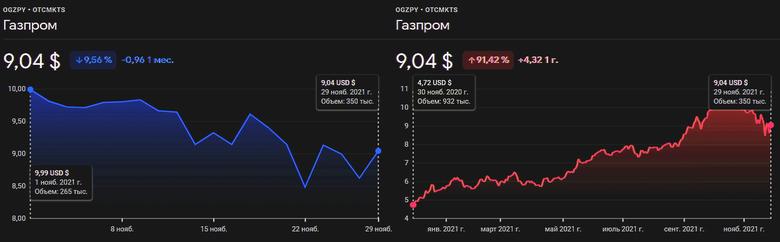

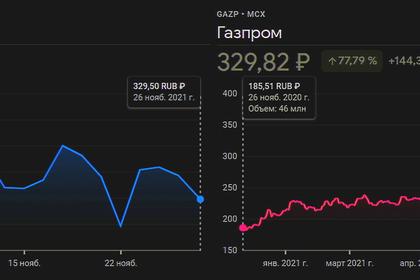

Чистая выручка от продажи газа увеличилась на 1 500 834 млн руб., или на 77%, за девять месяцев, закончившихся 30 сентября 2021 года, по сравнению с аналогичным периодом прошлого года и составила 3 460 716 млн руб. Увеличение выручки от продаж в основном вызвано увеличением выручки от продажи газа в Европу и другие страны.

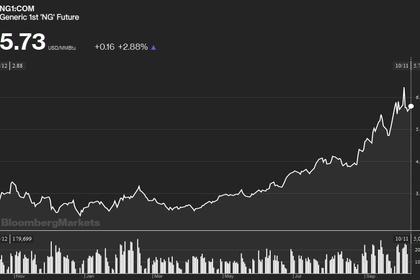

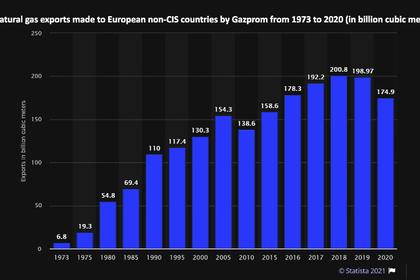

Чистая выручка от продажи газа в Европу и другие страны увеличилась на 1 325 694 млн руб., или на 117%, за девять месяцев, закончившихся 30 сентября 2021 года, по сравнению с аналогичным периодом прошлого года и составила 2 460 824 млн руб. Это объясняется увеличением средних цен (включая акциз и таможенные пошлины), выраженных в рублях, на 95% и ростом объемов продаж газа в натуральном выражении на 14%, или на 21,3 млрд куб. м. При этом средние цены, выраженные в долларах США, увеличились на 87%.

Чистая выручка от продажи газа в страны бывшего Советского Союза увеличилась на 67 757 млн руб., или на 34%, за девять месяцев, закончившихся 30 сентября 2021 года, по сравнению с аналогичным периодом прошлого года и составила 267 303 млн руб. Изменение обусловлено увеличением средних цен (включая таможенные пошлины), выраженных в рублях, на 25% и ростом объемов продаж газа в натуральном выражении на 13%, или на 2,8 млрд куб. м. При этом средние цены, выраженные в долларах США, увеличились на 20%.

Чистая выручка от продажи газа в Российской Федерации увеличилась на 109 702 млн руб., или на 18%, за девять месяцев, закончившихся 30 сентября 2021 года, по сравнению с аналогичным периодом прошлого года и составила 732 584 млн руб. Это объясняется главным образом увеличением объемов продаж газа в натуральном выражении на 13%, или на 18,9 млрд куб. м, и увеличением средних цен (за вычетом НДС) на 4%.

Чистая выручка от продажи продуктов нефтегазопереработки (за вычетом акциза, НДС и таможенных пошлин) увеличилась на 556 689 млн руб., или на 43%, за девять месяцев, закончившихся 30 сентября 2021 года, по сравнению с аналогичным периодом прошлого года и составила 1 858 231 млн руб. Увеличение чистой выручки от продажи продуктов нефтегазопереработки в основном связано с ростом средних цен во всех географических сегментах.

Чистая выручка от продажи сырой нефти и газового конденсата (за вычетом НДС и таможенных пошлин) увеличилась на 279 521 млн руб., или на 81%, за девять месяцев, закончившихся 30 сентября 2021 года, по сравнению с аналогичным периодом прошлого года и составила 622 682 млн руб. Изменение в основном связано с увеличением чистой выручки от продажи сырой нефти, преимущественно обусловленным ростом средних цен на сырую нефть.

Операционные расходы увеличились на 1 258 120 млн руб., или на 32%, за девять месяцев, закончившихся 30 сентября 2021 года, по сравнению с аналогичным периодом прошлого года и составили 5 202 452 млн руб.

Основное влияние на рост операционных расходов оказало увеличение расходов по статье «Покупные газ и нефть» на 534 972 млн руб., или на 85%, за девять месяцев, закончившихся 30 сентября 2021 года, по сравнению с аналогичным периодом прошлого года, вызванное главным образом увеличением средних цен на нефть и газ, а также ростом объемов покупки нефти.

Увеличение статьи «Налоги, кроме налога на прибыль» на 204 586 млн руб., или на 22%, за девять месяцев, закончившихся 30 сентября 2021 года, по сравнению с аналогичным периодом прошлого года в основном вызвано увеличением расходов по налогу на добычу полезных ископаемых, что было частично компенсировано уменьшением расходов на акциз. Увеличение расходов по налогу на добычу полезных ископаемых обусловлено преимущественно ростом цен на нефть, ростом ставки вследствие влияния налогового маневра и ростом объемов добычи газа.

За девять месяцев, закончившихся 30 сентября 2021 года, сальдо курсовых разниц, отраженное в составе «Чистого финансового дохода (расхода)», сформировало прибыль в размере 135 636 млн руб. по сравнению с убытком в размере 749 452 млн руб. за аналогичный период прошлого года.

За девять месяцев, закончившихся 30 сентября 2021 года, величина прибыли, относящейся к акционерам ПАО «Газпром», составила 1 550 299 млн руб.

Приведенный показатель EBITDA (рассчитываемый как сумма операционной прибыли, амортизации, убытка от обесценения или восстановления убытка от обесценения финансовых и нефинансовых активов, за вычетом оценочного резерва под ожидаемые кредитные убытки по дебиторской задолженности и резерва под снижение стоимости авансов выданных и предоплаты) увеличился на 1 278 451 млн руб., или на 137%, за девять месяцев, закончившихся 30 сентября 2021 года, по сравнению с аналогичным периодом прошлого года и составил 2 213 614 млн руб. Данное изменение в основном связано с увеличением выручки от продаж.

Чистая сумма долга (определяемая как сумма краткосрочных кредитов и займов и текущей части долгосрочной задолженности по кредитам и займам, краткосрочных векселей к уплате, долгосрочных кредитов и займов, долгосрочных векселей к уплате за вычетом денежных средств и их эквивалентов) уменьшилась на 388 124 млн руб., или на 10%, с 3 872 695 млн руб. по состоянию на 31 декабря 2020 года до 3 484 571 млн руб. по состоянию на 30 сентября 2021 года. Данное изменение в основном связано с увеличением остатков денежных средств и их эквивалентов.

Более подробно с данными консолидированной промежуточной сокращенной финансовой отчетности по МСФО за девять месяцев, закончившихся 30 сентября 2021 года, можно ознакомиться здесь.

-----

GAZPROM'S PROFIT RUB 1.6 TLN

GAZPROM - November 29, 2021 - Today PJSC Gazprom issued its unaudited consolidated interim condensed financial information prepared in accordance with International Accounting Standard 34 Interim Financial Reporting (IAS 34) for the nine months ended September 30, 2021.

The table below presents the unaudited consolidated interim condensed statement of comprehensive income for the nine months ended September 30, 2021 and for the nine months ended September 30, 2020. All amounts in the table are presented in millions of Russian Rubles.

|

|

Nine months ended

September 30,

|

| |

2021

|

2020

|

|

Sales

|

6,725,132

|

4,301,218

|

|

Net gain from trading activity

|

130,491

|

11,911

|

|

Operating expenses

|

(5,202,452)

|

(3,944,332)

|

|

Impairment loss on financial assets

|

(63,954)

|

(43,645)

|

|

Operating profit

|

1,589,217

|

325,152

|

|

|

|

|

|

Finance income

|

421,457

|

527,050

|

|

Finance expenses

|

(289,834)

|

(1,277,952)

|

|

Share of profit of associates and joint ventures

|

225,640

|

98,727

|

|

Profit (loss) before profit tax

|

1,946,480

|

(327,023)

|

|

|

|

|

|

Current profit tax expense

|

(245,891)

|

(57,376)

|

|

Deferred profit tax (expenses) income

|

(120,651)

|

182,192

|

|

Profit tax

|

(366,542)

|

124,816

|

|

|

|

|

|

Profit (loss) for the period

|

1,579,938

|

(202,207)

|

|

|

|

|

|

Profit (loss) for the period attributable to:

|

|

|

|

Owners of PJSC Gazprom

|

1,550,299

|

(218,378)

|

|

Non-controlling interest

|

29,639

|

16,171

|

|

|

1,579,938

|

(202,207)

|

More detailed information concerning the main items of the sales structure is presented in the table below.

|

in RUB million (unless indicated otherwise)

|

Nine months ended

September 30,

|

|

|

2021

|

2020

|

|

Sales of gas

|

|

|

|

Europe and other countries

|

|

|

|

Net sales (net of excise tax and customs duties)

|

2,460,824

|

1,135,130

|

|

Volumes in bcm

|

175.7

|

154.4

|

|

Average price, RUB per mcm (including excise tax and customs duties)

|

17,838.9

|

9,165.0

|

|

Former Soviet Union countries

|

|

|

|

Net sales (net of customs duties)

|

267,303

|

199,546

|

|

Volumes in bcm

|

24.1

|

21.3

|

|

Average price, RUB per mcm (including customs duties)

|

12,248.4

|

9,829.0

|

|

Russian Federation

|

|

|

|

Net sales (net of VAT)

|

732,584

|

622,882

|

|

Volumes in bcm

|

170.0

|

151.1

|

|

Average price, RUB per mcm (net of VAT)

|

4,308.4

|

4,122.9

|

|

Total gas sales

|

|

|

|

Retroactive gas price adjustments

|

5

|

2,324

|

|

Net sales (net of excise tax, VAT and customs duties)

|

3,460,716

|

1,959,882

|

|

Volumes in bcm

|

369.8

|

326.8

|

|

|

|

|

|

Net sales of refined products (net of excise tax, VAT and customs duties)

|

1,858,231

|

1,301,542

|

|

Net sales of crude oil and gas condensate (net of VAT and customs duties)

|

622,682

|

343,161

|

|

Electric and heat energy net sales (net of VAT)

|

415,744

|

348,467

|

|

Gas transportation net sales (net of VAT)

|

166,737

|

163,838

|

|

Other sales (net of VAT)

|

201,022

|

184,328

|

|

Total sales (net of excise tax, VAT and customs duties)

|

6,725,132

|

4,301,218

|

Net sales of gas increased by RUB 1,500,834 million, or 77 %, compared to the same period of the prior year to RUB 3,460,716 million for the nine months ended September 30, 2021. The increase of sales was mainly to an increase of sales of gas to Europe and other countries.

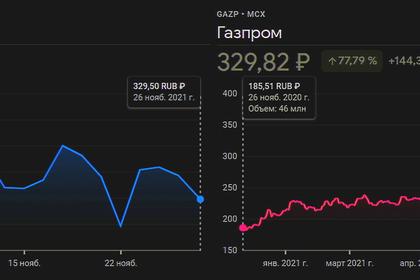

Net sales of gas to Europe and other countries increased by RUB 1,325,694 million, or 117 %, to RUB 2,460,824 million for the nine months ended September 30, 2021 compared to the same period of the prior year. The change was mainly due to an increase in average prices (including excise tax and customs duties) denominated in the Russian Ruble by 95 % and an increase in volumes of gas sold by 14 %, or 21.3 bcm. At the same time average prices denominated in US Dollar increased by 87 %.

Net sales of gas to Former Soviet Union countries increased by RUB 67,757 million or 34 %, to RUB 267,303 million for the nine months ended September 30, 2021 compared to the same period of the prior year. The change was due to an increase in average prices (including customs duties) denominated in the Russian Ruble by 25 % and an increase in volumes of gas sold by 13 %, or 2.8 bcm. At the same time average prices denominated in US Dollar increased by 20 %.

Net sales of gas in the Russian Federation increased by RUB 109,702 million, or 18 %, to RUB 732,584 million for the nine months ended September 30, 2021 compared to the same period of the prior year. This change was mainly explained by an increase in volumes of gas sold by 13 %, or 18.9 bcm, and an increase in average prices (net of VAT) by 4 %.

Net sales of refined products (net of excise tax, VAT and customs duties) increased by RUB 556,689 million, or 43 %, to RUB 1,858,231 million for the nine months ended September 30, 2021 compared to the same period of the prior year. The increase in net sales of refined products was mainly due to an increase in average prices in all geographic segments.

Net sales of crude oil and gas condensate (net of VAT and customs duties) increased by RUB 279,521 million, or 81 %, to RUB 622,682 million for the nine months ended September 30, 2021 compared to the same period of the prior year. The change was mainly due to an increase in net sales of crude oil primarily caused by an increase in average prices of crude oil.

Operating expenses increased by RUB 1,258,120 million, or 32 %, to RUB 5,202,452 million for the nine months ended September 30, 2021 compared to the same period of the prior year.

The increase in operating expenses was mainly caused by the increase of expenses in the item “Purchased gas and oil” by RUB 534,972 million, or 85 %, for the nine months ended September 30, 2021 compared to the same period of the prior year was caused by an increase in average prices of oil and gas and volumes of the oil purchase.

The increase in the item “Taxes other than on profit” by RUB 204,586 million, or 22 %, for the nine months ended September 30, 2021 compared to the same period of the prior year, was mainly due to an increase in mineral extraction tax expenses, which was partially compensated by a decrease in excise tax expenses. The increase in mineral extraction tax expenses mainly caused by an increase in crude oil prices, tax rate as a result of the tax maneuver and an increase in volumes of gas production.

The balance of foreign exchange differences reflected within the item “Net finance income (expense)” produced the gain in the amount of RUB 135,636 million for the nine months ended September 30, 2021 compared to the loss in the amount of RUB 749,452 million for the same period of the prior year.

Gain attributable to the owners of PJSC Gazprom amounted to RUB 1,550,299 million for the nine months ended September 30, 2021.

Adjusted EBITDA (calculated as the sum of operating profit, depreciation, impairment loss or reversal of impairment loss on financial assets and non-financial assets, less changes of allowance for expected credit losses on accounts receivable and impairment allowance on advances paid and prepayments) increased by RUB 1,278,451 million, or 137 %, for the nine months ended September 30, 2021 compared to the same period of the prior year and amounted to RUB 2,213,614 million. This change was mainly due to an increase in sales.

Net debt balance (defined as the sum of short-term borrowings and the current portion of long-term borrowings, short-term promissory notes payable, long-term borrowings, long-term promissory notes payable, less cash and cash equivalents) decreased by RUB 388,124 million, or 10 %, from RUB 3,872,695 million as of December 31, 2020 to RUB 3,484,571 million as of September 30, 2021. This change was mainly due to an increase in cash and cash equivalents.

More detailed information on the IFRS consolidated interim condensed financial information for the nine months ended September 30, 2021 can be found here.

Earlier:

2021, November, 26, 11:45:00

GAZPROM INVESTMENT 2022: RUB 1.8 TLN

Overall amount of Gazprom's investments to be used in 2022: RUB 1,757.7 billion.

Gazprom's borrowings for 2022: RUB 272.789 billion.

Final investment program and budget will be approved by the Gazprom Board of Directors.

2021, November, 16, 14:50:00

GAZPROM SUPPLY GROWTH

The Company increased its gas supplies to Turkey (+98.1 per cent), Germany (+19.6 per cent), Italy (+18.3 per cent), Romania (+247.1 per cent), Serbia (+92.9 per cent), Bulgaria (+48.2 per cent), Poland (+7.3 per cent), Greece (+13.7 per cent), Slovenia (+53.3 per cent), and Finland (+10.8 per cent).

2021, November, 2, 13:50:00

GAZPROM PRODUCTION, SUPPLIES UP

According to preliminary data, Gazprom produced 422.6 billion cubic meters of gas in January–October of 2021, which is 15.8 per cent (or 57.7 billion cubic meters) more than in the same period of last year.

2021, October, 29, 14:20:00

GAZPROM GAS PRODUCTION UP 16.6%

Amid strong demand, Gazprom has substantially expanded its gas production: over the past 9.5 months of 2021, it went up by 56.7 billion cubic meters (or 16.6 per cent) against the same period of last year.

2021, October, 29, 13:40:00

GAZPROM: MORE LNG

The Company's work in this promising direction will make it possible to strengthen the position of Gazprom in foreign markets and address in a more flexible manner the tasks related to providing reliable gas supplies to domestic consumers.

2021, October, 28, 13:50:00

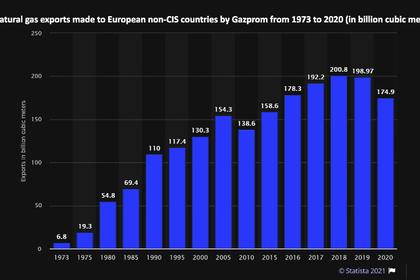

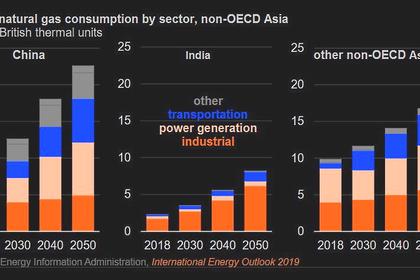

GAS FOR CHINA WILL UP

The increase in supply should help alleviate some of the price pressure in the domestic gas market as trucked LNG prices have soared to more than Yuan 7,000/mt ($1,093.82/mt), imported LNG remains over $30/MMBtu in the spot market and wider energy shortages persist amid cold weather.

2021, October, 11, 11:55:00

GAS DEMAND RECOVERY

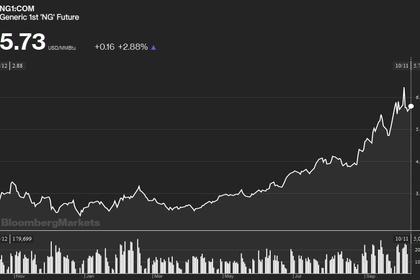

The steep rise in European gas prices has been driven by a combination of a strong recovery in demand and tighter-than-expected supply, as well as several weather-related factors.

All Publications »

Tags:

ГАЗПРОМ,

GAZPROM