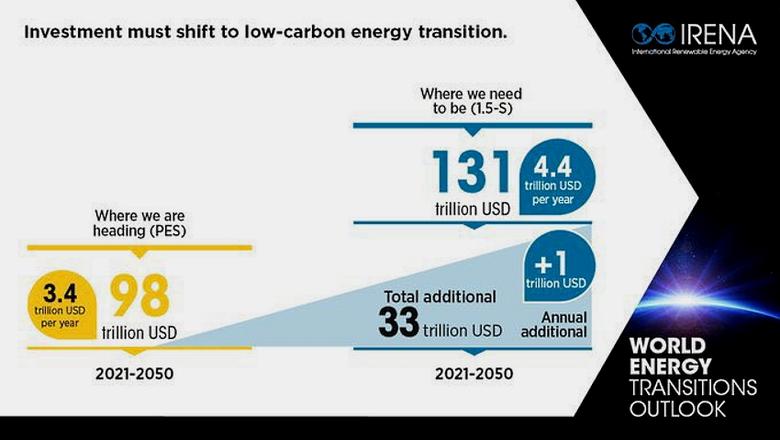

RENEWABLES NEED INVESTMENT $131 TLN

REUTERS - Nov 23 - The transition to clean energy will primarily be financed by the private sector as a standardised framework of reporting climate credentials for companies across the globe is established, investors and think tanks said.

These investments are likely to come from sources such as funds leveraged through banks and the private sector, institutional investors, debt financing and developed country finance, they told the Reuters Global Markets Forum last week.

The International Renewable Energy Agency (IRENA) estimates energy transition technologies will need investments of around $131 trillion by 2050.

Around 80% of this is expected to come from the private sector, with debt financing growing to a 60% share within that, IRENA deputy director-general Gauri Singh said.

Gero Farruggio, head of global renewables at Rystad Energy, believes companies will lead.

Big Tech companies that provide solutions to energy storage and are investing significantly on the technology side, along with corporations that are driving power purchase agreements are ones to watch, Farruggio said.

"Climate change is a systemic risk to all investors," said Karen Wong, head of ESG and sustainable investing at State Street Global Advisors, which manages nearly $3.9 trillion in assets.

Investors are aligning their portfolios to net zero, working with other funds and engaging with companies through "stewardship" and proxy-voting to integrate climate goals, she said.

A Barclays Private Bank survey of over 300 respondents, on average managing $833 million in assets, expects the share of impact investing within portfolios to reach 54% by 2027, from 41% this year.

Meanwhile, investors believe public finance will continue to play a vital role in creating risk mitigation mechanisms for renewable energy projects, to further leverage and unlock private investments.

GLOBAL STANDARDISATION

The new rules on carbon markets agreed upon at the United Nations COP26 climate conference would "provide some guidance," said Philip Gass, lead for transitions, Energy Programme at the International Institute for Sustainable Development.

Investors expect the standardised framework, being formulated by the International Sustainability Standards Board (ISSB), to target the reduction of greenhouse gases, predictive emissions, and carbon capture and storage (CCS).

But they said harmonised accountability and transparency in how companies measure and report sustainability will be key, especially as around 70% of green capital expenditure over the next 30 years is expected to happen in emerging markets.

"We can only manage what we can measure ... Standardisation (would) help address one of the biggest barriers to decarbonisation," Wong said.

As more companies report on a standardised framework, investors will get more robust and comparable data, said Wong, which will "drive more sustainable investing in developing countries."

-----

Earlier: