ОПЕК + РОССИЯ: + 400 ТБД

ПРАВИТЕЛЬСТВО РОССИИ - 2 декабря 2021 - Александр Новак провёл министерскую встречу стран ОПЕК и не-ОПЕК.

Участники встречи сохранили в силе договорённости по дальнейшему наращиванию добычи нефти на 400 тыс. баррелей в сутки в январе 2022 года, а также рассмотрели исполнение соглашения в октябре 2021 года.

Заместитель Председателя Правительства Александр Новак в качестве сопредседателя провёл 23-е заседание министерской встречи стран ОПЕК и не-ОПЕК. В рамках консультаций, прошедших в режиме видеоконференции, было рассмотрено исполнение добровольных обязательств стран – производителей нефти по сокращению добычи, планы участников соглашения на начало 2022 года, а также прогнозы по развитию ситуации на рынке.

Страны – участницы заседания подтвердили свои планы сохранить ранее утверждённые договорённости о продолжении увеличения добычи на суммарно 400 тыс. баррелей в сутки в январе 2022 года, сообщил Александр Новак по итогам заседания. По его словам, глобальный нефтяной рынок остаётся сбалансированным, при этом спрос продолжает восстанавливаться.

«Темпы роста мировой экономики в этом году составят 5,6%, на следующий год – ещё около 4,2% роста. Соглашение в октябре исполняется на высоком уровне в 116%. Видим, что запасы уже снизились до уровня меньше среднего пятилетнего значения», – отметил Александр Новак.

Кроме того, на рынок продолжают влиять новости относительно появления новых штаммов коронавируса. «Но в настоящее время нет новых объективных показателей для пересмотра ранее принятых решений», – добавил вице-премьер.

Проведение следующей, 24-й министерской встречи стран ОПЕК+ запланировано на 4 января 2022 года.

-----

ОПЕК + РОССИЯ: + 400 ТБД

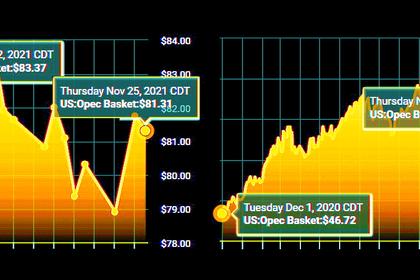

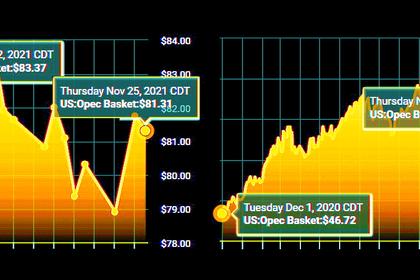

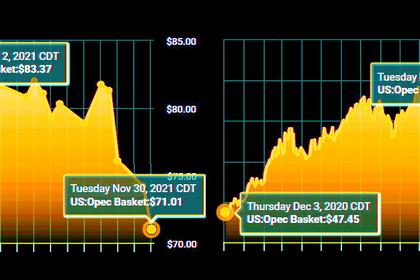

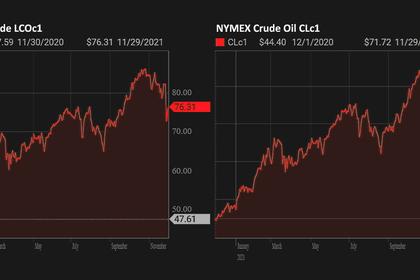

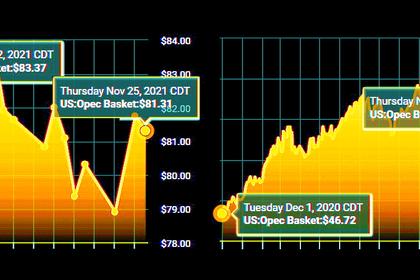

REUTERS - Dec 2 - Oil prices rose on Thursday, more than recouping the previous day's losses, as investors adjusted positions ahead of an OPEC+ decision over supply policy, but gains were capped amid fears the Omicron coronavirus variant will hurt fuel demand.

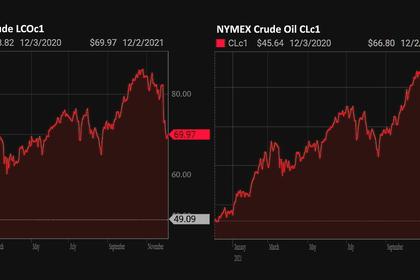

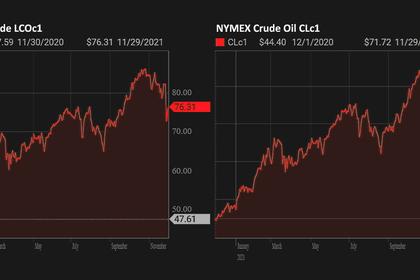

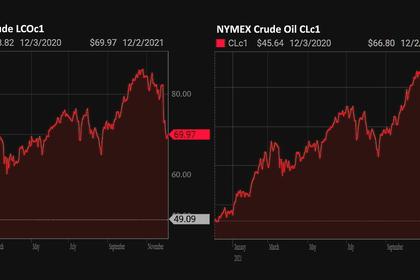

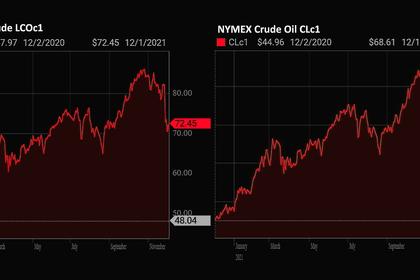

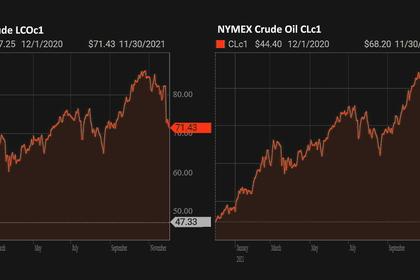

Brent crude futures rose $1.24, or 1.8%, to $70.11 by 0748 GMT, having eased 0.5% in the previous session.

U.S. West Texas Intermediate (WTI) crude futures gained $1.13, or 1.7%, to $66.70 a barrel, after a 0.9% drop on Wednesday.

"Investors unwound their positions ahead of the OPEC+ decision as oil prices have declined so fast and so much over the past week," said Tsuyoshi Ueno, senior economist at NLI Research Institute.

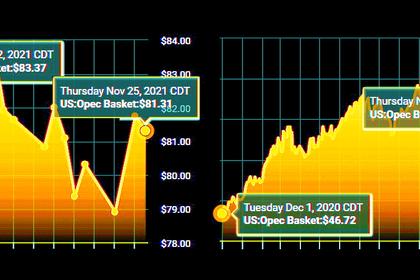

Global oil prices have lost more than $10 a barrel since last Thursday, when news of Omicron first shook investors.

"Market will be watching closely the producer group's decision as well as comments from some of key members after the meeting to suggest their future policy," Ueno said.

The Organization of the Petroleum Exporting Countries and its allies, together known as OPEC+, will likely decide on Thursday whether to release more oil into the market as previously planned or restrain supply.

Since August, the group has been adding an additional 400,000 barrels per day (bpd) of output to global supply each month, as it gradually winds down record cuts agreed in 2020.

The new variant, though, has complicated the decision-making process, with some observers speculating OPEC+ could pause those additions in January in an attempt to slow supply growth.

"Oil prices climbed as some investors anticipate that OPEC+ will decide to maintain the current supply levels in January to cushion any damage on demand from the Omicron spread," said Toshitaka Tazawa, an analyst at Fujitomi Securities Co Ltd.

Fears over the impact of the Omicron variant of the coronavirus rose after the first case was reported in the United States, and Japan's central bank has warned of economic pain as countries respond with tighter containment measures.

U.S. Deputy Energy Secretary David Turk said President Joe Biden's administration could adjust the timing of its planned release of strategic crude oil stockpiles if global energy prices drop substantially.

Gains in oil markets on Thursday were capped as the U.S. weekly inventory data showed U.S. crude stocks fell less than expected last week, while gasoline and distillate inventories rose much more than expected as demand weakened.

Crude inventories (USOILC=ECI) fell by 910,000 barrels in the week to Nov. 26, the Energy Information Administration (EIA) said, compared with analyst expectations in a Reuters poll for a drop of 1.2 million barrels.

-----

Earlier:

2021, December, 2, 12:35:00

OIL PRICE: NEAR $70

Brent rose $1.24, or 1.8%, to $70.11 a barrel, WTI gained $1.13, or 1.7%, to $66.70 a barrel.

2021, December, 2, 12:30:00

OPEC REMAIN PRUDENT

In these uncertain times, it is imperative that we – together with the non-OPEC countries in the DoC – remain prudent in our approach and prepared to be proactive as market conditions warrant.

2021, December, 1, 16:15:00

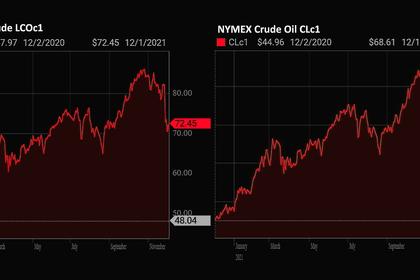

OIL PRICE: NOT BELOW $72

Brent rose $3.25, or 4.7%, to $72.48 a barrel, WTI rose $3.01, or 4.6%, to $69.19 a barrel.

2021, November, 30, 13:30:00

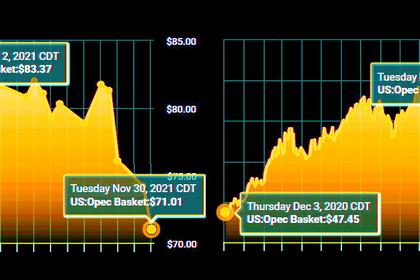

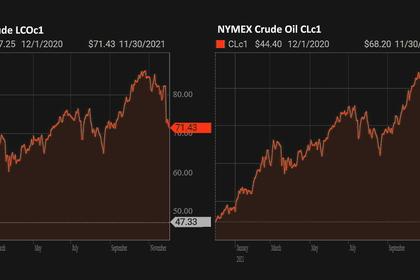

OIL PRICE: ABOVE $71

Brent fell $2.32, or 3.2%, to $71.12 a barrel, WTI fell $2.15, or 3.1%, to $67.80 a barrel.

2021, November, 30, 13:25:00

OPEC+: NO HASTY DECISIONS

"We need to monitor how the situation develops, we must carefully monitor the market. There is no need to make hasty decisions," Novak said.

2021, November, 29, 12:00:00

OIL PRICE: NEAR $76

Brent climbed $3.17, or 4.4%, to $75.89 a barrel, WTI was up $3.35, or 4.9%, at $71.50 a barrel.

2021, November, 29, 11:55:00

OPEC+ WARINESS

OPEC+ ministers, led by Saudi Arabia and Russia, are meeting after Dated Brent nosedived 11% on Nov. 26, sending shock waves into the energy market as news of the Omicron variant outbreak led to bans on flights from South Africa.

All Publications »

Tags:

ОПЕК,

РОССИЯ,

OPEC,

RUSSIA