AUSTRALIA'S GAS PLAN

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

AUSTRALIA'S GAS PLAN

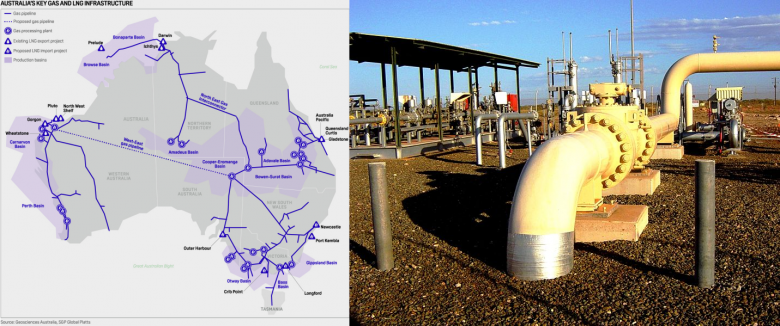

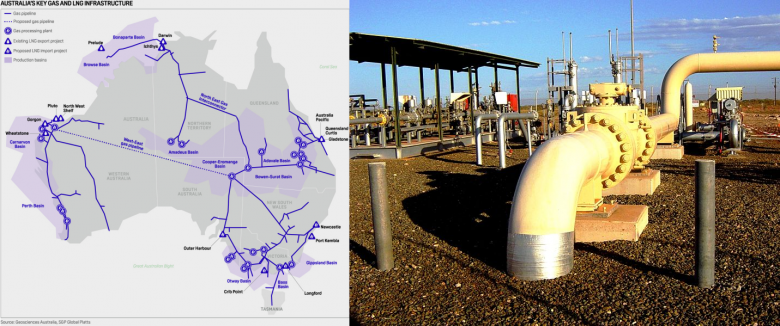

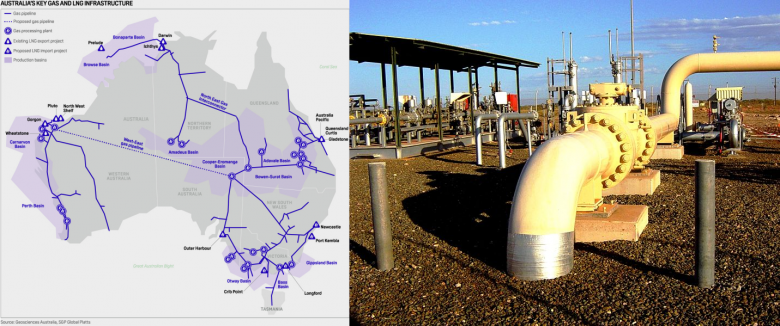

ENERDATA - 30 Nov 2021 - Australia has released the first National Gas Infrastructure Plan (NGIP) to identify a long-term development pathway for gas supply and infrastructure out to 2040. Demand for gas in the east coast gas market is forecast to be relatively stable across all demand scenarios until the mid-2030s, with established domestic customers and LNG export contracts supporting continued production. Increased market penetration of renewables will lead to greater requirements for peaking power generation, which is currently supplied by gas-fired power plants, and there are plans to build additional capacity on the east coast. Around 70% of gas produced on the east coast is currently destined for LNG export markets, the largest of which are China and Japan, and a large share of export demand is supported by long-term contracts that will expire in the mid-2030s.

Supply from both existing southern and northern basins is expected to decline during the remainder of this decade. In the longer term, forecasts highlight that without action, progressive declines in production from existing northern and southern basins will lead to gas shortages. Consequently, new basin supply must be developed by the end of this decade. In addition, the country plans to expand transportation capacity from north to south, as northern supply expands and southern supply declines.

Natural gas consumption increased very rapidly between 2000 and 2019 (3%/year) and then dropped by 3% in 2020 to 40 bcm. Electricity production accounts for 33% of the consumption, the hydrocarbon sector for 26%, industry for 25%, and buildings for around 16%. Natural gas production increased very rapidly, at a pace of around 20%/year over 2015-2019 and 8% in 2020, reaching 154 bcm. Most of the production is sourced from three basins: the Carnarvon Basin (north-west Western Australia), the Gippsland Basin (Victoria), and the Cooper-Eromanga Basin (central Australia).

-----

Earlier:

2021, October, 27, 12:50:00

AUSTRALIA NEED HYDROGEN

Australia is seeing a rapid rise in the addition of solar power and has over 80 hydrogen projects planned, with renewable energy-based schemes outnumbering blue hydrogen schemes.

2021, October, 26, 12:55:00

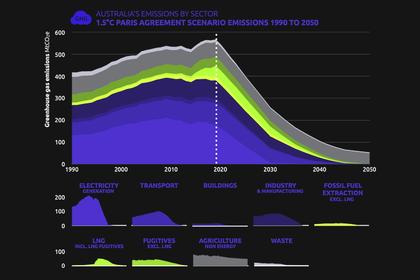

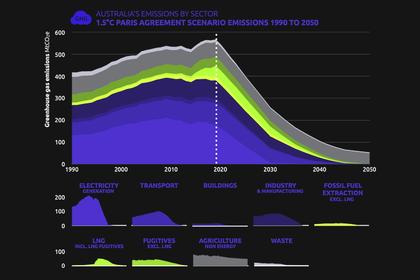

AUSTRALIA ZERO EMISSIONS 2050

Australia's adoption of a net zero emissions target is significant as it is one of the largest producers and exporters of fossil fuels and falling in line with the UN mandated net zero pledge would signal there could be tighter regulations on emissions reduction.

2021, October, 21, 15:10:00

AUSTRALIA'S RENEWABLE INVESTMENT $7.5 BLN

The projects were unveiled as part of Rio Tinto’s newly announced plans to spend $US7.5 billion ($A10 billion) slashing its scope 1 and scope 2 emissions by half by 2030.

2021, September, 28, 13:15:00

AUSTRALIA'S GREEN HYDROGEN

Edify Energy has received approval to build and operate a 1 GW green hydrogen production plant and a solar photovoltaic (PV) and battery storage project within the Lansdown Eco-Industrial Precinct in Townsville, Queensland (Australia).

2021, September, 21, 12:35:00

AUSTRALIA'S HYDROGEN UP

Australia's hydrogen industry said more is needed from the government to help the industry reach commercial scale.

2021, September, 13, 12:10:00

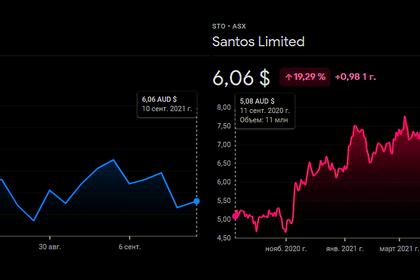

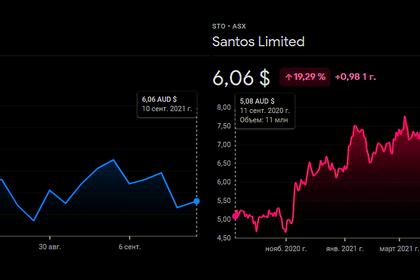

AUSTRALIA'S SANTOS MERGE

The Merger creates a regional champion of size and scale, with a pro-forma market capitalisation of approximately A$21 billion

All Publications »

Tags:

AUSTRALIA,

GAS,

LNG