VIETNAM'S ENERGY IMBALANCE

VIETNAMNET - 27/11/2021 - While the necessary course for a greener and more sustainable future in global energy policies seems set, Vietnam’s energy transition faces budgetary and capacity challenges, both of which need to be overcome with suitable solutions.

Vietnam’s endeavour to reduce greenhouse gas (GHG) emissions by 30 per cent by 2030 may be one of the biggest challenges for current Minister of Industry and Trade, Nguyen Hong Dien.

Tran Tuan Anh, his predecessor, once supported the extension of the feed-in tariff (FiT) mechanism for wind power projects. Meanwhile, Minister Dien wants to only apply the FiT mechanism for a certain period, to encourage only those projects that need investment.

The minister’s authority allows him to take several measures to reduce energy imports, strengthen the asynchronous energy infrastructure, and propose a mechanism for the development of new and renewable energy sources. Dien promised to do all this when he took his position.

However, “The Ministry of Industry and Trade (MoIT) will not propose an extension for the FiT scheme for wind power projects after October 31,” Dien said at a discussion of the National Assembly (NA) on November 9. According to Dien, an extension would be “unreasonable” and that such a mechanism would hurt other projects’ implementation.

Input prices of materials and equipment within the wind power field have decreased as the support policy was promulgated and continued a strong downward trend. The extension of this policy, said the minister, would cause “legal consequences and economic damage” to the state and electricity users.

Instead, Dien’s biggest wish seems to soon complete the regulations on the development of wind and solar power projects under the Law on Investment, with a bidding and auction mechanism to select investors and determine electricity prices.

Investors would negotiate prices with Electricity of Vietnam (EVN) within a set price bracket issued by the MoIT. This, however, will need support from the government and the NA. Yet so far, “The MoIT has not received an agreement from relevant ministries and agencies,” Dien said.

Cautious steps

The rapid reduction of emissions necessary to cope with climate change will have a huge impact on Vietnam’s energy industry, and is possibly closely linked to short-term policies to develop new and renewable energy sources, according to analysts.

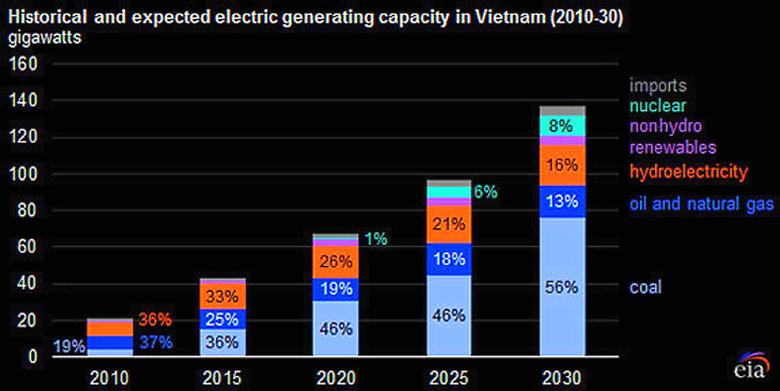

In the past, the approach was to rely on hydroelectricity to cut coal power plants’ generating capacity. But now, cutting capacity from traditional sources and giving priority to solar and wind power may help the MoIT to achieve the environmental goals, albeit putting pressure on the system.

Firstly, the MoIT will have to remedy signs of imbalance in regulating power sources. Data from EVN shows that by the end of April, the total solar power capacity reached 17,000MW, exceeding the planned capacity of the plan by 2030 by 5,000MW and accounting for nearly 25 per cent of the system’s installed capacity. Meanwhile, the market may continue to record a boom in wind power projects in the last months of the year, when about 5,400MW are added to the system.

However, this could bring the electricity price in danger of being disrupted when the cost of mobilised renewable energy is higher than the price of traditional power sources. For example, solar power has a selling price of 9.35 US cents per kWh, rooftop solar power costs 8.38 US cents per kWh, and onshore wind power is about 8.5 US cents per kWh.

Meanwhile, the average prices of gas-powered thermal plants like Nhon Trach, Ca Mau, and Phu My lies around 5.1-6.2 US cents per kWh. The maximisation of high-priced renewable energy sources and the reduction of gas-fired thermal power mobilisation has pushed up electricity prices, while the average commercial electricity price has remained unchanged since March 2019, standing at about 8.1 US cents per kWh. Also, the deep decline in the mobilisation of gas power sources is dragging the budget revenues from traditional energy sources to a lower level. For instance, the Ca Mau 1 and 2 thermal power plants only mobilised 3.5 billion kWh in the first eight months of this year.

With the current situation, it is expected that the total mobilised output in 2021 will be at 4.53 billion kWh for 2021, equal to about 65 per cent of the calculated capacity. Expected payments to the local state budget would then be equivalent to a mere 32 per cent of the annual average.

Preventing damage

According to calculations by Vietnam Oil and Gas Group, if gas output does not increase, the total gas output in 2021 is expected to be about 7.9 billion cubic metres. However, the gas exploitation plan assigned by the government expected 9.7 billion cu.m, with expected losses amounting to around $365 million. In 2022, a continued sharp decrease in gas production to around 6.52 billion cu.m could affect the state’s revenues by another $675 million.

Another important point is that the uncertainty of renewable energy will cause great challenges in frequency and voltage regulation, as well as in ensuring stability for the power system.

Nguyen Duc Ninh, director of the National Load Dispatch Centre, said that with the rapid and large increase in renewable energy, traditional power sources must be flexible and regularly adjust the output.

According to Ninh, mechanisms to curtail renewable energy sources has been applied by many countries around the world when their ratios reached a certain level. “Considering such mechanisms is very important for the stable operation of Vietnam’s power system when renewable energy continues to increase,” Ninh said.

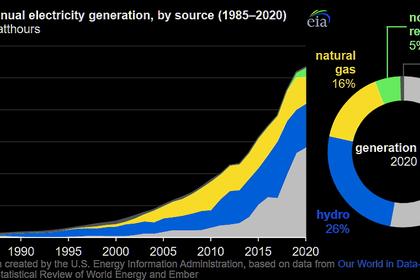

Vietnam has become the leading country in ASEAN in terms of installed solar and wind power capacity. According to the International Renewable Energy Agency, by the end of 2020, Vietnam’s total solar capacity reached about 16,500MW, far exceeding the target of 850MW in that year and even close to the target of 18,600MW set for 2030.

According to Dr. Bui Huy Phung from the Vietnam Institute of Energy Sciences, “Minister Dien will need about two years to develop a suitable bidding mechanism. During this transition, we must be very careful to retain investors,” said Phung.

Phung, who has 40 years of research experience in energy, believed that Vietnam’s transition to renewable energy will not be smooth. “People have to be aware of the risks and drastic fluctuations associated with it. Nevertheless, the direction remains unchanged, and the world will use more renewable energy,” Phung said.

-----

Earlier: