СДЕЛКА РОСНЕФТИ, SHELL

РОСНЕФТЬ - 17 Ноябрь 2021 - «Роснефть» приняла решение о реализации преимущественного права покупки доли 37,5% в НПЗ РСК (г. Шведт) у компании Shell. Соответствующие документы были направлены партнеру. Ожидается, что сделка будет закрыта после одобрения регулирующими органами.

В результате сделки доля «Роснефти» в РСК увеличится с 54,17% до 91,67%.

Главный исполнительный директор ПАО «НК «Роснефть» Игорь Сечин отметил: «Увеличение доли в НПЗ PCK свидетельствует о том, что немецкий рынок имеет стратегическое значение для «Роснефти». Компания традиционно выстраивает долгосрочные отношения с партнерами из ФРГ, гарантирует своевременные и бесперебойные поставки сырья, проводит модернизацию ключевых установок НПЗ.

РСК является одним из наиболее сложных в технологическом отношении НПЗ в Германии с индексом Нельсона 9,8. «Роснефть» планирует укреплять технологическое лидерство завода, в том числе, за счет реализации низкоуглеродных проектов с учетом действующей экологической повестки ЕС. Компания реализует проекты, направленные на производство более чистых видов топлива, например, «зеленого» водорода и экологичного авиационного топлива. Работа в этом направлении будет продолжена».

---

Справка:

ПАО «НК «Роснефть» является третьим по величине игроком на рынке нефтепереработки в Германии. Операционная деятельность ведется компанией Rosneft Deutschland GmbH, дочерним предприятием Компании. Данная компания управляет как поставками нефти на нефтеперерабатывающие заводы, акции которых принадлежат Роснефти (PCK Raffinerie GmbH, НПЗ MiRO, НПЗ Bayernoil), так и реализацией нефтепродуктов.

Нефтеперерабатывающий завод PCK Raffinerie GmbH расположен в городе Шведт, земля Бранденбург. Расположение завода позволяет поставлять нефть марки Urals по трубопроводу «Дружба». Мощность завода составляет 11,6 млн тонн в год (текущая доля «Роснефти» в мощности завода - 6,3 млн тонн в год), индекс Нельсона - 9,8. Текущие акционеры: ПАО «НК «Роснефть» - 54,17%, Shell - 37,5%, Eni - 8,33%.

-----

ROSNEFT, SHELL DEAL

ROSNEFT - 17 November 2021 - Rosneft exercised the pre-emption right for 37.5% share of the PCK (Schwedt) refinery from Shell. Relevant notifications have been shared with the partner. The transaction is subject to government and regulatory approvals.

As result of the purchase, Rosneft will increase its shareholding in PCK from 54.17% to 91.67%.

Rosneft Chief Executive Officer Igor Sechin noted: “Increasing the share of PCK refinery is testament to the strategic importance of the German market for Rosneft. The Company builds long-term relationships with its German partners, provides timely and uninterrupted crude supplies, and modernizes key refinery units.

PCK is one of the most technologically complex refineries in Germany, with a Nelson index of 9.8. Rosneft plans to strengthen the technological leadership of the refinery, including through the implementation of low-carbon projects, considering the current environmental agenda of the EU. The company is already developing projects aimed at the production of cleaner fuels, such as "green" hydrogen and sustainable aviation fuel. Work in this direction will continue”.

---

Notes for editors:

Rosneft is the third largest player in the German oil refining market. Operating activities are carried out by Rosneft Deutschland GmbH, a subsidiary of the Company. This company manages both the supply of crude oil to the refineries, the shares of which belong to Rosneft (PCK Raffinerie GmbH, MiRO refinery, Bayernoil refinery), and sales of petroleum products.

The PCK Raffinerie GmbH refinery is located in Schwedt, Brandenburg. The location of the refinery makes it possible to supply Urals crude through the Druzhba pipeline. The capacity of the refinery is 11.6 million tons per year (Rosneft's current share in the capacity is 6.3 million tons per year), the Nelson complexity index is 9.8. Current shareholders: Rosneft - 54.17%, Shell - 37.5%, Eni - 8.33%.

-----

Earlier:

2021, November, 12, 12:25:00

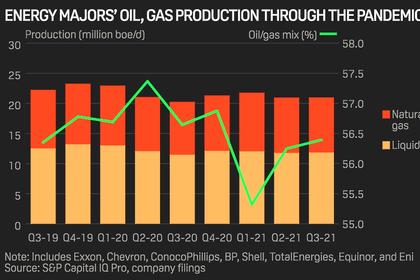

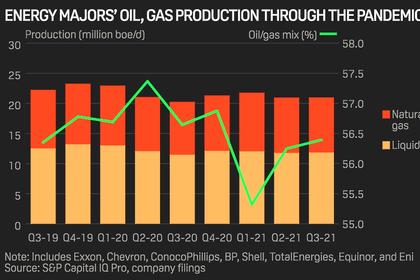

LIMITED OIL GAS PRODUCTION

At the end of 2019, combined oil output from ExxonMobil, BP, Shell, Chevron, TotalEnergues, Equinor, ConocoPhillips, and Eni stood at 13.3 million b/d, or about 13% of total global supplies,

2021, November, 1, 13:20:00

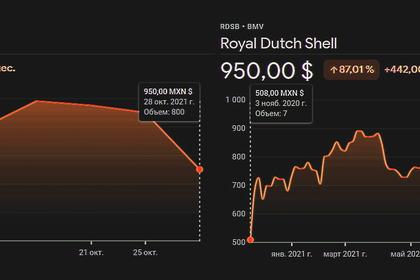

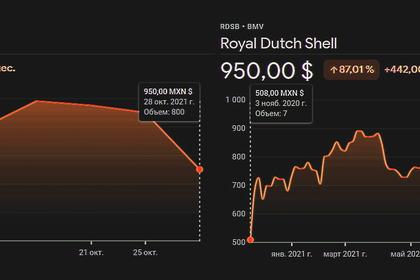

SHELL LOSS $400 MLN

Third quarter 2021 income attributable to Royal Dutch Shell plc shareholders was a loss of $0.4 billion, which included non-cash charges of $5.2 billion due to the fair value accounting of commodity derivatives and post-tax impairment charges of $0.3 billion, partly offset by net gains on sale of assets of $0.3 billion.

2021, September, 21, 12:30:00

SHELL, CONOCO AGREEMENT $9.5 BLN

Shell Enterprises LLC, a subsidiary of Royal Dutch Shell plc, has reached an agreement for the sale of its Permian business to ConocoPhillips, a leading shales developer in the basin, for $9.5 billion in cash.

All Publications »

Tags:

SHELL,

РОСНЕФТЬ,

ROSNEFT