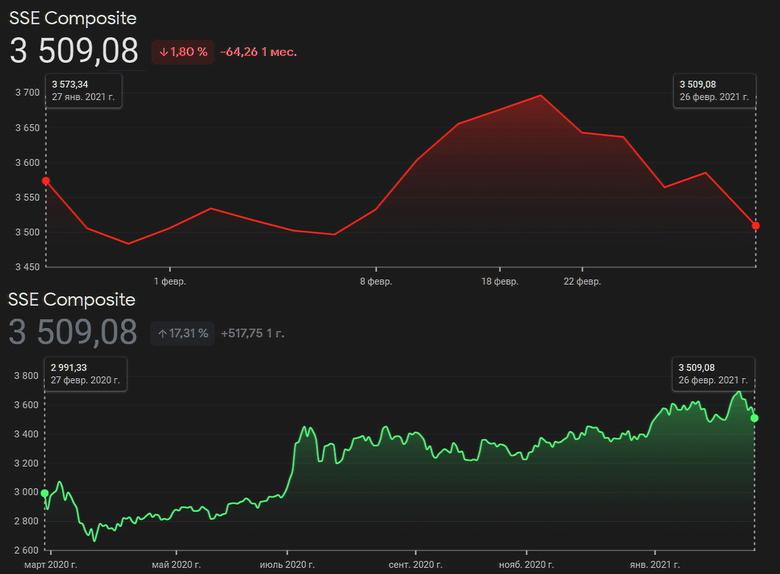

CHINA INDEXES DOWN

REUTERS - FEBRUARY 26, 2021 - China stocks fell sharply on Friday to end the week lower, in line with global markets, with the blue-chip index posting its worst week in 28 months, as a rout in global bonds sent yields flying and dampened appetite for risky assets.

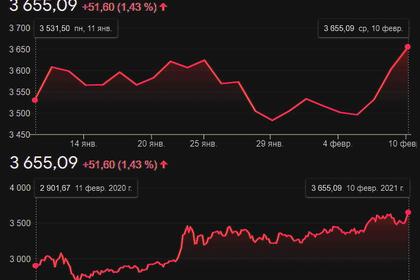

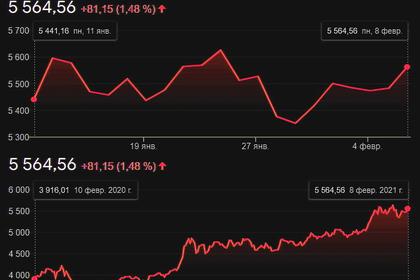

The blue-chip CSI300 index fell 2.4% to 5,336.76, while the Shanghai Composite Index dropped 2.1% to 3,509.08 points.

For the week, CSI300 slumped 7.7%, its steepest weekly decline since Oct. 12, 2018, while the SSEC dropped 5.1%.

Yields on the 10-year Treasury note eased back to 1.538% from a one-year high of 1.614%, but were still up a 40 basis points for the month in their biggest move since 2016.

Fears over policy tightening and lofty valuations had already pummelled China’s benchmark CSI300 index, which was down nearly 10% from its record high hit earlier in the month, mainly due to heavy selling in high-flying sectors such as consumer, healthcare and new energy firms.

Analysts said the trend of China’s policy tightening is quite evident, though the PBOC would refrain from sudden shifts in order to provide stability to the market.

Adding to the pressure were worries over Sino-U.S. trade relations.

Katherine Tai, President Joe Biden’s top trade nominee, backed tariffs as a “legitimate tool” to counter China’s state-driven economic model and vowed to hold Beijing to its prior commitments.

“Rising risk free rates hit high-flying stocks like liquor makers and healthcare firms, though cyclical players, in particular commodities stocks, that are benefited from hopes of a global economy recovery, would fare well going forward,” said Fu Yanping, an analyst with China Galaxy Securities’ wealth management arm.

However, Fu said China would be accommodative and ease its monetary policies appropriately in case of a further sharp drop in the market.

In an apparent move to sooth nerves, Chinese state newspaper Shanghai Securities News said in a commentary on Friday that investors remained confident overall and there were solid foundations for a stable stock market this year.

“This week does not necessarily mark the end of the rally. New fund flows from retail investors could continue for a while,” said Thomas Gatley, China corporate analyst at Gavekal.

Some analysts said the sharp sell-off provided opportunities to buy on the dip.

Thomas Masi, vice president and co-portfolio manager of the GW&K Emerging Wealth Strategy, said that the market’s fear of rising inflation - which he believes to be temporary - creates opportunities to buy into high-growth companies exposed to the world’s second-biggest economy.

-----

Earlier: