GLOBAL OIL DEMAND 2021: + 5.7 MBD ANEW

OPEC - 13 December 2021 - OPEC MONTHLY OIL MARKET REPORT

Oil Market Highlights

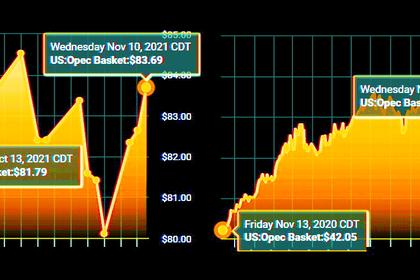

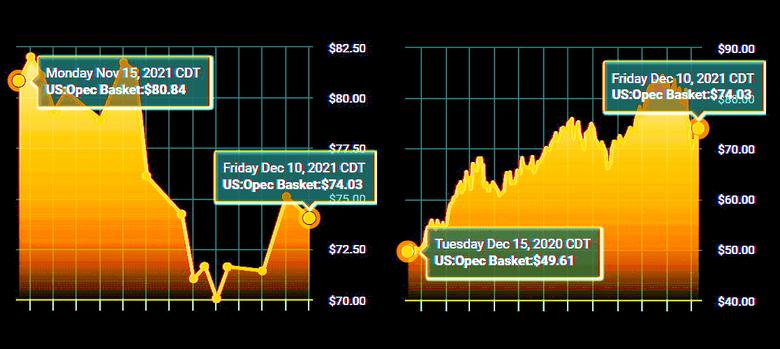

Crude Oil Price Movements

Crude oil spot prices declined in November, amid concerns regarding the emergence of the new Omicron COVID-19 variant, and easing of the energy crunch which had resulted in higher oil demand from the gas-tooil switching. The OPEC Reference Basket (ORB) value dropped by $1.74, or 2.1%, in November to average $80.37/b, amid lower prices of almost all medium and heavy sour grades in Asia, Europe, and the Americas.

The year-to-date (y-t-d) ORB value reached $69.45/b, which is $28.71, or 70.4%, higher compared with the same period last year of $40.75/b. Similarly, crude oil futures prices ended November sharply lower amid higher volatility after a broad selloff in futures and equity markets, amid the emergence of the new Omicron COVID- 19 variant and easing concerns about an energy crunch. The ICE Brent first-month fell by $2.90, or 3.5%, in November to average $80.85/b, and NYMEX WTI declined by $2.57, or 3.2%, to average $78.65/b.

DME Oman crude oil futures prices fell by $2.11 m-om, or 2.6%, to settle at $79.70/b in November. The spread between the ICE Brent and NYMEX WTI benchmarks narrowed further in November by 33¢ to average $2.20/b. Hedge funds and other money managers accelerated selling in November, contributing to the decline in oil prices. Combined speculative net length positions linked to ICE Brent and NYMEX WTI dropped to the lowest level since November 2020. The backwardation structure in all three markets weakened considerably in the second half of November.

World Economy

The global GDP growth forecast in 2021 is revised slightly down to 5.5%, from 5.6% in the previous month’s assessment, while the 2022 growth forecast remains unchanged at 4.2%. The US is still expected to grow by 5.5% in 2021 and 4.1% in 2022, unchanged from last month’s assessment. Similarly, Euro-zone economic growth remains at 5.1% for 2021 and at 3.9% for 2022. Japan’s economic growth forecast for 2021 is revised down to 2% from 2.5%, after an unexpectedly strong decline in 3Q21, but forecast for 2022 is revised up to 2.2% from 2%, with ongoing 4Q21 momentum expected to be carried over into next year. Given the softening growth momentum in 2H21, China’s economic growth forecast for 2021 is revised down to 8% from 8.3% and to 5.6% from 5.8% for 2022. India’s forecast for 2021 is revised down to now stand at 8.8%, compared with 9% in the previous month, but anticipated momentum from 4Q21 has lifted the 2022 growth forecast to 7%.

Russia GDP growth forecast remains unchanged at 4% for 2021 and 2.7% for 2022. Brazil’s economic growth forecasts for both 2021 and 2022 are also unchanged at 4.7% and 2%, respectively. The ongoing robust growth in the world economy continues to be challenged by uncertainties related to the spread of COVID-19 variants and the pace of vaccine rollouts worldwide, as well as ongoing global supply-chain bottlenecks.

Additionally, sovereign debt levels in many regions, together with rising inflationary pressures and potential central bank responses, remain key factors that require close monitoring.

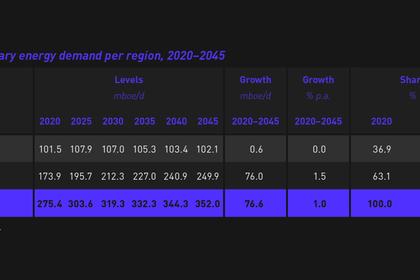

World Oil Demand

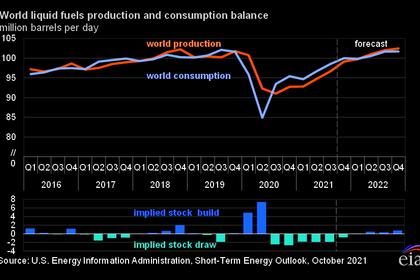

World oil demand is kept unchanged compared to last month’s assessment, showing a growth of 5.7 mb/d in 2021. However, oil demand was adjusted higher in 1H21, amid better-than-anticipated transportation fuel consumption in OECD, offset by a downwardly-revised estimate for 3Q21 due to increased COVID-19 cases and softer industrial production in China, as well as easing transportation fuel recovery in India. The 4Q21 oil demand was adjusted slightly lower, mainly to account for COVID-19 containment measures in Europe and the potential impact of the new Omicron COVID-19 variant. The forecast for 2022 is also kept unchanged at 4.2 mb/d. Indeed, some of the recovery previously expected in 4Q21 is now shifted to 1Q22, followed by a more steady recovery throughout 2H22. The impact of the new Omicron variant is expected to be mild and short-lived, as the world becomes better equipped to manage COVID-19 and its related challenges. This is in addition to a steady economic outlook in both the advanced and emerging economies.

World Oil Supply

Non-OPEC liquids supply growth in 2021 remained unchanged at around 0.7 mb/d y-o-y to average 63.7 mb/d. The upward revisions in the US, and Canada were offset by downward adjustments to Brazil, and Norway. The 2021 oil supply forecast primarily sees growth in Canada, Russia, China, US, Norway, Guyana, and Qatar, while output is projected to decline in the UK, Colombia, Indonesia and Brazil. Similarly, the non-OPEC supply growth forecast for 2022 is also kept unchanged at around 3.0 mb/d, to average 66.7 mb/d. The main drivers of liquids supply growth are expected to be the US and Russia, followed by Brazil, Canada, Kazakhstan, Norway and Guyana. OPEC NGLs are forecast to grow by 0.1 mb/d both in 2021 and 2022 to average 5.1 mb/d and 5.3 mb/d, respectively. In November, OPEC crude oil production increased by 0.29 mb/d m-o-m, to average 27.72 mb/d, according to available secondary sources.

Product Markets and Refining Operations

Refinery margins in all main trading hubs weakened in November, as the performance of all product across the barrel in all regions lost ground m-o-m with the exception of Naphtha in Asia. This downturn was attributed to a rise in product outputs as refineries ramped-up run rates, following major turnarounds to replenish product inventory levels. In addition, the seasonal demand-side weakness amid renewed lockdown measures as a result of a rise in COVID-19 infection rates further weighed on product markets. Going forward, a potential continuation of a rise in global refinery processing rates will most likely lead to a widening product balance and continued weakness in product markets in the coming month. Moreover, concerns over the spread of the Omicron variant is set to add to the downside and further suppress the robust recovery in jet fuel margins witnessed in the recent months, particularly during the end of the year holiday season.

Tanker Market

Dirty tanker spot freight rates remained steady in November, as the expected year-end upward momentum had yet to show. For VLCCs, the Middle East-to-East route averaged WS43, up 2% m-o-m. While this represented an improvement over November 2020, it is still well below pre-COVID levels for this time of year.

For Suezmax, the West Africa-to-US Gulf Coast averaged WS61 for a decline of 6%. In contrast, clean tanker spot rates strengthened, with gains both east and west of Suez. Optimism for the end of the year has been shaken somewhat by the uncertainty around the impact of the Omicron variant on economic activities, as well as the persistent imbalance in the tanker market.

Crude and Refined Products Trade

Preliminary data shows US crude imports in November partly recovered from a dip in the month before to average 6.4 mb/d. US crude exports also rose for the second month to average 2.9 mb/d. China’s crude imports averaged 8.9 mb/d in October, the lowest since February 2018, although preliminary customs data shows a recovery in November with crude imports averaging 10.2 mb/d. India’s crude imports feel back, following 2 months of gains, averaging 4.0 mb/d in October. In contrast, India’s product imports increased, driven by higher inflows of gasoline and fuel oil. Japan’s crude imports fell for the second month in a row, averaging 2.4 mb/d in October. In OECD Europe, the latest data for August shows crude imports remainingstrong at 8.7 mb/d, while crude exports continued to edge higher reaching 0.5 mb/d.

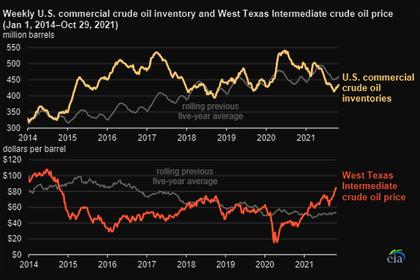

Commercial Stock Movements

Preliminary October data sees total OECD commercial oil stocks up by 9.9 mb m-o-m. At 2,773 mb, they were 357 mb lower than the same time one year ago, 207 mb lower than the latest five-year average and 174 mb below the 2015-2019 average. Within the components, crude and products stocks rose by 9.4 mb and 0.5 mb m-o-m respectively. At 1,307 mb, OECD crude stocks stood 154 mb below the latest five-year average and 149 mb below the 2015-2019 average. At 1,465 mb, OECD product stocks exhibited a deficit of 52 mb below the latest five-year average, and were 25 mb lower than the 2015-2019 average. In terms of days of forward cover, OECD commercial stocks rose m-o-m by 1.0 day in October to stand at 61.7 days. This is 12.1 days below October 2020 levels, 2.7 days below the latest five-year average, and 0.7 days less than the 2015-2019 average.

Balance of Supply and Demand

Demand for OPEC crude in 2021 is revised up by 0.2 mb/d from the previous month’s assessment to stand at 27.8 mb/d, around 4.9 mb/d higher than in 2020. Demand for OPEC crude in 2022 was revised up by 0.2 b/d from the previous month’s assessment to stand at 28.8 mb/d, around 1.0 mb/d higher than in 2021.

-----

Earlier: