DIET FOR ENERGY BEAST

By Llewellyn King Executive Producer White House Media, LLC

ENERGYCENTRAL - Jan 30, 2021 - In politics, any idea can be pressed into service if it fits a purpose. The one I have in mind has been snatched from its Republican originators and is now at work on the left wing of the Democratic Party.

The idea is “starve the beast.” It came from one of President Ronald Reagan’s staffers and was used to curb federal spending.

It was a central idea in the Republican Party through the Reagan years and was taken up with vigor by tax-cutting zealots. It was on the lips of those who thought the way to small government was through tax cuts, i.e., financial starvation.

Now “starve the beast’ is back in a new guise: a way to cut dependence on oil and natural gas.

This is the thought behind President Joe Biden’s decision to revoke the permit for the Keystone XL pipeline, bringing oil to the United States from Canada, even after the expenditure of billions of dollars and an infinity of studies.

It is the idea behind banning fracking and restricting leases on federal lands. Some Democrats and environmental activists believe that this blunt instrument will do the job.

But blunt instruments are unsuited to fine work.

It also is counterproductive to set out to force that which is happening in an orderly way. The Biden administration shows signs of wanting to do this, unnecessarily.

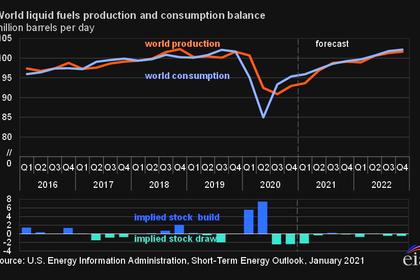

Lumping coal, oil, and gas as the same thing under the title “fossil fuel” is the first error. In descending order, coal is the most important source of pollution, and its use is falling fast. Oil continues to be the primary transportation fuel for the world. World oil production and use hovers around 100 million barrels a day -- and that has been fairly steady in recent years.

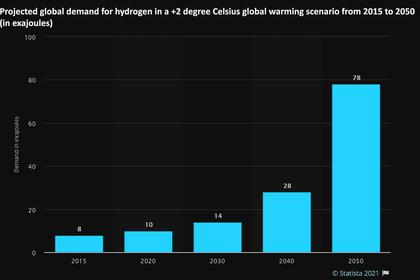

In the United States, the switch to electric vehicles is well underway and in, say, 20 years, they will be dominant. Likewise, in Europe, Japan, and China. That train has left the station and is picking up steam.

Government action, like building charging stations, won’t speed it up but rather will slow it down. The market is working. Willing buyers and sellers are on hand.

Every electric vehicle is a reduction in oil demand. But the world is still a huge market for petroleum and will be for a long time. What sense is there in hobbling U.S. oil exports? There are suppliers from Saudi Arabia to Nigeria keen to take up any slack.

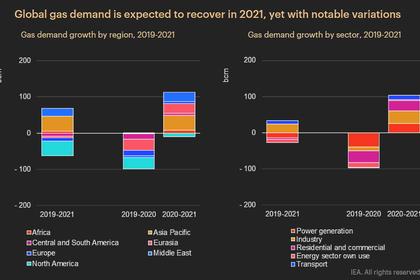

Natural gas is different. It is a superior fuel in that it has about half the pollutants of coal and fewer than oil. It is great for heating homes, cooking, making fertilizers and other petrochemicals. Starving the production just increases the cost to consumers.

The real target is, of course, electric utilities. They rushed to gas to get off coal. It was cheaper, cleaner, and more manageable. Also, gas could be burned in turbines that are easily installed and repaired. Boilers not needed; no steam required.

But there are greenhouse gases emitted and, worse, methane leaks at fracking sites and from faulty pipelines throughout the system. These represent a grave problem. Here government can move in with tighter regulation. If it is fixable, fix it. But methane leaks are no reason to cripple domestic production.

The question for the beast-starvers comes from Clinton Vince, who chairs the U.S. energy practice and co-chairs the global energy practice of Dentons, the world’s largest law firm. He asks, “Is it better to sell natural gas to India and China or to let them build more coal-fired plants? Particularly if carbon-capture and sequestration technology can be improved.”

If we are to continue to reduce carbon emissions in the United States, we need to take a holistic view of energy production and consumption. Does it make sense to allow carbon-free nuclear plants to go out of service because of how we value electricity in the short term? A market adjustment, well within government purview, could save a lot of air pollution immediately.

The hydrocarbon beast doesn’t need to be starved, but a diet might be a good idea.

-----

This thought leadership article was originally shared with Energy Central's Utility Management Community Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Utility Management Community today and learn from others who work in the industry.

-----

Earlier: