SAUDI ARAMCO PIPELINE INVESTMENT $10 BLN

REUTERS - FEBRUARY 10, 2021 - Saudi Aramco is preparing a financing package of up to $10 billion that it could offer to buyers of its pipeline business unit, three sources said, as the oil giant seeks to extract value from its assets in an era of lower oil prices.

Aramco is in talks with banks to provide “staple financing”, which is a financing package provided by the seller that buyers can use to back their purchase.

International investors including BlackRock, KKR and Brookfield Asset Management, which could invest in the pipeline business, are also in talks with lenders on possible financing, said the sources, speaking anonymously because the talks are private.

The loan could be up to $10 billion, said two of the sources, covering much of the value of the assets.

Aramco and Brookfield declined to comment. BlackRock and KKR did not respond to comment requests.

The planned pipeline sale would be similar to infrastructure deals signed over the last two years by Abu Dhabi’s national oil company ADNOC, which raised billions of dollars by leasing its oil and gas pipeline assets to investors, sources have previously said.

Aramco, the world’s biggest oil company, completed the largest initial public offering yet in late 2019, raising $25.6 billion. It later sold more shares, taking the total to $29.4 billion.

Those funds were transferred to the Public Investment Fund (PIF), Saudi Arabia’s sovereign wealth fund responsible for transforming the economy, as society grapples with climate change and shifts from fossil fuel towards lower carbon energy.

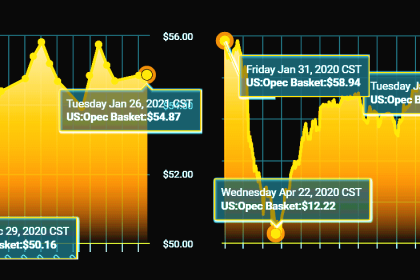

The pandemic has dealt a further blow to the fossil fuel industry by destroying demand.

Saudi Aramco’s profits plummeted last year, but it stuck to a promised $75 billion annual dividend, most of which goes to the government.

It will likely need to transfer significant amounts of money to the Saudi government and the PIF in the coming years.

Saudi Arabia’s Crown Prince Mohammed bin Salman, the kingdom’s de facto ruler, said last month Aramco will sell more shares in the coming years to bolster PIF’s coffers.

-----

Earlier: