CLEAN ENERGY WITHOUT CHINA

By David Gaier Owner David Gaier PR

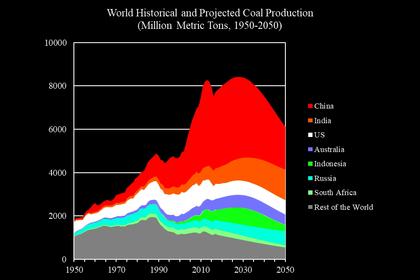

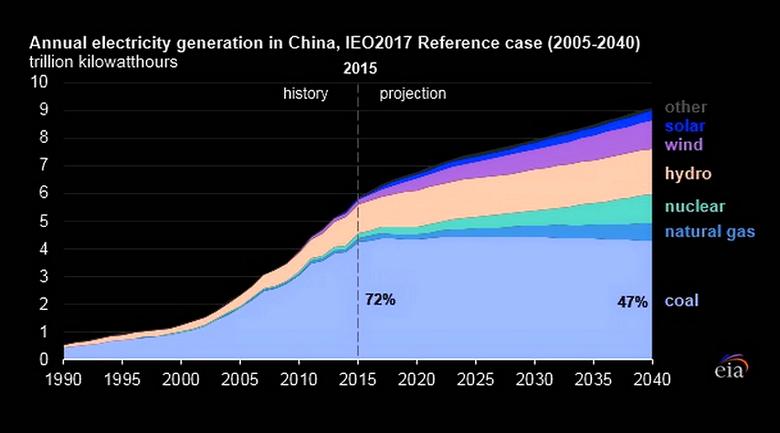

ENERGYCENTRAL - Feb 5, 2021 - Coal, historically the longest-used source of fuel for generating electricity, has been under withering fire in the U.S. for more than a decade as the single largest source of both carbon and criteria pollutants in the power sector. Admittedly, its share of the generation market has decreased substantially, starting with the plunge in natural gas prices that began in June 2008, when the Henry Hub spot price was $12.69 per MMBU, falling in August 2009 to $2.99, and currently at $2.71 according to the US EIA.

Piled on top of this sustained commodity market change were new federal clean air rules, including the 2011 Cross-State Air Pollution Rule (CSAPR), updated in 2017, requiring certain eastern states to reduce pollution from upwind states in order to maintain National Ambient Air Quality Standards. The Mercury and Air Toxics Standards (MATS) rule, also enacted in 2011, replaced the previous, court-vacated Clean Air Mercury Rule, setting federal air pollution limits that individual coal- and oil-fired electric generating units (EGUs) with a capacity of 25 megawatts or greater must meet by 2015. It required many generators to invest in and install wet and dry scrubbers, dry sorbent injection systems, activated carbon injection systems, and fabric filters. And the Clean Power Plan (CPP) was unveiled in 2015, requiring a reduction of carbon emissions from electricity generation of 32% by 2030, relative to 2005 levels. The Trump administration’s EPA challenged the rule and tried to replace it with the so-called Affordable Clean Energy Rule, while staying the CPP. But on January 19, 2021, the District of Columbia Court of Appeals ruled the Affordable Clean Energy Rule violated the Clean Air Act but did not reinstate the Clean Power Plan, punting the matter into the hands of the new Biden Administration.

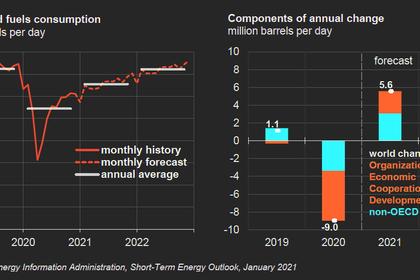

In the meantime, pure economics, the age of many existing coal plants, and the development of new, much cleaner natural gas-fueled generation, especially combined-cycle plants, ate away at the market share of U.S. coal generation, which went from about 33% in 2015 to about 20% in 2020. At the same time, energy efficiency, demand response, and more recently the pandemic have slowed the growth in electricity demand—energy consumption fell faster than gross domestic product in 2020, and the pace at which both will return to 2019 levels remains uncertain, according to U.S Energy Information Administration. And local, state, and national social and political activism by environmental groups, especially the Sierra Club, likely contributed to the closing of operating coal plants that were on the bubble of profitably or especially controversial, especially on the basis of environmental justice.

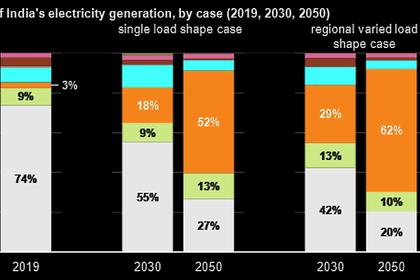

At the same time, a report from Morgan Stanley issued on January 1st asserted that renewable energy, including utility-scale solar and wind power will provide nearly 40% of U.S. electricity by 2030. Still, even as the new administration rolls out what appear to be aggressive actions against fossil generation as well as a markedly ambitious green energy plan, Morgan Stanley forecast that coal-based power production would actually increase this year by 2%. Moreover, the horizons for financing, siting, permitting, and construction of large-scale renewables suggest that many of those resources won’t be online for several years more.

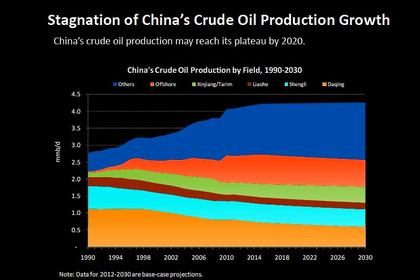

But even if the US makes great strides in the closing of old, high-emitting coal plants and adds massive renewable sources, the global nature of the problem is a daunting obstacle in the race against global warming. According to studies by Global Energy Monitor (GEM) and the Centre for Research on Energy and Clean Air (CREA), the outlook is bleak in the territory of the largest offender: Even including decommissions, China reportedly put 30 GW of new coal capacity online in 2020, with 88 GW of coal power under construction and 247 GW under development. Yet according to Colorado-based BTU Analytics as reported in POWER Magazine, the U.S. has just 236 GW of coal-fired generation capacity in its entire fleet, across 267 plants, as of the fourth quarter of 2020.

Ironically, many observers note that capacity factors of existing Chinese coal plants are typically much lower than baseload, with new construction focused on national infrastructure investment rather than filling a capacity need on the grid. And according to Boston University’s Global Development Policy Center, forty percent of China’s overseas power plant financing and direct investment is in coal-fired power plants, highly concentrated in Southeast Asia (40 percent), South Asia (31 percent), and Africa (16 percent). Notably, according to a report on February 2d in Climate Home News, China’s own Central Environmental Inspection Team (CEIT) “slammed China’s energy authority [the National Energy Administration], for failing to apply environmental standards on rampant coal power expansion across the country.

At the same time, China continues to tout its investment in renewables, and according to government data doubled its construction of new wind and solar power plants in 2020 from 2019. But its investment in and construction of coal plants continues in parallel, and despite pledges by Chinese President Xi to become carbon neutral by 2060, China hasn’t submitted a climate plan to the Nations to back up his promises, prompting the MIT Technology Review to ask, just last summer, “If China plans to go carbon neutral by 2060, why is it building so many coal plants?

If it wanted to keep that promise, even over a 30-year window, China could make a big difference: According to Climate Action Tracker, “If China were to achieve its announced goal of achieving carbon neutrality before 2060, it would lower global warming projections by around 0.2 to 0.3°C, the biggest single reduction ever estimated by the Climate Action Tracker.” The organization added, “It’s clear that China needs to re-examine its economic recovery and aim it at more low-carbon projects if it wants to reach the carbon neutrality goal before 2060.”

Nonetheless, strides against the coal fleet are real and measurable. For example, according to The Guardian, “Renewable energy generated by wind, sunlight, water, and wood made up 42% of the UK’s electricity last year compared with 41% generated from gas and coal plants together” and Britain’s power-generation carbon intensity declined to the lowest level ever recorded last year. Ember Climate reports that EU-27 coal power has halved since 2015, generating just 13% of Europe’s electricity in 2020. Florida Power & Light shuttered its last coal plant in the state last New Year’s Eve and is converting another to natural gas. Out west, Arizona’s Navajo Generating Station along with its feeder Kayenta Mine and the Reid-Gardner plant in Nevada have closed, ostensibly to be followed by the San Juan Generating Station in northwestern New Mexico in 2022.

But the Global Energy Monitor made it a point to say recently that “To decarbonize the power sector by 2050, a recent study by the Center for Research on Energy and Clean Air and the Draworld Environment Research Center found that Chinaʼs coal fleet should fall 38%, from the current 1,095 GW to 680 GW by 2030.

I’m not taking that bet right now.

-----

This thought leadership article was originally shared with Energy Central's Clean Power Community Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Clean Power Community today and learn from others who work in the industry.

-----

Earlier: