SAUDI ARABIA, KUWAIT OIL PRODUCTION RISE

PLATTS - 12 Dec 2021 - Saudi Arabia and Kuwait are continuing work to increase crude oil production at the Neutral Zone fields they share, which could be a key source of additional barrels as OPEC+ spare capacity is expected to tighten significantly in 2022.

"Coordination is currently underway between companies operating in the divided area and the submerged area adjacent to it," the two countries said Dec. 10 in a joint statement as Saudi Crown Prince Mohammed bin Salman capped off a tour of Gulf Cooperation Council countries with a visit to Kuwait that concluded Dec. 10.

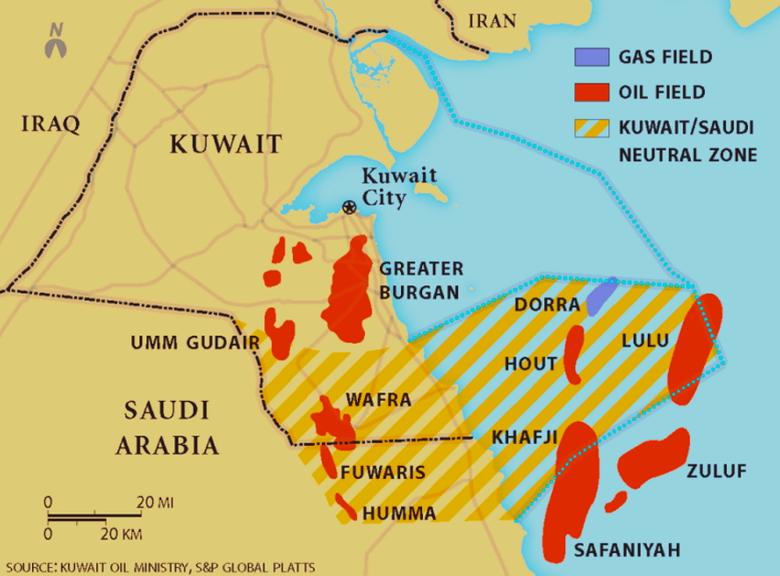

Crude production in the Neutral Zone's onshore Wafra and offshore Khafji fields has suffered from technical challenges stemming from its lengthy shutdown, sources have told S&P Global Platts, with output ranging from below 200,000 b/d some months to as high as 270,000 b/d. Prior to their shutdown in the mid-2010s, the fields typically produced a combined 500,000 b/d.

As the OPEC+ alliance intends to phase out its production cuts by late 2022 and global oil demand rises in the pandemic recovery, the Neutral Zone may be counted on for incremental supply, though Platts Analytics forecasts that output will be capped at 250,000 b/d throughout 2022 due to the operational setbacks.

Crude exports from the Neutral Zone in 2021 have ranged from a low of 158,000 b/d in August to a high of 257,000 b/d in November, according to Kpler shipping data.

The exports have gone regularly to India, China, South Korea and the US, with Japan and Thailand also taking some cargoes in recent months, the Kpler data showed.

Neutral zone oil and gas fields

The Neutral Zone fields, which lie in onshore and offshore territory shared by Saudi Arabia and Kuwait at their border, were offline for more than four years until 2020, due to a political dispute that was resolved with a signing of an agreement in December 2019.

Production in the zone is divided evenly between the two countries.

Sources involved in reviving production say the rehabilitation of the fields and infrastructure has encountered several challenges that have hindered a full ramp-up.

The offshore Khajfi is operated by Saudi Arabia's Aramco Gulf Operations Co. and Kuwait Gulf Oil Co., while the onshore Wafra is operated by KGOC and Saudi Arabian Chevron.

OPEC+ coordination

Besides the Neutral Zone, the two countries also said in their statement they would continue to support the OPEC+ alliance in "enhancing the stability of the global oil market, and stressed the importance of continuing this cooperation and the need for all participating countries to adhere to the OPEC+ agreement."

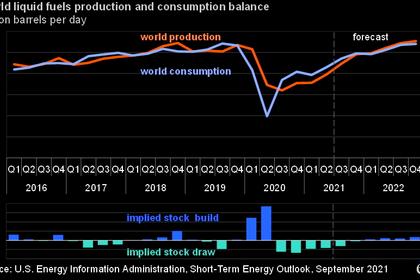

OPEC has partnered with Russia and nine other countries since 2017 on a series of production cuts aimed at stabilizing the oil market, most notably in spring 2020 with a historic 9.7 million b/d cut that has been gradually tapered.

The alliance plans to eventually eliminate the cut by late 2022, though the deal can be adjusted as needed.

At its most recent meeting Dec. 2, ministers agreed to continue with lifting quotas by 400,000 b/d for January, despite signs of a looming oversupply in early 2022. The alliance will next meet Jan. 4 to decide on February volumes.

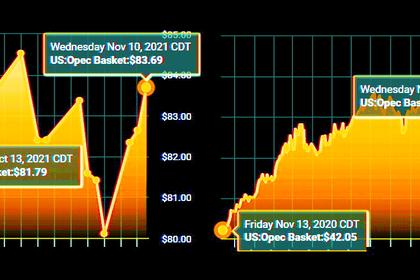

Pressure from the US and other key customers for more crude to cool down prices in recent months has led to some speculation that OPEC+ customers with spare capacity could breach their quotas to make up for other members' shortfalls as they max out their production capabilities – a notion that OPEC+ ministers have rejected so far.

Countries that have previously exceeded their quotas are also required under the deal to make "compensation cuts" of equivalent volume to get back into compliance.

Saudi Arabia and Kuwait also agreed to cooperate on renewable energy development, electrical interconnections and emissions controls under the Middle East Green Initiative launched by Saudi Arabia earlier this year.

-----

Earlier: