ABU DHABI ENERGY TRANSITION

PLATTS - 03 Feb 2021 - Abu Dhabi is pressing ahead with ambitious plans to hike oil production and become self-sufficient in gas, while also targeting low-carbon technologies such as CCUS and hydrogen, writes Dania Saadi.

Abu Dhabi came late to the oil exploration boom that spread across the Middle East after World War I, and later on it stood out for holding on to foreign interests in its energy assets when nationalization swept the region during the 1960s and 1970s.

This foreign exploration collaboration, which was aided offshore by French oceanographer Jacques Cousteau and filmed by Louis Malle, has survived to this day.

The Anglo-Persian Oil Company (now BP), Shell, Compagnie Française des Pétroles (now Total), Exxon and Mobil Oil were part of Abu Dhabi's oil history and the emirate is still courting these partners—and several more from India to Russia—to help it achieve its 2030 strategy: boosting oil production capacity to 5 million b/d from more than 4 million b/d now.

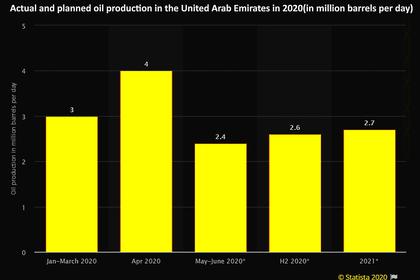

Abu Dhabi, which has the majority of oil and gas reserves in the UAE, a seven-member federation, is pressing ahead with these efforts even as the coronavirus pandemic devastates energy consumption, fears of approaching global peak crude demand take hold, and energy transition looms over the oil and gas industry.

Unabated investment

The headwinds do not appear to be pushing state-owned Abu Dhabi National Oil Co. off its planned course.

In 2020, ADNOC attracted around $17 billion in foreign investments, increased its oil output capacity to more than 4 million b/d and got the nod to spend $122 billion between 2021 and 2025. The Supreme Petroleum Council (SPC), formerly in charge of Abu Dhabi's energy decision-making, approved the ambitious capital expenditure plan for various energy projects and mandated the national oil producer to become a "hydrogen leader” as well.

Surviving the age of energy transition may be the biggest challenge for ADNOC, which is vying with fellow Gulf producers and speeding up growth plans before the peak demand scenario becomes reality.

And ADNOC remains a core element in Abu Dhabi's economic growth plans. So it came as no surprise when last December ADNOC CEO Sultan al-Jaber was appointed as a member of Abu Dhabi's Supreme Council for Financial and Economic Affairs, a new body chaired by the emirate's ruler (who is also the UAE president), which folded in the SPC through a merger.

Jaber has been rising through the ranks of government ever since he was appointed ADNOC CEO in 2016, gaining the role of UAE special envoy for climate change in 2020.

Combining oil and low-carbon

Jaber, who previously worked at ADNOC and moved around several Abu Dhabi government companies until his return to the energy firm in 2016, is now transforming the national oil producer to compete in the energy transition age.

Prior to his appointment as ADNOC CEO, Jaber was CEO of Energy at Mubadala Development Co. (now Mubadala Investment Co.), a sovereign wealth fund now managing $232 billion in assets and focused on economic diversification. While at Mubadala, Jaber helped establish Masdar, a clean energy firm, in 2006. Masdar now has a renewable energy portfolio of over 10.7 GW, with projects ranging from offshore wind farms in the UK to waste-to-energy projects in Australia.

So combining two seemingly conflicting projects—accelerating oil and gas investments and creating a clean energy portfolio—is nothing new to Jaber, who is also championing foreign participation to reach both goals.

And judging from the line-up of investors who want to do business with it, ADNOC is in a good position to make it through the energy transition age.

International oil companies that have pledged to lower their energy production and reduce their carbon footprint are still holding on to their ADNOC investments and some have even acquired new stakes. OMV and Eni bought stakes in ADNOC Refining from the parent company and formed a joint venture, ADNOC Global Trading, alongside ADNOC.

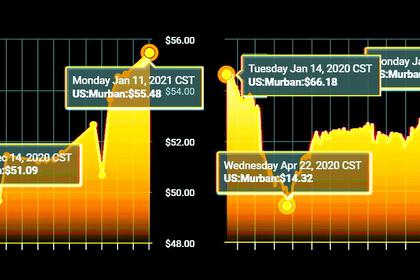

BP and Total, which each hold 10% of ADNOC Onshore, signed on to be part of ICE Futures Abu Dhabi, a new exchange that will trade futures of ADNOC's flagship crude grade. The launch of the Murban futures contract, based on the crude produced by ADNOC Onshore, was delayed from 2020 due to the pandemic, but it is set to start trading on the Abu Dhabi-based exchange on March 29.

BlackRock, the $7 trillion asset manager whose Aladdin Climate system promises investors the ability to assess climate risk in their portfolio, invested alongside other companies to buy a stake in select ADNOC oil pipelines in 2019 for $5 billion. That transaction was the first foreign investment involving mid-stream assets in a Middle Eastern national oil company and was followed by similar deals with foreign investors for ADNOC's gas pipelines and real estate assets in 2020.

CCUS and hydrogen

France's Total, which aims to become carbon neutral by 2050, started the first production of unconventional gas in Abu Dhabi in 2020, from its 40% stake in Ruwais Diyab, a partnership with ADNOC, which is seeking to achieve gas self-sufficiency. Total and ADNOC have also signed an agreement to explore joint research, development and deployment opportunities in carbon capture, utilization and storage (CCUS) and reduction of CO2 emissions. ADNOC also has an agreement with Eni to explore new opportunities for collaboration in CCUS.

Currently ADNOC's Al Reyadah facility has the capacity to capture 800,000 tons CO2 annually and the company plans to expand the capacity six-fold by capturing CO2 from its own gas plants, with the aim of reaching 5 million tons CO2/year by 2030. ADNOC also plans to reduce its greenhouse gas emissions intensity by 25% by 2030.

More recently, ADNOC teamed up with Mubadala and Abu Dhabi-owned investor ADQ in an alliance aimed at making Abu Dhabi a leader in low-carbon green and blue hydrogen production.

So far, ADNOC appears to be managing to navigate energy transition by knitting together its strategies around oil and gas production and low-carbon investments.

Abu Dhabi has come a long way since 1962, when the shipping of its first crude in the open market aboard the tanker British Signal marked the realization of its oil dreams. But with ADNOC's help, the emirate may be able to embrace energy transition without compromising on its continued ambitions in petroleum.

-----

Earlier: