GLOBAL OIL DEMAND RECOVERY

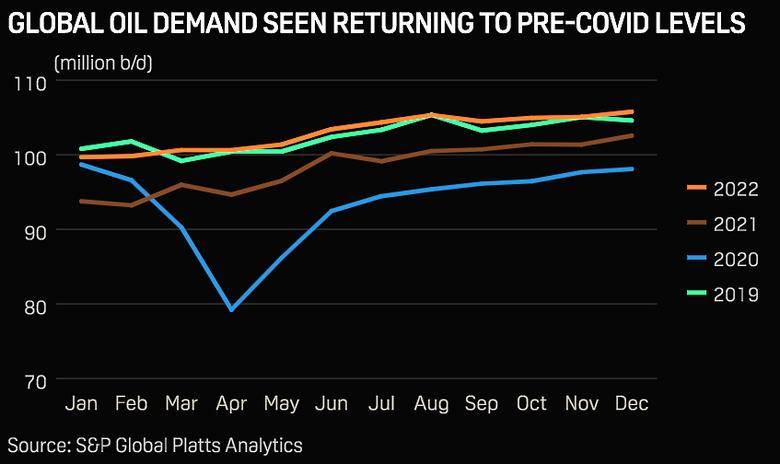

PLATTS - 23 Dec 2021 - Even as cases of COVID's omicron variant continue to spiral around world, most market watchers remain sanguine that 2022 will be year when global oil demand finally catches up and overtakes pre-COIVD levels.

The outbreak of the highly transmissible mutation may dent the pace of oil demand recovery but won't derail its trajectory, appears to be the consensus.

Underlying oil demand fundaments remain strong going into 2022. Pent-up demand is already stretching supply lines to the limit while booster jabs and previous infections lower the chance of serious harm from the virus.

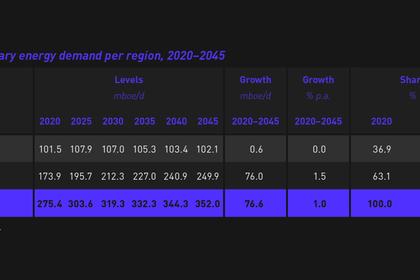

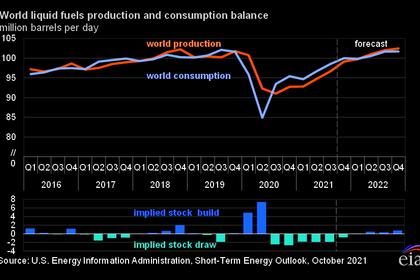

Despite the headwinds, both the International Energy Agency and OPEC expect oil demand to exceed the 100 million b/d mark in the summer of 2022, thus returning to the level before the COVID-induced slump in the first half of 2020.

Although the recovery hit a speed bump with winter rising cases in many parts of the northern hemisphere, new lockdowns remained limited, and high-frequency mobility data is showing limited impact.

Indeed, most high frequency data has shown global mobility is now rebounding after an initial retreat over omicron restrictions.

While mobility wobbled particularly in Europe in early December, adjusted data from Google shows global activity improved to just 3.8% below pre-COVID levels in the week to Dec. 19, the highest since the pandemic tanked oil consumption om 2020.

The data, which represents countries consuming about half of the world's oil, suggests the demand recovery has been little fazed by the variant, despite regional disparities.

Global scheduled airline capacity also grew 1% on the week in the week starting Dec. 20, with even European flight traffic improving despite curbs on UK travelers to France and Germany.

Diminishing returns

Damien Courvalin, head of energy research at Goldman Sachs sees omicron as a short-term risk to prices, with 2022/23 remaining a "structural bull market" supported by the fact the global economy has become more resilient to the crisis.

"We've already had record-high demand before this newest variant and you're adding higher jet demand and the global economy is still growing," Courvalin said on Dec 17. "You see how we will average a new record high in demand in 2022, and again, in 2023."

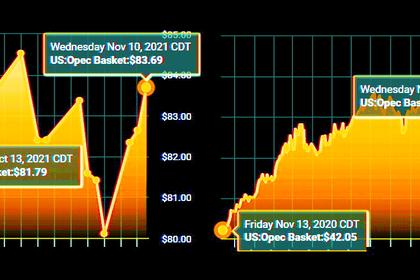

Ever bullish Goldman Sachs forecasts Brent to stay around $85/b in 2022 and 2023 but sees a return to $100/b as a possibility.

S&P Global Platts Analytics expects global oil demand to grow by 4.6-4.8 million b/d in 2022 or just short of 5% to average 103 million b/d. At that level, total demand will surpass pre-pandemic levels by some 0.6-0.8 million b/d in 2022.

"Into 2022, we expect new COVID variants like delta and omicron may continue to emerge, as well as localized coronavirus outbreaks, but not of the magnitude seen in January 2021, May 2021, or even the August 2021 spikes. Total demand is expected to extend its recovery, though the pace of improvement will lessen," Platts Analytics said in a note.

Upbeat OPEC

Initial concerns over omicron that caused oil prices to plunge by almost 20% within days at the start of December are "exaggerated in view of the vaccination progress in the important consumer countries," Commerzbank said in a note.

OPEC+ has also signaled that it will temper its planned 400,000 b/d month production expansion if demand weakens significantly.

Even IEA, which on Dec. 14 cut its outlook for both the level of demand in first-quarter 2022 and year-on-year growth, is hedging its bets.

"New containment measures put in place to halt the spread of the virus are likely to have a more muted impact on the economy versus previous COVID waves ... We expect demand for road transport fuels and petrochemical feedstocks to continue to post healthy growth," it said.

OPEC is even more optimistic over demand resilience and expects an only slightly oversupplied oil market in the second half of 2022.

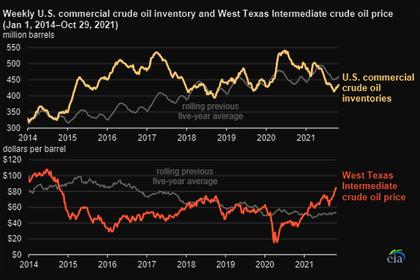

Global oil stocks have also rebounded sharply. According to the IEA, OECD commercial oil stocks in October were 243 million barrels below the 5-year average. By comparison, at the peak of the pandemic, OECD oil stocks in mid-June 2020 were almost 300 million barrels above the 5-year average.

In the US, the world's biggest oil consumer, gasoline demand has already hit 2019 levels.

Inflation threat

Nevertheless, fears persist that omicron's vaccination-dodging potential could force a new wave of mobility restrictions, a move that would leave air travel and jet fuel most affected.

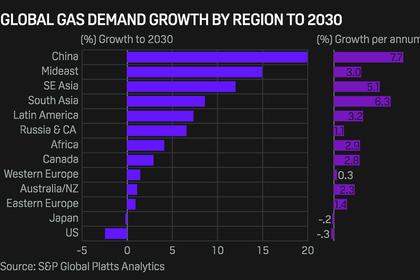

As things stand, Platts Analytics sees jet fuel posting the strongest percentage and volume gains of all oil products in 2022 at 31% or 1.7 million b/d. But global jet demand is still not seen returning to pre-COVID levels until 2024 at the earliest.

Gasoline and gasoil are seen both gaining about 4%, or roughly 1 million b/d each, to reach 2019 levels during the second half of the year. Among the other products, only ethane will outperform the barrel average and gain 8% or nearly 0.4 million b/d.

Soaring levels of inflation could also temper demand.

As the global economy emerges from the pandemic, markets expect the US Federal Reserve and other central banks to start hiking interest rates in early 2022 in a bid to cool economic growth. A resulting stronger dollar would also increase the cost of oil for importing countries.

While additional demand for oil will come as a result of switching from gas to oil as power companies and refiners avoid record high gas prices, the effect has been less than expected, according to the IEA, with little sign of this materializing in India, and Chinese power generation normalizing.

But if the current trends continue and economies continue to cautiously reopen despite the threat from omicron, the IEA's forecast may be left as the sole pessimistic voice on the near-term oil demand recovery as the new year begins.

-----

Earlier: