U.S. RISKY ASSET PRICES RISE

U.S. FRB - November 8 - Financial Stability Report November 2021

Overview

This report reviews conditions affecting the stability of the financial system by analyzing vulnerabilities related to valuation pressures, borrowing by businesses and households, financial leverage, and funding risk. It also highlights several near-term risks that, if realized, could interact with these vulnerabilities.

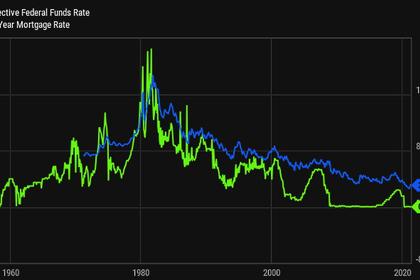

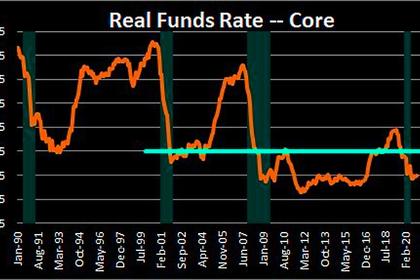

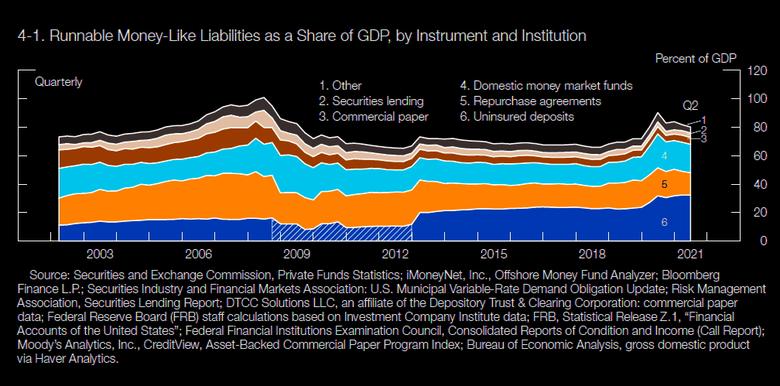

Since the May 2021 Financial Stability Report was issued, prices of risky assets generally rose further. Despite concerns about the spread of the Delta variant of the virus that causes COVID-19, asset prices were supported by increased earnings expectations and low Treasury yields. Business and household borrowing as a percentage of gross domestic product (GDP) decreased further. Banks continued to be profitable and strongly capitalized. By contrast, structural vulnerabilities persist in some types of money market funds (MMFs) and other cash-management vehicles as well as in bond and bank loan mutual funds and could again amplify shocks to the financial system in times of stress.

Our view of the current level of vulnerabilities is as follows:

1. Asset valuations. Prices of risky assets generally increased since the previous report, and, in some markets, prices are high compared with expected cash flows. House prices have increased rapidly since May, continuing to outstrip increases in rent. Nevertheless, despite rising housing valuations, little evidence exists of deteriorating credit standards or highly leveraged investment activity in the housing market. Asset prices remain vulnerable to significant declines should investor risk sentiment deteriorate, progress on containing the virus disappoint, or the economic recovery stall.

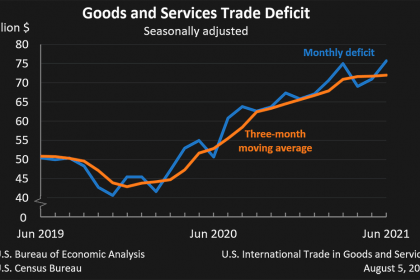

2. Borrowing by businesses and households. Key measures of vulnerability from business debt, including debt-to-GDP, gross leverage, and interest coverage ratios, have largely returned to pre-pandemic levels. Business balance sheets have benefited from continued earnings growth, low interest rates, and government support. However, the rise of the Delta variant appears to have slowed improvements in the outlook for small businesses. Key measures of household vulnerability have also largely returned to pre-pandemic levels. Household balance sheets have benefited from, among other factors, extensions in borrower relief programs, federal stimulus, and high aggregate personal savings rates. Nonetheless, the expiration of government support programs and uncertainty over the course of the pandemic may still pose significant risks to households.

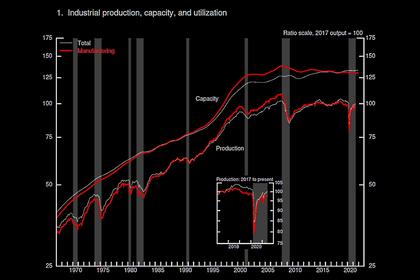

3. Leverage in the financial sector. Bank profits have been strong this year, and capital ratios remained well in excess of regulatory requirements. Some challenging conditions remain due to compressed net interest margins and loans in the sectors most affected by the COVID-19 pandemic. Leverage at broker-dealers was low. Leverage continued to be high by historical standards at life insurance companies, and hedge fund leverage remained somewhat above its historical average. Issuance of collateralized loan obligations (CLOs) and asset-backed securities (ABS) has been robust.

4. Funding risk. Domestic banks relied only modestly on short-term wholesale funding and continued to maintain sizable holdings of high-quality liquid assets (HQLA). By contrast, structural vulnerabilities persist in some types of MMFs and other cash-management vehicles as well as in bond and bank loan mutual funds. There are also funding-risk vulnerabilities in the growing stablecoin sector.

The report also details how near-term risks have changed since the May 2021 report based in part on the most frequently cited risks to U.S. financial stability as gathered from outreach to a wide range of market contacts (discussed in the box “Salient Shocks to Financial Stability Cited in Market Outreach”). Despite recent improvements, an increase in uncertainty over the course of the pandemic might pose risks to asset markets, financial institutions, and borrowers in the United States and globally. In addition, stresses in the real estate sector in China caused in part by China’s ongoing regulatory focus on leveraged institutions, as well as a sharp tightening of global financial conditions, especially in highly indebted emerging market economies (EMEs), could pose some risks to the U.S. financial system. If realized, the effects of near-term risks could be amplified through the financial vulnerabilities identified in this report.

The report includes additional boxes that analyze salient topics related to financial stability. Two boxes explore recent notable events in financial markets. The first, “Retail Investors, Social Media, and Equity Trading,” analyzes recent volatility in so-called meme stocks by linking changes in demographics, regulations, and technology to recent trends in the demand for and supply of retail trading opportunities in equity markets. The second, “The Role of Foreign Investors in the March 2020 Turmoil in the U.S. Treasury Market,” documents the material role played by foreign investors in the selloff of Treasury securities in March 2020 and assesses the drivers of these sales. Central counterparties (CCPs) are important institutions underpinning the financial system. The box “Liquidity Vulnerabilities from Noncash Collateral at Central Counterparties” considers potential challenges CCPs may face in quickly monetizing noncash collateral in the event of stress. The next two boxes discuss the Federal Reserve’s work to adapt its financial stability framework to incorporate climate and cyber risks. The box “The Financial Stability Oversight Council’s Climate Report and the Federal Reserve’s Actions” discusses the Federal Reserve’s work to identify and address climate-related financial risks. Similarly, the box “Cyber Risk and Financial Stability” describes how the Federal Reserve considers cyber risk in its framework for monitoring financial stability. Finally, the box “LIBOR Transition Update” reviews progress with the transition away from LIBOR.

-----

Earlier: