CONOCOPHILLIPS LOSS $0.8 BLN

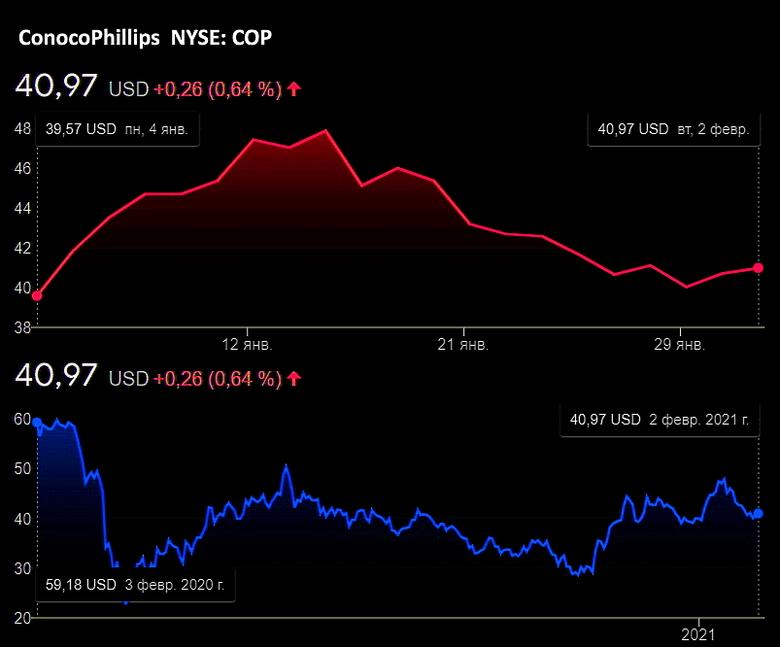

CONOCOPHILLIPS - Feb. 2, 2021 - HOUSTON – ConocoPhillips (NYSE: COP) today reported a fourth-quarter 2020 loss of $0.8 billion, or ($0.72) per share, compared with fourth-quarter 2019 earnings of $0.7 billion, or $0.65 per share. Excluding special items, fourth-quarter 2020 adjusted earnings were a loss of $0.2 billion, or ($0.19) per share, compared with fourth-quarter 2019 adjusted earnings of $0.8 billion, or $0.76 per share. Special items for the current quarter were primarily due to non-cash impairments related to the Alaska North Slope Gas asset and non-core assets in Lower 48, in addition to exploration-related expenses in Other International, partially offset by an unrealized gain on Cenovus Energy equity.

Full-year 2020 earnings were a loss of $2.7 billion, or ($2.51) per share, compared with full-year 2019 earnings of $7.2 billion, or $6.40 per share. Excluding special items, full-year 2020 adjusted earnings were a loss of $1.0 billion, or ($0.97) per share, compared with full-year 2019 adjusted earnings of $4.0 billion, or $3.59 per share.

“I want to thank our workforce for their efforts in the face of a most challenging year,” said Ryan Lance, chairman and chief executive officer. “Throughout 2020, they protected each other, helped mitigate the spread of COVID-19 and safely executed our business as we adapted to changing market conditions. There was nothing easy about 2020, but the lessons from the year served to strengthen our conviction that ConocoPhillips offers the right value proposition for this volatile business -- free cash flow generation, a strong balance sheet, commitment to differential returns of and on capital and ESG leadership.

“Despite the significant industry-wide downturn in 2020, we successfully delivered this value proposition and remain committed to it. As we enter 2021, our ability to lead the sector in value creation is enhanced by the recent Concho acquisition that creates a best-in-class competitor of scale to thrive in the new energy future.”

Full-Year 2020 Summary and Recent Announcements

• Enhanced both our portfolio and financial framework through the acquisition of Concho in an all-stock transaction, as well as purchasing bolt-on acreage in Canada and Lower 48.

• Full-year production, excluding Libya, of 1,118 MBOED; curtailed approximately 80 MBOED during the year.

• Cash provided by operating activities was $4.8 billion. Excluding working capital, cash from operations (CFO) of $5.2 billion exceeded capital expenditures and investments of $4.7 billion, generating free cash flow of $0.5 billion.

• Generated $1.3 billion in disposition proceeds from non-core asset sales.

• Distributed $1.8 billion in dividends and repurchased $0.9 billion of shares, representing a 53 percent return of CFO to shareholders.

• Ended the year with cash, cash equivalents and restricted cash totaling $3.3 billion and short-term investments of $3.6 billion, equaling $6.9 billion in ending cash and short-term investments.

• Announced two significant discoveries in Norway and achieved first production at Tor II; continued appraisal drilling and started up first pads and related infrastructure in Montney.

• Adopted a Paris-aligned climate risk framework with ambition to achieve net-zero operated emissions by 2050 as part of our commitment to ESG excellence.

Quarterly Dividend

ConocoPhillips announced a quarterly dividend of 43 cents per share, payable March 1, 2021, to stockholders of record at the close of business on Feb. 12, 2021.

-----

Earlier:

2020, October, 30, 13:25:00

CONOCOPHILLIPS LOSS $0.5 BLN

ConocoPhillips (NYSE: COP) today reported a third-quarter 2020 loss of $0.5 billion, or ($0.42) per share, compared with third-quarter 2019 earnings of $3.1 billion, or $2.74 per share.

|

2020, October, 20, 15:15:00

CONOCOPHILLIPS, CONCHO RESOURCES ACQUISITION $9.7 BLN

ConocoPhillips (NYSE: COP) and Concho Resources (NYSE: CXO) announced that they have entered into a definitive agreement to combine companies in an all-stock transaction.

|

2020, May, 28, 11:25:00

AUSTRALIA'S SANTOS BUYING $1.265 BLN

Santos today is pleased to announce it has completed the acquisition of ConocoPhillips’ northern Australia and Timor-Leste assets for a reduced purchase price of US$1.265 billion plus an increased contingent payment of US$200 million subject to a final investment decision (FID) on Barossa.

|