U.S. CLEAN ENERGY INVESTMENT $1.2 TLN

By RICK JOYCE VP Customer Solutions mPrest Inc

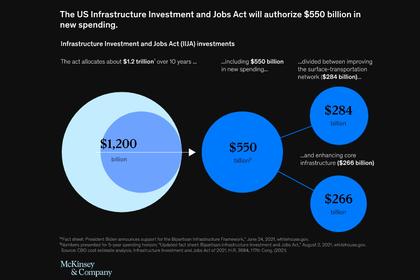

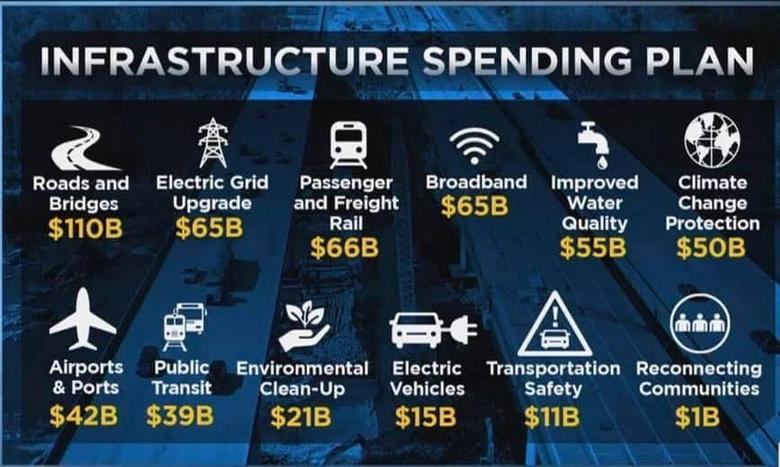

ENERGYCENTRAL - Dec 20, 2021 - The $1.2 trillion Infrastructure Investment and Jobs Act signed by President Biden last month contains more than $80 billion to advance the clean energy transition and fight climate change. Funding is earmarked for innovations ranging from electric vehicles (EVs) to grid technology and grid reliability purposes. This includes $5 billion in grants for states to deploy public EV chargers, in addition to another $2.5 billion to support stations for EV charging or for fueling vehicles with hydrogen, propane, or natural gas. This comes on the heels of the Biden Administration’s lofty goal of making the U.S. a global leader in renewable energy and clean technology.

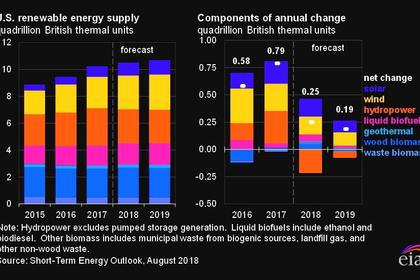

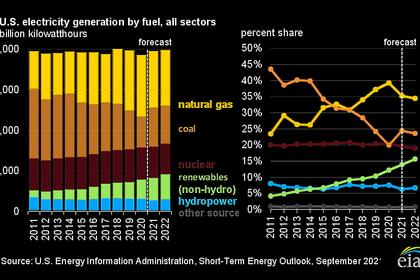

The bill also directs $3 billion to the Department of Energy’s Smart Grid Investment Grant Program, which funded billions of dollars of grid technology investments after the 2008 recession, to increase the flexibility of the electrical grid to support the incoming wave of renewable energy. Distributed Energy Resources (DERs) such as rooftop solar panels on homes and EV charging equipment are existing parts of this equation, with the hope that these grants spur more innovation that allows for the grid to become modernized.

The full impact of these investments and other regulatory actions on modern energy grids remains to be seen. But we can be sure that the future landscape of energy resources will include a growing amount of small, flexible DERs in addition to utility-scale generation. This will in turn drive a need for supporting technologies to help utilities and operators manage a diverse and distributed mix of generation resources.

Modernizing the Grid

The antiquated U.S. electric grid is an intricate ecosystem, made up of interconnected consumers, electrical suppliers, utilities, and government agencies. A modernized grid involves consumers who capture and store their own energy behind-the-meter through DERs. Then, in times of excess, upload energy back to the grid for utilities to store and redistribute.

So what does the grid of the future look like? Consumers will serve as manufacturers, to the benefit of the electrical grid’s reliability and performance, under the direction of government oversight. What’s more, an emergence of new energy operators and groups like Community Choice Aggregators and VPP aggregators will continue to drive a need for flexibility in the market.

Lower cost of DERs, heightened consumer interest in these technologies and a supportive regulatory environment have sent DER deployment skyrocketing, even before the infrastructure bill emerged to boost these programs further. Yet many utilities have been slow to adopt systems that will give them the necessary awareness and analysis of DERs to accommodate for a more modernized grid. In the face of increased deployment of these technologies, driven by infrastructure investments, grid operators must look at non-wires solutions like Distributed Energy Management Resource Systems (DERMS) more seriously to keep pace with the energy transition.

DERMS Respond to Innovation and Demand

More intelligence in the grid equals more control, and more control means more efficiency and reliability. That’s where DERMS come into play. DERMS allow the grid to balance demand with supply while lowering stress on distribution, transmission and control operators and creating opportunities for new utility business models.

DERs are resilient and reliable resources but proper management is required to maintain these benefits and scale up capacity. DERMS allow utility grid operators to make real-time adjustments to move power across the grid. Many DERMS also deploy AI-based technologies to enable load forecasting and DER plan creation. This allows rooftop solar systems, EV charging, and energy storage to meet in the intersection of supply and demand. The ‘07 Smart Grid Investment Grant laid the foundation by creating innovative grid resources designed to make the grid more intelligent and automated. The next round of funding over the next 10 years will transform the grid and the integration of DERMS can usher in a new era of decarbonization, stabilization and improved customer experience for utilities on a global scale.

While there’s still a ways to go and investments to be made, the Infrastructure Investment and Jobs Act is one step towards a clean energy future.

-----

Earlier: